United Kingdom Car Loan Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Used Car and New Cars), By Provider Type (Banks, Non-Banking Financial Services, and Original Equipment Manufacturers), and United Kingdom Car Loan Market Insights, Industry Trend, Forecasts to 2035.

Industry: Banking & FinancialUnited Kingdom Car Loan Market Insights Forecasts to 2035

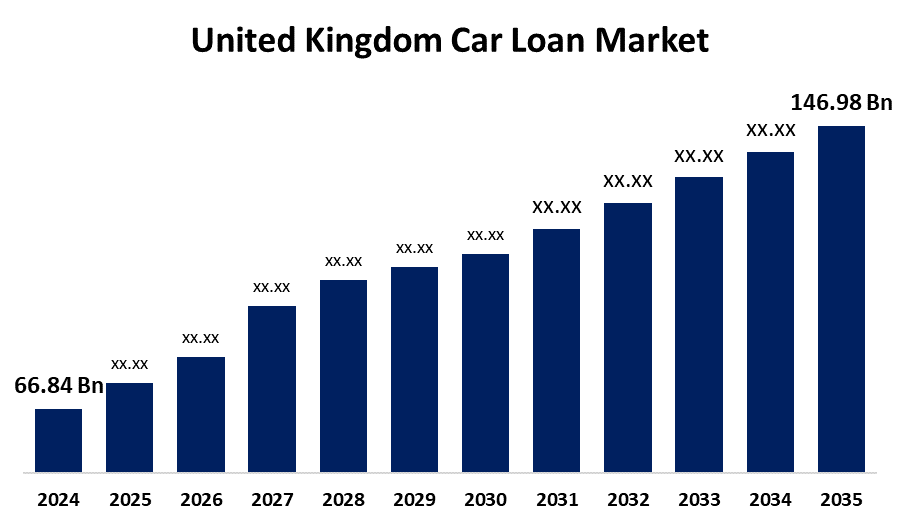

- The United Kingdom Car Loan Market Size was estimated at USD 66.84 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.43% from 2025 to 2035

- The United Kingdom Car Loan Market Size is Expected to Reach USD 146.98 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Car Loan Market Size is Anticipated to reach USD 146.98 Billion by 2035, Growing at a CAGR of 7.43% from 2025 to 2035. The increased car ownership, readily accessible options for financing, online lending resources, and competitive interest rates. Technological developments in loan processing and the growing need for personal mobility are other factors driving market growth.

Market Overview

The United Kingdom car loan market refers to the industry that includes financial services and products that assist customers in using borrowed money to buy cars. Usually provided by banks, auto dealerships, and specialty lenders, these loans let consumers spread out their payments over time in monthly installments. The market fosters the expansion of the automobile industry, improves consumer affordability, and responds to changing trends, including online loan applications and financing for electric vehicles. Increasing use of flexible financing options, internet lending platforms, and electric automobiles. Lenders capitalize on attractive lending rates and growing consumer demand for personal mobility. Younger and tech-savvy consumers who require easy, clear, and reasonably priced auto financing options are further drawn in by the expansion of online loan services and customized financial solutions. Digital loan approvals, blockchain-based contract administration, and AI-powered credit rating. Mobile apps are utilized by lenders to offer customized loan solutions, and rapid funding is made possible through interaction with auto dealerships. These developments increase transparency in loan administration and payout, speed up processing, and boost client satisfaction.

Report Coverage

This research report categorizes the market for the United Kingdom car loan market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom car loan market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom car loan market.

United Kingdom Car Loan Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 66.84 Billion |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 7.43% |

| 2035 Value Projection: | USD 146.98 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 92 |

| Segments covered: | By Product Type, By Provider Type and COVID-19 Impact Analysis |

| Companies covered:: | Barclays Partner Finance, Santander UK, Lloyds Bank, Nationwide Building Society, Royal Bank of Scotland, Close Brothers Motor Finance, Black Horse Finance, MotoNovo Finance, Moneybarn, Zopa, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The demand for auto loans has been driven by rising car ownership, particularly among middle-class individuals. Credit is now more widely available due to technological developments in fintech and digital banking, which have streamlined loan processing. A greater percentage of clients are being drawn in by competitive interest rates and adaptable repayment plans. Furthermore, more purchasers are searching for financing as a consequence of the rising popularity of electric vehicles and government incentives to promote sustainable travel. Consumer convenience is further improved by integrated financing systems and online auto marketplaces, which promote loan usage. All of these elements work together to support the market's strong and steady expansion.

Restraining Factors

The high car prices, stringent credit evaluations, and unstable economic conditions that erode consumer confidence. For many prospective borrowers, the affordability and accessibility of auto finance are impacted by low financial literacy, unemployment, and volatile inflation, which additionally make loan applications more difficult.

Market Segmentation

The United Kingdom car loan market share is classified into product type and provider type.

- The used car segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom car loan market is segmented by product type into used car and new cars. Among these, the used car segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to used automobiles are more accessible, there are fewer new cars available, and consumers decide on more economical options. Strong demand and easier loan approvals have greatly increased financing activity in the sector.

- The banks segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom car loan market is segmented by provider type into banks, non-banking financial services, and original equipment manufacturers. Among these, the banks segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of their extensive loan alternatives, including hire purchase and PCP agreements, competitive interest rates, and broad financial networks. Their widespread accessibility and solid reputation continue to fuel their steady expansion and client preference in the auto lending market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom car loan market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Barclays Partner Finance

- Santander UK

- Lloyds Bank

- Nationwide Building Society

- Royal Bank of Scotland

- Close Brothers Motor Finance

- Black Horse Finance

- MotoNovo Finance

- Moneybarn

- Zopa

- Others.

Recent Developments:

- In September 2024, Dacia introduced the Spring, the UK's most affordable electric vehicle, available from £158 per month through a Personal Contract Purchase (PCP) deal. This offer aims to make EV ownership more accessible to a wider range of consumers.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom car loan market based on the below-mentioned segments

United Kingdom Car Loan Market, By Product Type

- Used Car

- New Cars

United Kingdom Car Loan Market, By Provider Type

- Banks

- Non-Banking Financial Services

- Original Equipment Manufacturers

Need help to buy this report?