United Kingdom Car Rental Market Size, Share, and COVID-19 Impact Analysis, By Booking Type (Online Booking, Offline Booking), By Duration (Short Term, Long Term), and United Kingdom Car Rental Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationUnited Kingdom Car Rental Market Insights Forecasts to 2035

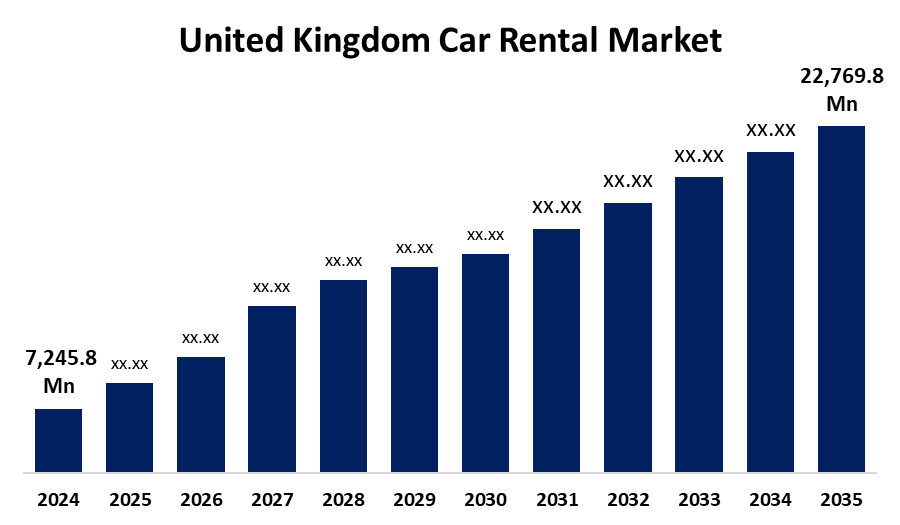

- The United Kingdom Car Rental Market Size Was Estimated at USD 7,245.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.97% from 2025 to 2035

- The United Kingdom Car Rental Market Size is Expected to Reach USD 22,769.8 Million by 2035

Get more details on this report -

The United Kingdom Car Rental Market is anticipated to reach USD 22,769.8 million by 2035, growing at a CAGR of 10.97% from 2025 to 2035. The United Kingdom has a well-developed transportation infrastructure and tourism industry, and additionally, factors such as, rise in online booking platforms, growing demand for eco-friendly vehicles, and multinational companies investing heavily on the technological advancements.

Market Overview

The Car rental is a transportation service where a business provides rental cars to clients for a set length of time for a fixed cost. There are driving forces in the market that are supporting the growth of the UK car rental market, such as increased domestic/international travel, urbanization, and changes in people's travel habits towards less environmentally damaging methods of travel. Demand is heavily reliant on growth in business and leisure travel, specifically during peak seasons. The new trend of mobile applications and online booking channels facilitates comfort and increases the breadth of the market. During this period of growth, the industry is also undergoing a disruption towards digital platforms, contactless payments, and electric vehicles. As future opportunities, companies prioritizing fleet variety, app-based bookings, and flexibility with rentals have become the market leaders. As a result of rising demand for electric and hybrid vehicles due to increased environmental awareness, rental companies are now investing in green fleets. The market dynamics are also changing based on consumer preferences for shorter-term rentals and the increase in weekend getaways and short trips. The green plan from the UK government, which is promoting electric vehicles, has also enabled the car rental industry to respond to environmentally aware consumers. Government regulations for the UK car rental sector focus on business practices, security, and consumer protection.

Both transparency in pricing and laws on certifying driver identity are acknowledged by the Competition and Markets Authority (CMA), which has further straightforward rules, including that car rental companies show rental car pricing clearly reflecting all key elements, including all compulsory fees, charges, and limitations, including documents noting warranty information. The Department for Transport (DfT) also administers the Rental Vehicle Security Scheme (RVSS), which seeks to dissuade rental vehicles from potential illegal use. The GOV. UK website guides businesses to take further steps to verify or certify the identity of the driver, including checking driver's licenses and other identification documentation.

Report Coverage

This research report categorizes the market for the United Kingdom car rental market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom car rental market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom car rental market.

Driving Factors

The main driver of the United Kingdom rental car market is the increased domestic and international tourism. The increasing trend of staycations, whereby UK citizens are travelling within their own country, rental car services are becoming increasingly essential for convenience and flexibility. Many customers want greater mobility to avoid the expenses and obligations associated with car ownership. The emergence of low-cost airlines and cheap airline travel is also increasing demand for rental car services throughout the country. Due to the decline of carbon emissions, the UK car rental market is moving towards electric and hybrid vehicles, in support of reducing carbon emissions and supporting eco-friendly transportation options. The UK car rental market is expected to grow in the next five years, partly due to the rising need for flexible commutes for business and leisure purposes. Further, upward potential for growth exists in the UK car rental market during the forecast period, because of the recent influx of mobile applications, on-demand fare changes, e-services, and better customer interface. The customer interaction with car rental services has undergone changes with the advent of mobile applications that allow one to book cars, choose the rental vehicles they would like, and undertake real-time tracking. Also, the final requirement from the target population in the UK favors firms that provide mobile app solutions to enhance the experience of rental booking and management. This, therefore, implies that technology features into their decision-making procedure and projection of the market growth. With increasing pollution and rising concerns, the government has imposed stricter laws and made it easier to rent cars, which will strongly stimulate the growth of the UK auto rental business in the next five years.

Restraining Factors

Potential shifts in consumer preferences towards environmentally-friendly and electric vehicles, expanding mobility alternatives (e.g., car sharing, ride-sharing), and increases in insurance costs are among the challenges that are constraining the UK car rental market. In particular, high insurance premiums related to car rentals or leasing are a turn-off factor for potential buyers, in long-term leasing can potentially hinder the market growth. Many times, customers get charged additional rental fees due to these costs, which may dampen the appeal of car rentals as a transportation option relative to other alternatives. Environmental or electric vehicles are growing in importance to customers and can influence their car rental preferences and possibly shift demand toward electric vehicle rental services. Additionally, the car rental business has felt the impact of the COVID-19 pandemic along with its economic consequences, including supply chain implications and revenue drops. In addition, there are threats posed by car sharing and subscription services with the introduction of new competitive pressures requiring new business models and adaptations.

Market Segmentation

The United Kingdom rental car market share is classified into booking type and duration.

- The online booking segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom rental car market is segmented by booking type into online booking, offline booking. Among these, the online booking segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Online booking in the UK is becoming more and more popular among consumers, which indicates a shift to digital efficiency and convenience with enhanced adoption of smartphones and a desire for simple booking processes that deliver convenience. The simplicity and effectiveness of comparing prices and selecting their preferred car from numerous options undoubtedly excite the consumer. Similarly, rental companies can increase clientele and efficiency in booking and inventory management through online platforms. Throughout the projection period, this trend is expected to prevail, along with the continual investment in personalized experiences and user-friendly platforms, further bolstering the market position of online bookings.

- The short-term segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom rental car market is segmented by duration into short-term long long-term. Among these, the short-term segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to being flexible in nature and being inexpensive, short-term rentals have become far attractive for travelers and mobile consumers. These rentals are popular among business and leisure travelers as a quick accommodation option during their brief stay. Economic growth in the United Kingdom has assured further sustenance to the building of demand for short-term rentals, with this demand coming from the rising number of temporary lodgers in city areas. The increased focus on sustainability practices has forced rental companies to add eco-friendly cars to the fleet as a ploy to lure the environmentally conscious.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom rental car market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Hertz Corporation

- Uber Technologies Inc

- Europcar International

- Avis Budget Group Inc

- Enterprise Rent-A-Car UK Ltd

- Lex Autolease Ltd.

- National Car Rental

- Brittany Ferries Car Hire

- David's Car Hire

- Dollar Rent A Car, Inc

- LeasePlan UK Ltd

- Others

Recent Developments:

- In October 2023, as a global mobility leader, Enterprise Holdings has strengthened its ambition to help shape the future of mobility with stunning results across its business segments, significant growth in international expansion, and global accolades for its sustained commitment to customers and employees during the fiscal year. With almost 9,500 fully staffed airport and neighbourhood offices across more than 90 countries and territories, Enterprise Holdings has an integrated global network of franchisees and subsidiaries.

- In September 2022, Green Motion is a renowned name in the vehicle rental industry and has acquired U-Save in a key step towards strengthening its strategic market position. This acquisition is expected to go a long way in perturbing the existing competitive scenarios in the vehicle rental industry. The growth of Green Motion, which offers varied types of cars and solutions orienting toward ecology, is a great blessing for businesses and their clients. As a greens-conscious vehicle rental company, Green Motion has long been accepted as an industry leader.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom Car Rental Market based on the below-mentioned segments:

United Kingdom Car Rental Market, By Booking Type

- Online Booking

- Offline Booking

United Kingdom Car Rental Market, By Duration

- Short Term

- Long Term

Need help to buy this report?