United Kingdom Broth Market Size, Share, and COVID-19 Impact Analysis, By Type of Broth (Chicken Broth and Beef Broth), By Packaging Type (Canned Broth and Boxed & Carton Broth), and United Kingdom Broth Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited Kingdom Broth Market Insights Forecasts to 2035

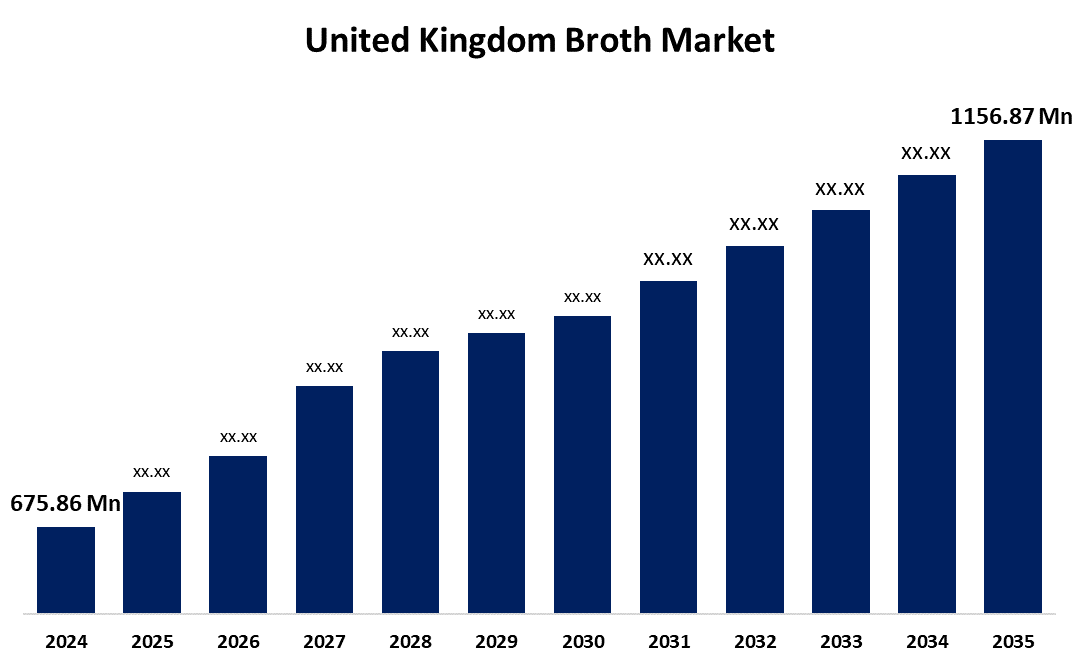

- The United Kingdom Broth Market Size Was Estimated at USD 675.86 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.01% from 2025 to 2035

- The United Kingdom Broth Market Size is Expected to Reach USD 1156.87 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom Broth Market Size is anticipated to reach USD 1156.87 Million by 2035, Growing at a CAGR of 5.01% from 2025 to 2035. The increasing demand from consumers for wholesome, rapidly consumable foods. Demand for bone and vegetable broths is being driven by the popularity of diets high in protein and increasing awareness of health advantages, including support for immunity and gut health.

Market Overview

The United Kingdom broth market refers to the industry involved in the manufacturing, marketing, and distribution of liquid food products that are created by boiling meat, bones, vegetables, and seasonings. Broth is coveted for its high nutritional value, rich flavor, and health advantages, which include immune system and digestive support. The market serves both retail customers and the foodservice sector and offers a variety of varieties, including bone broth, chicken broth, and vegetable broth. Growing popularity in protein-rich diets and natural, functional foods. Innovation in broth-based products has been supported by rising awareness of gut health and wellness trends as well as growing desire for rapid yet wholesome meal options. Market accessibility and growth potential are further supported by the expansion of retail distribution and e-commerce platforms. Customers need for effortless, health-focused products. Low-sodium and gluten-free choices are being introduced by brands to accommodate dietary requirements, while vegan and flexitarian consumers are drawn to plant-based broths made with ingredients like seaweed and miso. Additionally, innovations in shelf-stable packaging boost product life and accessibility.

Report Coverage

This research report categorizes the market for the United Kingdom broth market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom broth market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom broth market.

United Kingdom Broth Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 675.86 Million |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 5.01% |

| 2035 Value Projection: | USD 1156.87 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 188 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type of Broth, By Packaging Type, and COVID-19 Impact Analysis |

| Companies covered:: | Rapunzel Naturkost, Ankerkraut, Bone Brox Gmbh, Scott Brothers Butchers, JARMINO UK, Spear & Arrow Bone Broth, Bone Broth Bros, Osius Bone Broth, Ostmann, Tellofix, Wela-Trognitz, PICHLER BIOFLEISCH GMBH & CO., and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The increasing customer demand for ready-to-eat, convenient, and nutrient-dense food options. Growing awareness of broth's health advantages, including immune support, weight management, and gut health, is boosting demand from customers who are concerned about their health. Interest in bone broths has increased as an outcome of the popularity of diets high in collagen and protein. Additionally, new vegan and organic broth variations have emerged as a consequence of the growing popularity of plant-based diets. The availability of broth goods has also increased because to the growth of retail outlets, particularly internet platforms. The market's consistent rise is a result of busy lifestyles and the demand for rapid meal solutions.

Restraining Factors

The high production costs linked to premium ingredients and labor-intensive cooking methods are a drawback, leading to higher retail pricing. Furthermore, the short preservation period of natural broths makes distribution and storage difficult.

Market Segmentation

The United Kingdom broth market share is classified into type of broth and packaging type.

- The chicken broth segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom broth market is segmented by type of broth into chicken broth and beef broth. Among these, the chicken broth segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to its high protein content, numerous culinary applications, and customer demand for foods that are comforting and immune-boosting. Its many recipe possibilities and reputation as a low-fat, healthful alternative support its steady demand and expansion.

- The canned broth segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom broth market is segmented by packaging type into canned broth and boxed & carton broth. Among these, the canned broth segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because it is readily available in stores, has a long shelf life, and is easy to store. It is a popular option for daily cooking needs because of its dependability and ease of use, which appeal to time-pressed customers who require quick meal alternatives.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom broth market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Rapunzel Naturkost

- Ankerkraut

- Bone Brox Gmbh

- Scott Brothers Butchers

- JARMINO UK

- Spear & Arrow Bone Broth

- Bone Broth Bros

- Osius Bone Broth

- Ostmann

- Tellofix

- Wela-Trognitz

- PICHLER BIOFLEISCH GMBH & CO.

- Others.

Recent Developments:

- In April 2023, Borough Broth launched its Organic Chicken Bone Broth and Organic Chicken and Ginger Bone Broth in collaboration with Planet Organic. These broths are made with turmeric, lemongrass, and apple cider vinegar, and are designed to offer a flavorful and nutritious bone broth experience. This partnership aims to provide consumers with high-quality, organic broth options.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom broth market based on the below-mentioned segments:

United Kingdom Broth Market, By Type of Broth

- Chicken Broth

- Beef Broth

United Kingdom Broth Market, Packaging Type

- Canned Broth

- Boxed & Carton Broth

Need help to buy this report?