United Kingdom Cell Therapy Market Size, Share, and COVID-19 Impact Analysis, By Therapy Type (Autologous, Allogeneic), By Therapeutic Area (Oncology, Cardiovascular Disease (CVD), Musculoskeletal Disorders, Dermatology, Others), and UK Cell Therapy Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Cell Therapy Market Forecasts to 2035

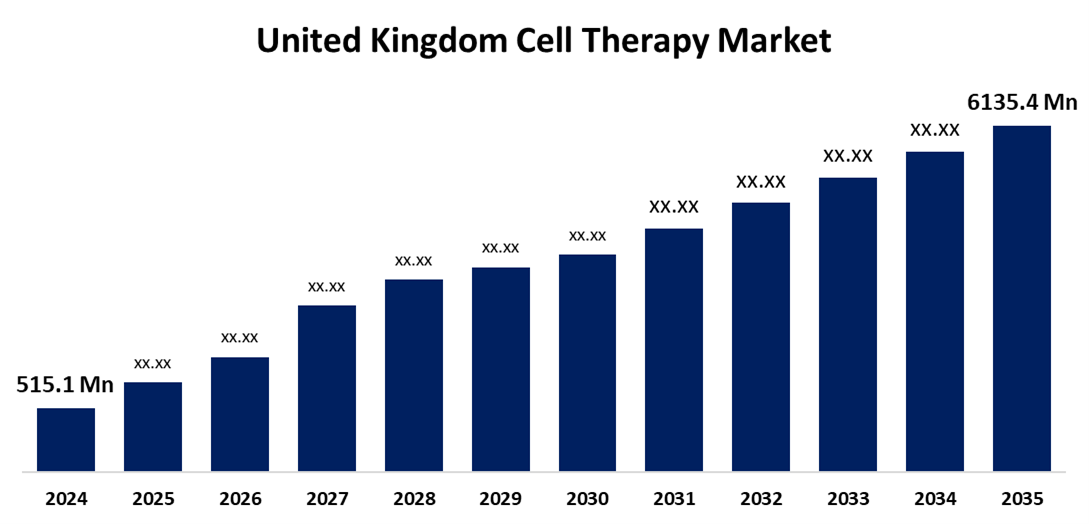

- The United Kingdom Cell Therapy Market Size Was Estimated at USD 515.1 Million in 2024

- The UK Cell Therapy Market Size is Expected to Grow at a CAGR of around 25.26% from 2025 to 2035

- The UK Cell Therapy Market Size is Expected to Reach USD 6135.4 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The UK Cell Therapy Market Size is anticipated to Reach USD 6135.4 Million by 2035, Growing at a CAGR of 25.26% from 2025 to 2035. The UK cell therapy market is growing due to strong government and private investment, advanced research infrastructure, and supportive regulatory frameworks. NHS partnerships and MHRA guidance streamline clinical trials. Additionally, increasing demand for regenerative and personalized medicine drives innovation and market expansion.

Market Overview

The UK Cell Therapy Market Size refers to the use of cell therapy in the creation of regenerative medicines, a multidisciplinary field that uses techniques primarily associated with cell treatment to maintain, enhance, or restore the function of cells, tissues, or organs. The market for cell therapy is expanding quickly due to better manufacturing standards, successful product introductions, and more funding. Global management of high volumes is made possible by improvements in cell banking, manufacturing, storage, and characterisation capabilities. More clinical trials are being fuelled by the growth of personalised medicine, especially genetically engineered cell therapies, which provide individualised treatments that increase efficacy and decrease negative effects. Market expansion is anticipated to be further accelerated by cooperative efforts to reprogramme neonatal stem cells into induced pluripotent stem cells (iPSCs). The sector is tremendously innovative, and innovations in new cell sources, production processes, and delivery systems have improved the safety and effectiveness of therapies. Additionally, mergers and acquisitions are playing a key role in consolidating resources, expanding geographic reach, and accelerating product development, creating a competitive and sustainable environment for long-term growth in the cell therapy sector.

To improve capacities through Advanced Therapy Treatment Centres (ATTCs) and create apprenticeships, the UK government has committed £3 million to the Cell and Gene Therapy Catapult. By accelerating the development of therapies and their incorporation into healthcare systems, this program seeks to improve the UK's standing as a leader in advanced therapeutic innovation. In 2024, Genflow Biosciences also obtained €4 million to develop its gene therapy candidate GF-1002 for liver disease, demonstrating the UK's strong support for innovative biotech initiatives. These major investments and growing enterprises show the nation’s commitment to promoting growth and leadership in the cell and gene therapy sector

Report Coverage

This research report categorizes the market for the UK cell therapy market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom cell therapy market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom cell therapy market.

United Kingdom Cell Therapy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 515.1 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 25.26% |

| 2035 Value Projection: | USD 6135.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 213 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Therapy Type, By Therapeutic Area |

| Companies covered:: | Autolus Therapeutics, Orchard Therapeutics, Quell Therapeutics, Achilles Therapeutics, MeiraGTx, Cell and Gene Therapy Catapult, Adaptimmune, OXB, Purespring Therapeutics, Rinri Therapeutics, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Regenerative medicine is advancing the cell therapy segment by repairing damaged tissue, with FDA approvals of CAR-T therapies for cancer marking important milestones. The field is expanding into autoimmune diseases, orthopaedic injuries, and heart conditions, with early trials showing promise with mesenchymal stem cells. Big pharma companies have stepped up their investment, and regulators such as the FDA are making it easier to enter the cell therapy market with designations such as regenerative medicine advanced therapies. Increased patient awareness, driven by the success of autologous treatments for Parkinson's, is adding impetus to the growth and adoption of cell therapies and further pushing this market segment forward.

Restraining Factors

The manufacturing of cell therapies is a unique, complex undertaking due to patient-centric cells, tight quality controls, and regulatory expectations, all of which increase costs and limit standardization. Added complexities such as personalized processing, logistics, and limited capacity at various facilities add time delays to the supply chain and affect the timely delivery of treatment. The processes associated with cell therapy will need to improve to allow future widespread implementation and market expansion. These factors hamper the cell therapy market during the forecast period.

Market Segmentation

The United Kingdom cell therapy market share is classified into therapy type and therapeutic area.

- The autologous segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom cell therapy market is segmented by therapy type into autologous, allogeneic. Among these, the autologous segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The increase in this segment is due to the increased adoption of several CAR-T therapies due to their beneficial treatment results in different types of cancers and genetic disorders. The regulatory bodies have approved some of these therapies, and their wider adoption is underway.

- The oncology segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom cell therapy market is segmented by therapeutic area into oncology, cardiovascular disease (CVD), musculoskeletal disorders, dermatology, and others. Among these, the oncology segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. These therapies leverage the patient's immune system or modified cells to target and kill cancer cells. Their success during clinical trials and in practice now confirms their potential to change cancer treatments. Furthermore, regulatory authorities will expedite their approvals for cell therapies in oncology, making their way to market faster. Given all this, the malignancies segment serves as a key driver of the cell therapy market growth, providing new hope to cancer patients and transforming their treatment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom cell therapy market and a with comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Autolus Therapeutics

- Orchard Therapeutics

- Quell Therapeutics

- Achilles Therapeutics

- MeiraGTx

- Cell and Gene Therapy Catapult

- Adaptimmune

- OXB

- Purespring Therapeutics

- Rinri Therapeutics

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom cell therapy market based on the below-mentioned segments:

United Kingdom Cell Therapy Market, By Therapy Type

- Autologous

- Allogeneic

United Kingdom Cell Therapy Market, By Therapeutic Area

- Oncology

- Cardiovascular Disease (CVD)

- Musculoskeletal Disorders

- Dermatology

- Others

Need help to buy this report?