United Kingdom Chocolate Market Size, Share, and COVID-19 Impact Analysis, By Type (Dark Chocolate, Milk Chocolate, and White Chocolate), By Product Form (Countlines, Molded Chocolates, Boxed Chocolates, and Seasonal Chocolates), and United Kingdom Chocolate Market Insights, Industry Trend, Forecasts to 2035.

Industry: Consumer GoodsUnited Kingdom Chocolate Market Insights Forecasts to 2035

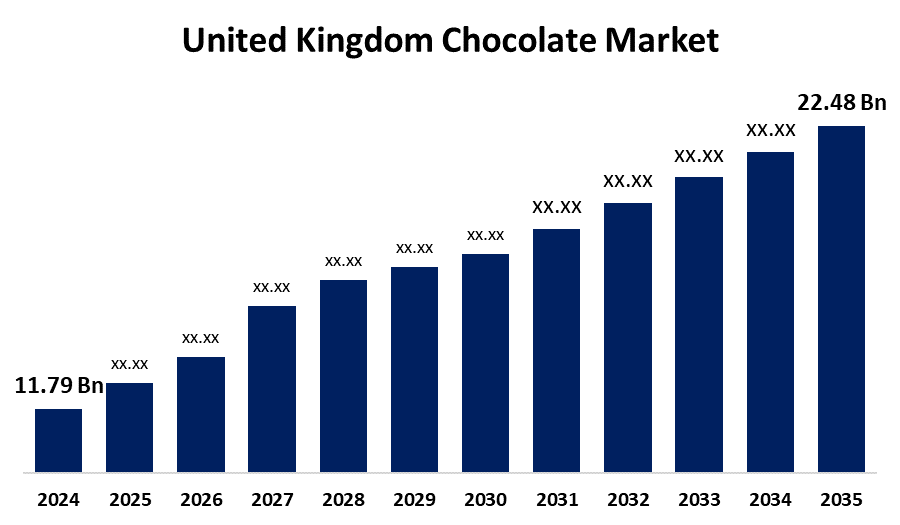

- The United Kingdom Chocolate Market Size Was Estimated at USD 11.79 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.04% from 2025 to 2035

- The United Kingdom Chocolate Market Size is Expected to Reach USD 22.48 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Chocolate Market Size is Anticipated to reach USD 22.48 Billion By 2035, Growing at a CAGR of 6.04% from 2025 to 2035. The increasing giving behaviours, growing online retail channels, rising consumer demand for premium and organic chocolates, and ongoing product innovation that appeals to consumers of every generation who are ethically and health-conscious.

Market Overview

The United Kingdom chocolate market refers to the industry involved with the manufacturing, marketing, and distribution of chocolate goods, such as milk, white, and dark chocolate, as well as flavored and filled varieties. The market, which includes several sectors such boxed assortments, countlines, and seasonal chocolates, is driven by changing consumer preferences, seasonal demand, and premiumization trends. Its continued growth and development are being shaped by e-commerce, health-conscious innovations, and ethical sourcing. Furthermore, there is substantial development potential for both existing brands and newcomers to the industry due to growing e-commerce platforms, personalized gifting trends, and growing demand for chocolate that is supplied ethically and sustainably. Chocolates containing probiotics, adaptogens, and superfoods as a result of health-conscious consumers seeking practical advantages. In keeping with the trend toward healthy enjoyment, there is also an increasing desire for plant-based, dairy-free, and lower-sugar formulas.

Report Coverage

This research report categorizes the market for the United Kingdom chocolate market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom chocolate market cooling market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom chocolate market.

United Kingdom Chocolate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 11.79 Billion |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 6.04% |

| 2035 Value Projection: | USD 11.79 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Product Form and COVID-19 Impact Analysis |

| Companies covered:: | Artisan du Chocolat Ltd, Barry Callebaut AG, Chocoladefabriken Lindt & Sprüngli AG, Ferrero International SA, Hotel Chocolat Group Plc, Mars Incorporated, Mondelez International, Inc. (including Cadbury), Montezumas Chocolates Ltd, Moo Free Ltd, Nestle SA, and Other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for low-sugar, vegan, and organic chocolate products has grown as a result of health-conscious tendencies. Sales are also increased by gift-giving customs and seasonal events. Digital marketing and the expansion of e-commerce improve accessibility and interaction. In order to attract socially conscious customers, firms are compelled by sustainability concerns to use eco-friendly packaging and ingredients that are sourced ethically. Furthermore, product diversification with distinctive flavors and textures maintains market vibrancy and competitiveness, supporting ongoing expansion in the active U.K. chocolate sector.

Restraining Factors

The high prices for raw materials, including sugar and cocoa, which have an impact on profit margins and production efficiency. Market expansion and product diversification are further constrained by health concerns over sugar consumption, stringent government laws governing food labeling, and competition from healthier snack options.

Market Segmentatio

The United Kingdom chocolate market share is classified into type and product form.

- The milk chocolate segment accounted for the highest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom chocolate market is segmented by type into dark chocolate, milk chocolate, and white chocolate. Among these, the milk chocolate segment accounted for the highest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to growing product advancements, its popularity as a comfort food, and its frequent use as a gift and during festive occasions. New taste combinations, appealing packaging, and brand loyalty all increase customer interest and encourage repeat business.

- The seasonal chocolates segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom chocolate market is segmented by product form into countlines, molded chocolates, boxed chocolates, and seasonal chocolates. Among these, the seasonal chocolates segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of generating eagerness and promoting impulsive purchases. Health-conscious customers are drawn to products with additional beneficial components, and milk chocolate's dominance in the UK market during vacations and special occasions is sustained by high mass-market demand and broad availability.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom chocolate market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

• Artisan du Chocolat Ltd

• Barry Callebaut AG

• Chocoladefabriken Lindt & Sprüngli AG

• Ferrero International SA

• Hotel Chocolat Group Plc

• Mars Incorporated

• Mondelez International, Inc. (including Cadbury)

• Montezumas Chocolates Ltd

• Moo Free Ltd

• Nestle SA

• Others.

Recent Developments:

- In January 2024, Baileys introduced a new line of chocolate truffles infused with the flavor of its original Bail eys Irish Cream Liqueur and a traditional vanilla birthday cake-flavored truffle center. These treats are available at retailers like TK Maxx, B&M, The Range, and Card Factory for £4.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom Chocolate Market based on the below-mentioned segments

United Kingdom Chocolate Market, By Type

- Dark Chocolate

- Milk Chocolate,

- White Chocolate

United Kingdom Chocolate Market, By Product Form

- Countlines

- Molded Chocolates

- Boxed Chocolates

- Seasonal Chocolates

Need help to buy this report?