United Kingdom Caffeinated Beverage Market Size, Share, and COVID-19 Impact Analysis, By Product (Carbonated Soft Beverage, Energy Beverage, RTD Tea & Coffee, and Others), By Flavor (Natural and Synthetic), and United Kingdom Caffeinated Beverage Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited Kingdom Caffeinated Beverage Market Insights Forecasts to 2035

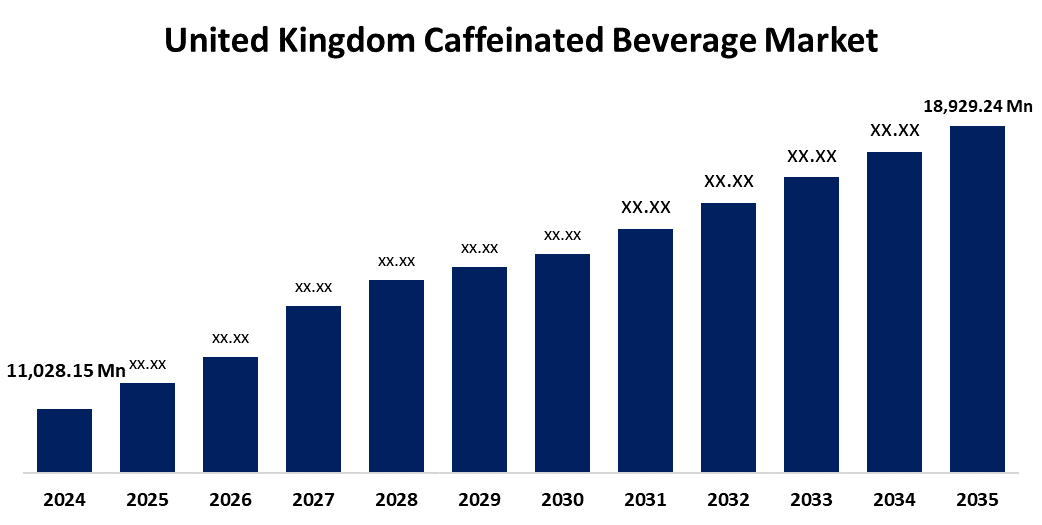

- The United Kingdom Caffeinated Beverage Market Size Was Estimated at USD 11,028.15 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.03% from 2025 to 2035

- The United Kingdom Caffeinated Beverage Market Size is Expected to Reach USD 18,929.24 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Caffeinated Beverage Market Size is anticipated to reach USD 18,929.24 Million by 2035, growing at a CAGR of 5.03% from 2025 to 2035. The increasing demand for energy-boosting beverages, busy schedules, the growth of café culture, and product developments such as natural ingredients, healthier formulations, and functional beverages that appeal to younger and wellness-conscious consumers.

Market Overview

The United Kingdom caffeinated beverage market refers to the industry includes the manufacturing, selling, and consuming of beverages that contain caffeine, including tea, coffee, energy drinks, and soft drinks. These drinks are popular because of their invigorating qualities and practical advantages, such as heightened attentiveness and decreased weariness. Demand is driven by lifestyle choices, rising health consciousness, flavor innovation, and the rise of on-the-go consumption styles, and the industry serves a varied consumer base. The increasing demand from active and health-conscious customers for functional and energy-boosting beverages. The market potential is further boosted by the growing popularity of ready-to-drink tea and coffee as well as novel formulations such plant-based, low-sugar, and organic beverages. Accessibility and product reach are improved by the growing e-commerce industry, rising young consumption, and the expanding café culture. Furthermore, in a competitive market, premiumization and personalization trends offer new ways for businesses to stand out and appeal to a wide range of consumer preferences. The development of functional beverages that contain natural caffeine sources, vitamins, and adaptogens. Low-calorie, organic, and plant-based decisions are being introduced by brands. Customizable blends, cold brew methods, and sustainable packaging are also converting conventional caffeinated beverages into contemporary, environmentally responsible, and health-conscious goods.

Report Coverage

This research report categorizes the market for the United Kingdom caffeinated beverage market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom caffeinated beverage market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom caffeinated beverage market.

United Kingdom Caffeinated Beverage Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 11,028.15 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.03% |

| 2035 Value Projection: | USD 18,929.24 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 256 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Product and By Flavor |

| Companies covered:: | Nestle Red Bull Suntory Holdings Limited Monster Energy Company PepsiCo The Coca-Cola Company Others. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

The changing consumer patterns, where a higher need on energy-boosting beverages has resulted from hectic schedules and rising work expectations. The demand for products has increased due to the developing café culture and growing appreciation for high-end, artisanal coffee and tea. The popularity of organic and low-sugar beverages is being boosted by health-conscious consumers who are also looking for natural and functional beverages with clean labels. Consumption is also fueled by the increased preference among young people for energy drinks and ready-to-drink formats. Furthermore, the growth of convenience stores and e-commerce improves product availability, facilitating market expansion across different consumer categories and geographical areas.

Restraining Factors

The health issues connected with energy drink sugar content, possible adverse effects, and excessive caffeine consumption. Increased demand for healthier beverages, regulatory monitoring, and shifting consumer tastes toward caffeine-free options all hinder market expansion and restrict its appeal to particular demographics.

Market Segmentation

The United Kingdom caffeinated beverage market share is classified into product and flavor.

- The energy beverage segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom caffeinated beverage market is segmented by product into carbonated soft beverage, energy beverage, RTD tea & coffee, and others. Among these, the energy beverage segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to increasing demand for performance-enhancing beverages due to the growing popularity of sports and fitness activities. Furthermore, market expansion is supported by strong marketing, celebrity endorsements, and extensive product availability through retail and online channels.

- The synthetic segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period

The United Kingdom caffeinated beverage market is segmented by flavor into natural and synthetic. Among these, the synthetic segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of Increasing health consciousness, an appetite for organic and functional ingredients, a preference for clean-label products, and a trend toward beverages with more natural, authentic flavors and fewer artificial additives.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom caffeinated beverage market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nestle

- Red Bull

- Suntory Holdings Limited

- Monster Energy Company

- PepsiCo

- The Coca-Cola Company

- Others.

Recent Developments:

- In May 2024, ZOA Energy, co-founded by Dwayne "The Rock" Johnson, launched a new Green Apple flavor in its zero-sugar line. Infused with B & C vitamins and electrolytes, the drink aims to provide a crisp, refreshing taste for energy drink enthusiasts.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom caffeinated beverage market based on the below-mentioned segments:

United Kingdom Caffeinated Beverage Market, By Product

- Carbonated Soft Beverage

- Energy Beverage

- RTD Tea & Coffee

- Others

United Kingdom Caffeinated Beverage Market, By Flavor

- Natural

- Synthetic

Need help to buy this report?