United Kingdom Butchery and Meat Processing Market Size, Share, and COVID-19 Impact Analysis, By Type (Hot Meat, Frozen Meat, and Others), By Application (Agricultural Market, Supermarket, Franchise Store, Food Processing Company, and Others), and United Kingdom Butchery and Meat Processing Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited Kingdom Butchery and Meat Processing Market Insights Forecasts to 2035

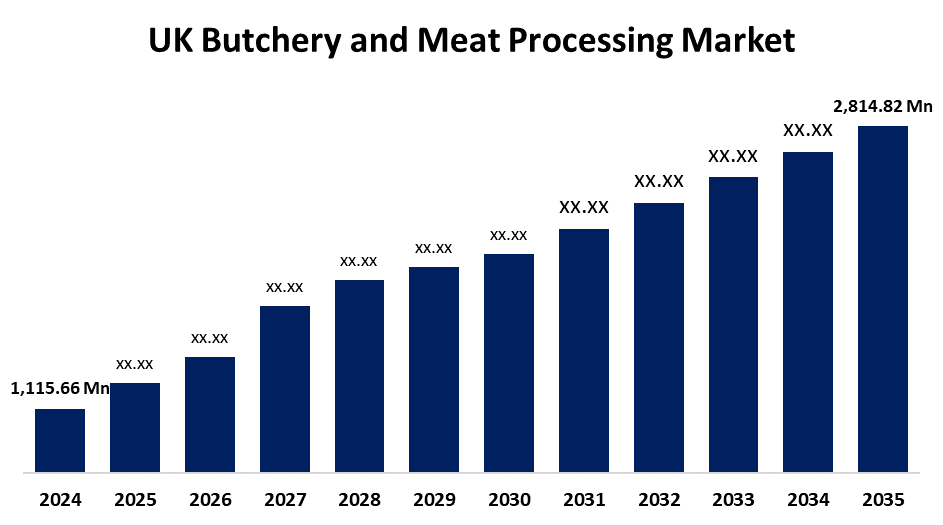

- The United Kingdom Butchery and Meat Processing Market Size Was Estimated at USD 1,115.66 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.78% from 2025 to 2035

- The United Kingdom Butchery and Meat Processing Market Size is Expected to Reach USD 2,814.82 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Butchery and Meat Processing Market Size is anticipated to reach USD 2,814.82 Million by 2035, growing at a CAGR of 8.78% from 2025 to 2035. The growing customer demand for value-added and convenient meat goods ready-to-cook/eat, increasing awareness of health benefits (clean label, high-protein, ethically sourced), and significant automation and processing technical developments. An additional driver driving this rise is the expansion of export prospects.

Market Overview

The United Kingdom butchery and meat processing market refers to the industry that includes the slaughtering, cutting, preparing, packing, and distributing of different meats, poultry, beef, lamb, and so forth for human consumption. It is composed of both conventional butcher shops and massive industrial processors that serve retailers, foodservice, and international markets with fresh, chilled, frozen, and value-added such as pre-marinated, ready-to-cook meat products. For the purpose of maintaining carcass balance and financial sustainability, this crucial industry also manages byproducts. Customers are turning to it for convenience on an increasing basis. The outcome is a high demand for pre-packaged meal solutions, pre-portioned cuts, pre-marinated meats, and ready-to-cook meals. Companies that offer quality and convenience of preparation in this area can gain a greater portion of the market. The standing of British meat as being of superior quality offers a solid basis for growth into foreign markets. In order to fulfill the demand for premium beef products worldwide, there are opportunities to boost exports by utilizing the "British" brand. Blockchain for farm-to-fork traceability, advanced automation for efficiency, and intelligent packaging to increase shelf life. It also entails creating value-added goods that address changing consumer needs, including prepared meals with unusual flavors and health-conscious, ethically based alternatives.

Report Coverage

This research report categorizes the market for the United Kingdom butchery and meat processing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom butchery and meat processing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom butchery and meat processing market.

United Kingdom Butchery and Meat Processing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,115.66 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 8.78% |

| 2035 Value Projection: | USD 2,814.82 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 236 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Type and By Application |

| Companies covered:: | Tyson Foods, Delis, Wen’s Food Group, New Hope Group, Yurun Holding Group, COFCO Group, Cargill, BRF S.A, Danish Crown, JBS Foods, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The consumer preferences constantly shift, with a notable trend toward convenient, high-value goods like pre-marinated meats or ready-to-cook meals that cater to people with busy schedules. Simultaneously, growing health consciousness drives demand for high-protein, lean, organic, and ethically produced products, encouraging processors to use sustainable processes and clearer labels. For increased efficiency, uniformity, and food safety, technological innovations such as automation, AI-driven quality control, and improved traceability (like blockchain) are essential. subsequently, the possibility of growing export prospects enables UK producers to benefit from the international recognition of British meat.

Restraining Factors

The higher production costs labor, electricity, and animal feed, continuous staffing shortages across the supply chain, and supply chain interruptions that affect the logistics and availability of raw materials. Traditional meat consumption is also continuously challenged by strict environmental regulations and changing customer preferences toward plant-based diets.

Market Segmentation

The United Kingdom Butchery And Meat Processing Market share is classified into type and application.

- The frozen meat segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period

The United Kingdom butchery and meat processing market is segmented by type into hot meat, frozen meat, and others. Among these, the frozen meat segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to growing customer demand for value-added meat products that provide easy and fast dinner alternatives for hectic lifestyles, such as pre-marinated and ready-to-cook meats.

- The supermarket segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom butchery and meat processing market is segmented by application into agricultural market, supermarket, franchise store, food processing company, and others. Among these, the supermarket segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of their large customer base and the ability to supply an abundance of meat products, serving a wide range of tastes, and serving as a major source of purchases for customers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom butchery and meat processing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tyson Foods

- Delis

- Wen’s Food Group

- New Hope Group

- Yurun Holding Group

- COFCO Group

- Cargill

- BRF S.A

- Danish Crown

- JBS Foods

- Others.

Recent Developments:

- In May 2025, Beyond Meat launched Beyond Steak® in the UK, offering plant-based steak pieces with 24g of protein per 100g. Available at Tesco, the product targets flexitarians seeking healthier, sustainable, and meat-like alternatives.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom butchery and meat processing market based on the below-mentioned segments:

United Kingdom Butchery and Meat Processing Market, By Type

- Hot Meat

- Frozen Meat

- Others

United Kingdom Butchery and Meat Processing Market, By Application

- Agricultural Market

- Supermarket

- Franchise Store

- Food Processing Company

- Others

Need help to buy this report?