United Kingdom Cereal Bar Market Size, Share, and COVID-19 Impact Analysis, By Product (Granola Bars, Protein Bars, Breakfast Bars, and Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online, and Others), and United Kingdom Cereal Bar Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited Kingdom Cereal Bar Market Insights Forecasts to 2035

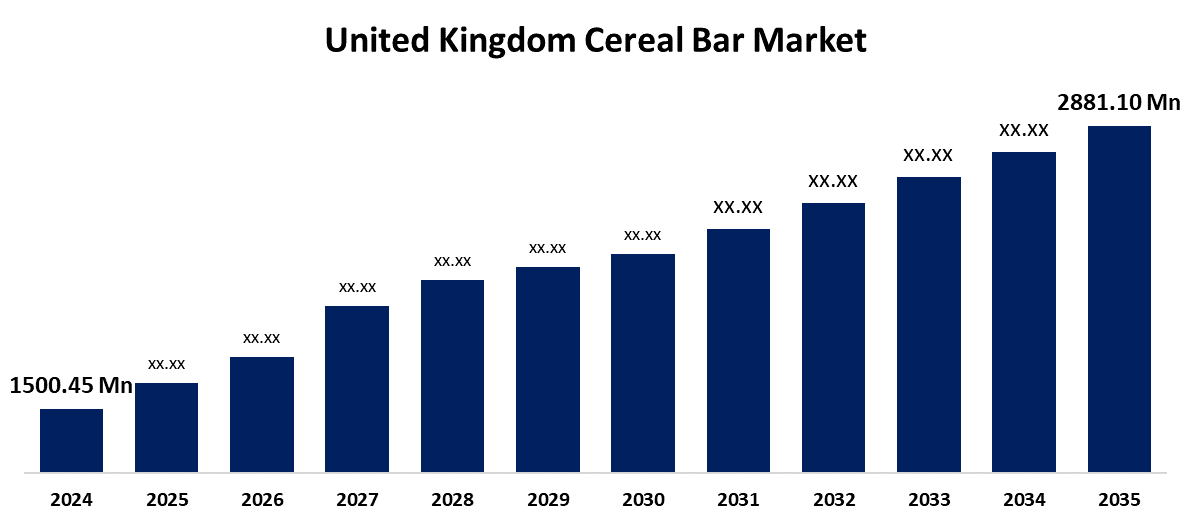

- The United Kingdom Cereal Bar Market Size was estimated at USD 1500.45 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.11% from 2025 to 2035

- The United Kingdom Cereal Bar Market Size is Expected to Reach USD 2881.10 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United Kingdom Cereal Bar Market Size is anticipated to Reach USD 2881.10 Million by 2035, Growing at a CAGR of 6.11% from 2025 to 2035. The increased demand for quick and healthful snack foods is driving the markets steady expansion. The popularity of cereal bars is being driven by a number of customer groups, including urbanization, busy lifestyles, and health-conscious eating habits.

Market Overview

The United Kingdom Cereal Bar Market Size refers to the industry focused on the manufacturing, marketing, and distribution of ready-to-eat snack bars, mostly composed of cereal grains like rice, wheat, barley, or oats are all included in the cereal bars market. Moreover, to increase their nutritional content and visual appeal, these bars frequently contain extra components, including nuts, seeds, dried fruits, sweeteners, and functional additions (such as fiber, protein, and vitamins). Cereals like oats, rice, or wheat are the main elements of a cereal bar, which is a small, portable snack that is also mixed with nuts, dried fruits, honey, and sweeteners. Generally speaking, cereal bars are more healthful than other snack options, so they can accommodate different diets, such as high-protein, vegan, and gluten-free ones. Cereal bars are made using cereal and additional ingredients; they are often referred to as granola bars or muesli bars. Users get quick energy from the product, which is a convenient and portioned food. Many consumers eat the bars in place of more conventional breakfasts and dinners. Among the reasons propelling market expansion are the ongoing R&D efforts of industry participants, the introduction of new products, country growth, e-commerce presence strengthening, and marketing expenditures.

Report Coverage

This research report categorizes the market for the United Kingdom cereal bar market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom cereal bar market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom cereal bar market.

United Kingdom Cereal Bar Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1500.45 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.11% |

| 2035 Value Projection: | USD 2881.10 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 192 |

| Tables, Charts & Figures: | 92 |

| Segments covered: | By Product, By Distribution Channel |

| Companies covered:: | Eat Natural, Jordans (ABF), Stoats Porridge Bars, Weetabix Food Company, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for the United Kingdom cereal bar is boosted by the growing need for dietary requirements and health objectives, while simultaneously offering vital nutrients. Moreover, growing demands for healthier, ready-to-eat snacks, producers are prompting prompted by this trend to develop and strengthen their products. Besides, major industry participants are concentrating on product innovation and research and development (R&D) activities, which drive the market growth. The growing customer desire for plant-based, high-fiber, and protein-enriched choices has increased the categorys appeal to a wider range of dietary preferences. Innovation in flavors, textures, and useful components such as probiotics, extra vitamins, or superfoods also helps to maintain interest. Additionally, concerned about their clean-label claims and environmentally friendly packaging, which helps the industry grow.

Restraining Factors

The market expansion could be restricted by the growing prices for raw materials, especially oats, nuts, and dried fruits, on profit margins, and increased retail pricing, saturation of the market, and fierce competition with harder to differentiate brands.

Market Segmentation

The United Kingdom cereal bar market share is classified into product, and distribution channel.

- The protein bars segment accounted for a significant share in 2024 and is anticipated to grow at a rapid pace during the forecast period.

The United Kingdom cereal bar market is divided by product into granola bars, protein bars, breakfast bars, and others. Among these, the protein bars segment accounted for a significant share in 2024 and is anticipated to grow at a rapid pace during the forecast period. This segment is growing due to consumers growing health consciousness has increased demand for healthier snack options, and snack bars frequently include healthy components, including fruits, nuts, and whole grains. Furthermore, the segments range of tastes and formulas accommodates a range of consumer preferences, increasing its market share.

- The online segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period.

The United Kingdom cereal bar market is segmented by distribution channel into supermarkets and hypermarkets, convenience stores, specialty stores, online, and others. Among these, the online segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period. This is because, for a variety of reasons, consumers buy cereal bars from internet retailers and e-commerce platforms. With the ability to browse and purchase cereal bars from the comfort of their homes or while on the go, the convenience element is noticeable.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom cereal bar market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Eat Natural

- Jordans (ABF)

- Stoats Porridge Bars

- Weetabix Food Company

- Others

Recent Developments:

- In August 2024, the top cereal bar brand in the UK, Nature Valley, introduced a new line of family-friendly snacks. The brand-new, incredibly light and fluffy Soft Baked Muffin Bars are currently available in Morrisons and Sainsburys, with additional grocery listings to come in Asda and Ocado.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom cereal bar market based on the below-mentioned segments:

United Kingdom Cereal Bar Market, By Product

- Granola Bars

- Protein Bars

- Breakfast Bars

- Others

United Kingdom Cereal Bar Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

Need help to buy this report?