United Kingdom Butter Market Size, Share, and COVID-19 Impact Analysis, By Product (Cultured Butter, Uncultured Butter, and Others), By Sales Channel (Offline, Online), and United Kingdom Butter Market Insights, Industry Trend, Forecasts to 2035.

Industry: Consumer GoodsUnited Kingdom Butter Market Insights Forecasts to 2035

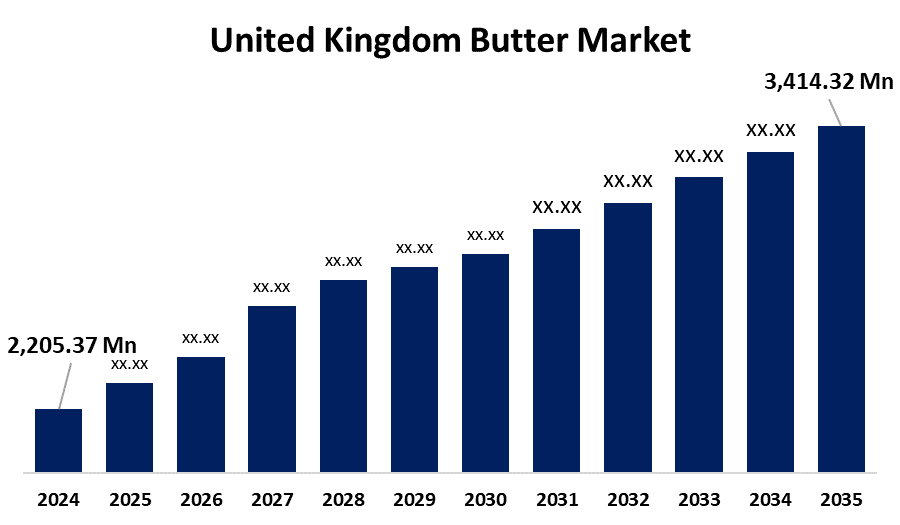

- The United Kingdom Butter Market Size was estimated at USD 2,205.37 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.05% from 2025 to 2035

- The United Kingdom Butter Market Size is Expected to Reach USD 3,414.32 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Butter Market Size is anticipated to reach USD 3,414.32 Million by 2035, growing at a CAGR of 4.05% from 2025 to 2035. The market for butter in the British industry is driven by rising customer demand for natural, premium dairy products as well as a growing favor for traditional butter in culinary applications.

Market Overview

The United Kingdom butter market refers to the marketplace focused on the production and application of butter, which is an important part of the nation's dairy products industry. This is a milk product made by churning milk is butter. It is a semi-solid emulsion made from the protein and fat in milk. Although it is heavy in fat and calories, it also has many vital elements. It is an excellent source of vitamin A, a fat-soluble vitamin that is necessary for strong skin, a healthy immune system, and clear vision. Additionally, it has vitamin E, which promotes heart health and protects damaged cells by acting as an antioxidant. Besides, it has trace amounts of calcium, phosphorus, and niacin, among other minerals. British cuisine relies heavily on butter, which is used for everything from baking and cooking to spreading on bread. Meanwhile, in response to shifting dietary choices, plant-based butter substitutes have become more popular as health and sustainability become more of a priority. The customer switched to low-fat, low-cholesterol, and low-calorie butter due to high consumption of butter could result in heart disease, opening up new growth opportunities.

Report Coverage

This research report categorizes the market for the United Kingdom butter market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom butter market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom butter market.

United Kingdom Butter Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2,205.37 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.05% |

| 2035 Value Projection: | USD 3,414.32 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 207 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product (Cultured Butter, Uncultured Butter, and Others), By Sales Channel (Offline, Online) |

| Companies covered:: | County Foods Ltd, Butter County Foods Ltd, Meadow Foods, Graham’s The Family Dairy, Modern Milkman, The Edinburgh Butter Co, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom butter is primarily driven by the rich culinary history and the vital component of traditional British cooking. Further, growing customer preference for high-end, organic, and regionally produced a greater emphasis on authenticity and quality, expanding the market revenue. Moreover, consumer interest in plant-based butter substitutes is being fueled by health-conscious trends, and eco-friendly dairy farming practices are being prompted by sustainability concerns. Packaged butter is popular in retail and hotel chains, which propels the market growth. Additionally, rising levels of disposable income are anticipated to fuel consumer demand for premium butter.

Restraining Factors

The wide market adoption could be hampered by the rising production costs for the British butter business, especially for premium and organic types. The use of butter is also being challenged by the rising popularity of plant-based substitutes and growing health concerns about saturated fats, which has an impact on market expansion overall.

Market Segmentation

The United Kingdom butter market share is classified into product and sales channel.

- The uncultured butter segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period.

The United Kingdom butter market is segmented by product into cultured butter, uncultured butter, and others. Among these, the uncultured butter segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period. This is due to the need for fresh, pasteurized cream to be churned to produce uncultured butter. This unsalted, neutral-tasting butter is frequently used in baking because it doesn't change the flavor of the finished product. The baking and confectionery industries' growing demand for uncultured butter is anticipated to fuel segmental expansion.

- The offline segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom butter market is segmented by sales channel into offline and online. Among these, the offline segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of the desire for in-store purchasing for fresh dairy products and the persistence of traditional retail channels supporting the expansion. Offline sales continue to be a major market driver due to authenticity and quality can be physically verified through offline channels.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom butter market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- County Foods Ltd

- Butter County Foods Ltd

- Meadow Foods

- Graham’s The Family Dairy

- Modern Milkman

- The Edinburgh Butter Co

- Others

Recent Developments:

- In March 2025, Kerrygold relaunched its spreadable butter into the UK market, offering consumers the classic taste of Kerrygold with added convenience. The new product aims to provide a smooth, easy-to-spread texture while maintaining the rich, creamy flavor that Kerrygold.

- In October 2024, Castle Dairies officially launched its Welsh Salted Block Butter nationwide in Sainsbury’s stores across the UK. This marked a significant expansion for the South Wales-based butter manufacturer, which built a reputation for high-quality Welsh dairy products and crafted using Welsh cream, churned and hand-salted to achieve a rich, creamy texture and balanced taste.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom butter market based on the below-mentioned segments:

United Kingdom Butter Market, By Product

- Cultured Butter

- Uncultured Butter

- Others

United Kingdom Butter Market, By Sales Channel

- Offline

- Online

Need help to buy this report?