United Kingdom Catamaran Market Size, Share, and COVID-19 Impact Analysis, By Product (Sailing Catamarans and Power Catamarans), By Size (Small, Medium, and Large), and UK Catamaran Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationUnited Kingdom Catamaran Market Forecasts to 2035

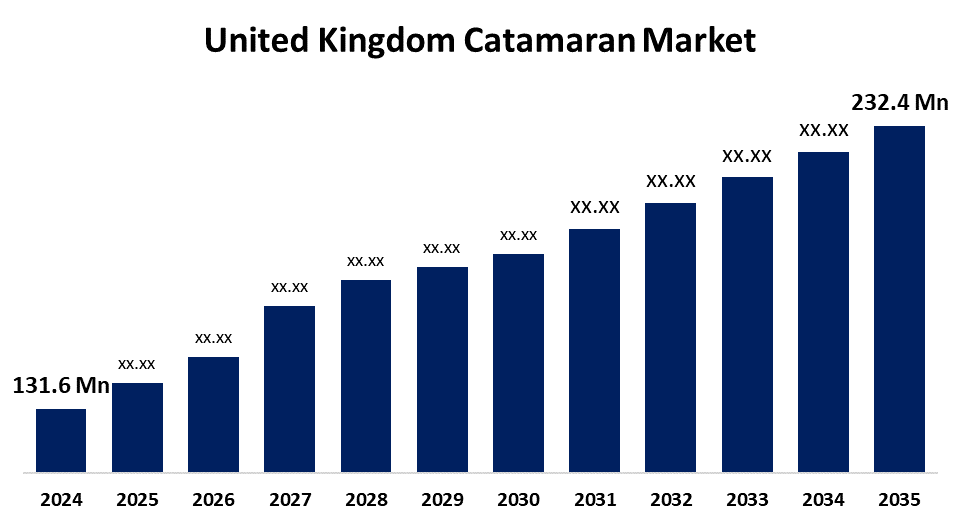

- The United Kingdom Catamaran Market Size Was Estimated at USD 131.6 Million in 2024

- The UK Catamaran Market Size is Expected to Grow at a CAGR of around 5.31% from 2025 to 2035

- The UK Catamaran Market Size is Expected to Reach USD 232.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The UK Catamaran Market Size is anticipated to reach USD 232.4 Million by 2035, growing at a CAGR of 5.31% from 2025 to 2035. Demand for luxury charters, marine tourism, increased disposable income, and wealthy demographics are all contributing to fast growth in the UK catamaran market. Sustainable, technology-driven boats and a growing interest in recreational boating are its key drivers

Market Overview

The UK catamaran market refers to a type of twin-hull, stable, fast, and comfortable. They are used for sailing, racing, cruising, and fishing. They can be powered by sails or an engine and can range from small recreation vessels to large commercial vessels. The catamaran market is booming due to increasing discretionary incomes, an increase in marine/boat tourism, and a growing interest in cruising and racing events. Catamarans are preferred over monohulls due to their comfort, stability, and size, making them the best choice for long-haul trips and luxury-style cruising. There is now a hybrid of performance sailing luxury experience that has drawn interest from the private, commercial, and military sectors alike. Some of the propulsion technologies are at a point where they are pushing the boundary of the capability of the catamaran. Manufacturers are also shifting toward faster, more efficient, and environmentally aware transport. Additionally, there are now improvements in material design, such as 3D printing and the use of biofuels as green alternatives as a method for construction and reducing emissions. Future catamarans, as indicated by early Model Predictive Control (MPC) boat simulations, will showcase radically improved hull designs, engine configurations, and enhancements in smart technologies such as GPS, fish-finding software, a 360-degree camera system, automatic docking systems, and high-end audiovisual systems. Improvements identified will provide improved experience, efficiency, and sustainability, making a catamaran an attractive option for modern-day water travel and marine recreation.

Report Coverage

This research report categorizes the market for the UK catamaran market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom catamaran market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom catamaran market.

United Kingdom Catamaran Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 131.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.31% |

| 2035 Value Projection: | USD 232.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 162 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By Product and By Size |

| Companies covered:: | Incat Crowther, LeisureCat, Robertson & Caine, Fountaine Pajot, Lagoon, Manta Marine, Blyth Catamarans Ltd, Catalac Catamarans, Nacra, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rising disposable incomes, an increase in maritime tourism, and technical developments are all contributing to the growth of the catamaran market. Digital controls, renewable fuels, and 3D printing are types of innovations that are improving efficiency and attractiveness. Furthermore, government programs supporting the growth of infrastructure and maritime tourism are fostering an environment that is conducive to market expansion by drawing in customers looking for upscale and environmentally responsible water travel experiences.

Restraining Factors

High upfront costs, ongoing repairs and maintenance, and restricted docking capabilities are significant hindering aspects for the catamaran space. Complicated handling for inexperienced buyers and local regulations in certain places can also be a limiting factor, especially for first-time boat buyers or budget-conscious consumers. These factors hamper the catamaran market during the forecast period.

Market Segmentation

The United Kingdom catamaran market share is classified into product and size.

- The sailing catamarans segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom catamaran market is segmented by product into sailing catamarans and power catamarans. Among these, the sailing catamarans segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Sailboats that have the right engine and propeller are a comfortable and safe platform, even when at sea. Innovative sail designs and technological breakthroughs have made it easier than ever to load and unload sails on sailing catamarans. Sailboats promote peacefulness and friendliness because they can carry a lot of overly friendly people at once. Additionally, sailing catamarans are cheaper; cheaper dollars per cubic foot volume.

- The medium segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom catamaran market is segmented by size into small, medium, and large. Among these, the medium segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Features like fully outfitted cabins, independent living quarters, and low docking needs are driving the segment's increasing popularity in terms of performance, size, and affordability.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom catamaran market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Incat Crowther

- LeisureCat

- Robertson & Caine

- Fountaine Pajot

- Lagoon

- Manta Marine

- Blyth Catamarans Ltd

- Catalac Catamarans

- Nacra

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom catamaran market based on the below-mentioned segments:

United Kingdom Catamaran Market, By Product

- Sailing Catamarans

- Power Catamarans

United Kingdom Catamaran Market, By Size

- Small

- Medium

- Large

Need help to buy this report?