Bottled Water Production in the UK - Market Research Report (2020-2035)

Industry: Consumer GoodsBottled Water Production in the UK - Market Research Report (2020-2035)

|

Market Size |

Profit |

Employees |

Businesses |

|

$11.36bn |

$ XX.X Mn |

4,000+ |

60+ |

Bottled Water Production in the UK Industry Analysis

The convenience and portability of bottled water, combined with the health risk associated with drinking contaminated tap water, are the main drivers of bottled water demand. Growth in the market is fueled by several factors, including a shift toward flavored and premium bottled water, as well as developments in environmentally friendly packaging, such as recyclable and biodegradable packaging. Additionally, growing urbanisation, better disposable income, a rising consumer consciousness of health-related issues, and increasing understandings of waterborne diseases have all led to a greater demand for bottled water from health-conscious consumers. Industry market size is expected to increase at a compound annual rate of 4.97% through 2024-35 to approximately $19.36 billion. To cater to the higher demand of consumers looking for more variety, companies are also increasing their range of flavoured waters. To ensure the quality and safety of products, the production of bottled water is regulated by the UK government, primarily by local authorities who have the responsibility to register producers and enforce compliance with regulations. Producers must register with the local authority, ensure bottled water meets hygiene requirements, and comply with the labelling requirements. The bottled water production market in the UK is expected to continue to grow, and opportunities exist in the market, such as sustainable packaging, functional waters, and premium segments.

Trends and Insights

- Health and wellness trends are driving market growth: As consumers continue to prioritise their health and well-being, there is a growing trend towards bottled water as a healthier alternative to sugary beverages. Additionally, there is an increasing demand for functional water products fortified with vitamins, minerals, and electrolytes to meet specific health needs such as improved energy, recovery, and hydration.

- Sustainability and premiumization trends: With the growing environmental concerns regarding plastic waste, bottled water brands are moving towards recyclable and biodegradable bottles, which align with the larger trend towards sustainability in society. In addition to sustainability, premiumization is rising as consumers will spend more on luxury bottled water brands that are often sourced from remote areas or have unique mineral characteristics.

- Rising convenience and shifting lifestyle trends: Since consumers nowadays emphasize portable beverage choices due to increasingly busy lifestyles, bottled water is a perfect option for ease of travel. This trend particularly affects young professionals and active individuals who are looking for hydration throughout the day, which increases the water bottle production in the UK.

Industry Statistics and Trends

Market size and recent performance (2020-2035)

The industry market size has grown at a CAGR of 4.61% over the past five years, to reach an estimated $11.36bn in 2024.

Restraint Insights

Competition and economic pressures present a challenge to the market.

- Alternative hydration products, particularly public tap water and home filtration systems, are posing an increasing threat to the bottled water industry. Tap water is becoming an increasingly attractive and cost-effective choice for consumers, and as long as governments and water utilities take steps to improve quality and safety, consumers will certainly embrace it. Significant challenges also arise from economic conditions, including slowdowns and rising costs of transportation, energy, and raw materials.

Industry outlook (2020-2035)

Market size is projected to grow during the forecast period from 2024 to 2035.

The Biggest Companies in Bottled Water Production in the UK.

|

Company |

Market Share (%) 2024 |

Market Size ($m) 2024 |

|

PepsiCo |

XX |

XX.X |

|

DANONE |

XX |

XX.X |

|

Nestlé |

XX |

XX.X |

|

Primo Water Corporation |

XX |

XX.X |

|

The Coca-Cola Company |

XX |

XX.X |

|

FIJI Water Company LLC |

XX |

XX.X |

|

Buxton |

XX |

XX.X |

|

Highland Spring |

XX |

XX.X |

|

VOSS WATER |

XX |

XX.X |

|

Crag Spring Water |

XX |

XX.X |

Products & Packaging Segmentation

The market size is calculated across several different product and packaging categories.

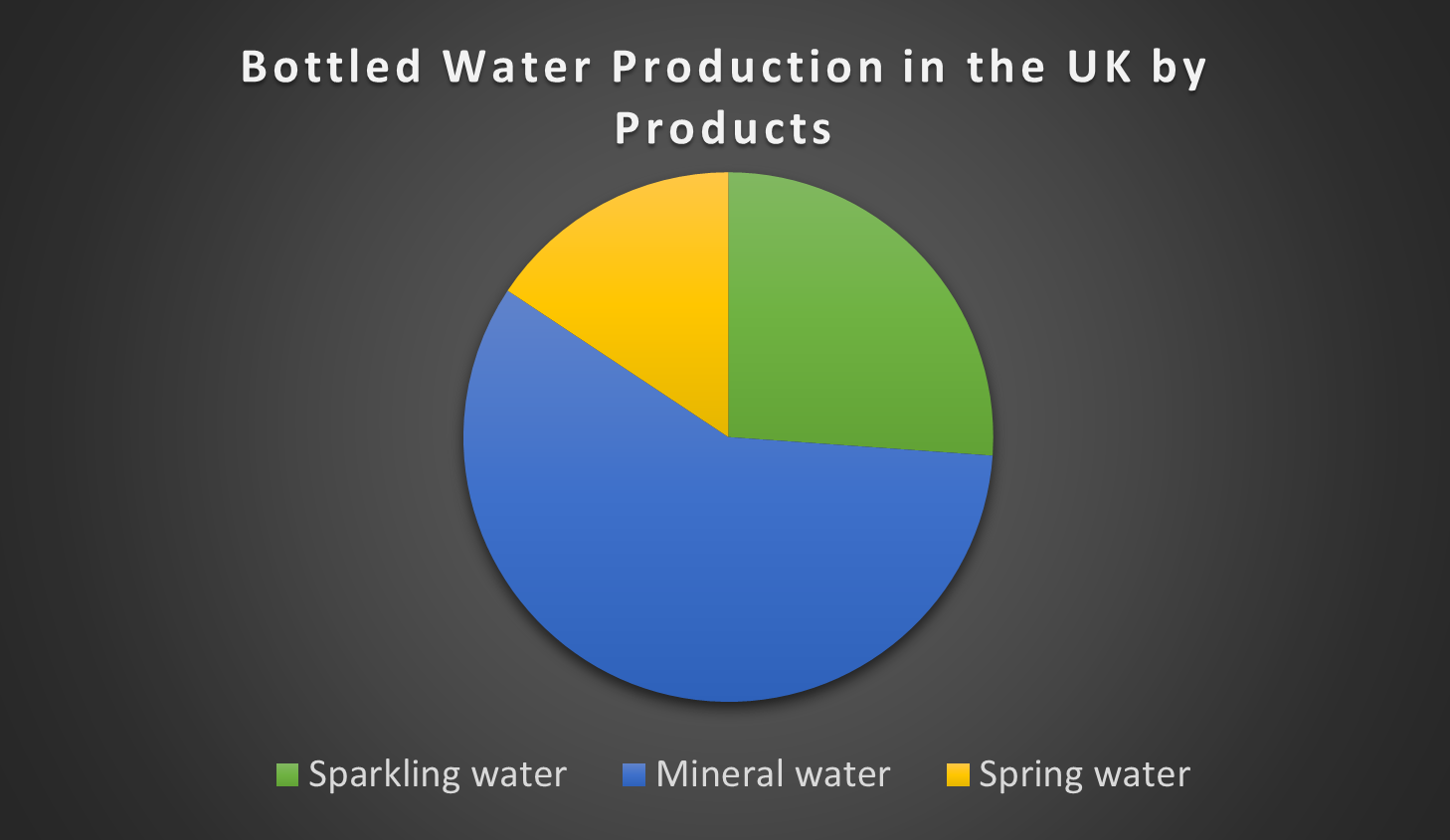

- By Product

The market size is calculated by product categories such as sparkling water, mineral water, and spring water. Mineral water is the largest segment of the Bottled Water Production in the UK. Mineral water is considered valuable because of the purity of the water and the health benefits of the minerals it contains. Demand for purified water is increasing, particularly among health-conscious consumers, who look for water with all contaminants removed.

Get more details on this report -

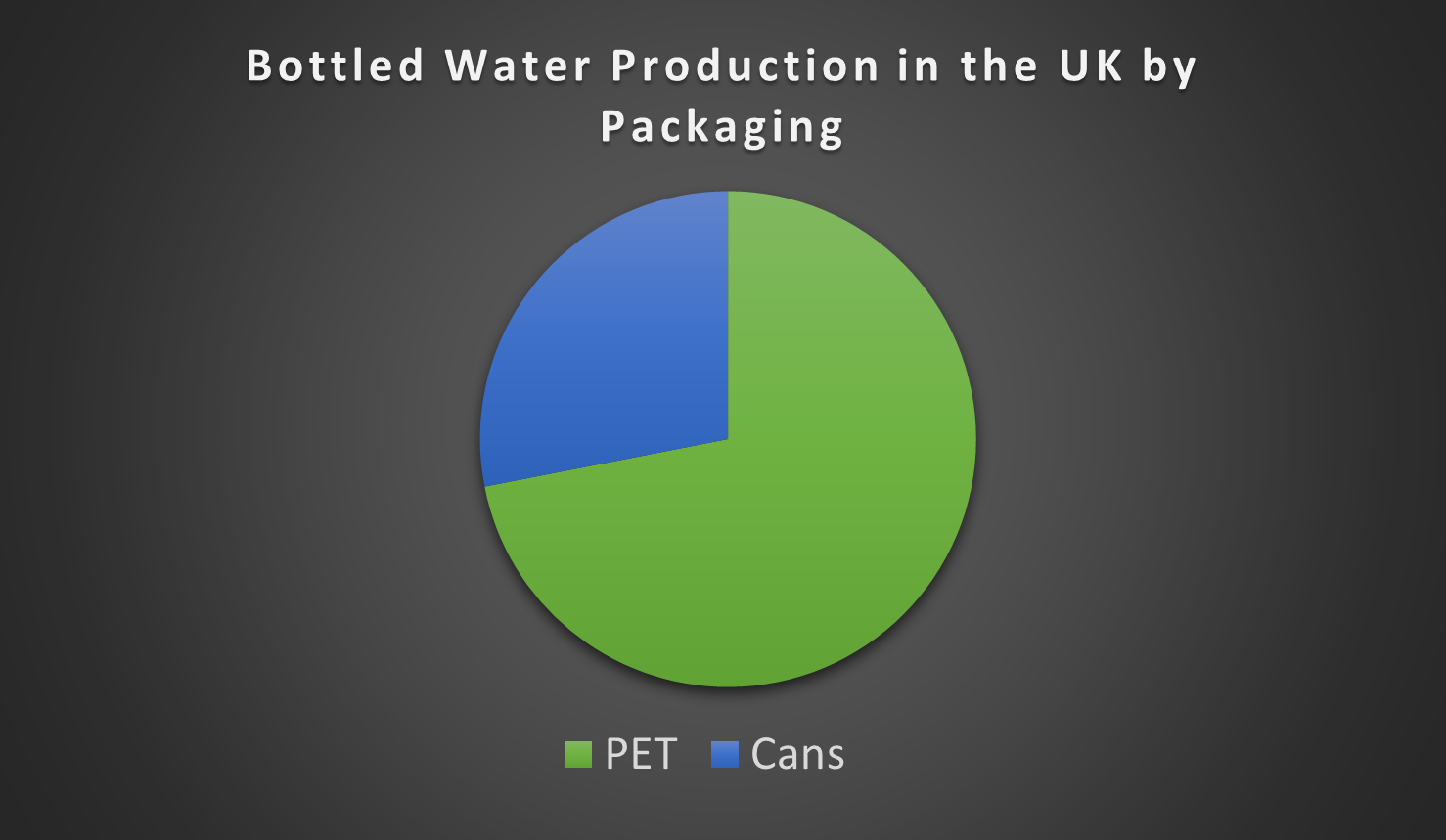

- By Packaging

The market size is calculated by packaging categories such as PET and cans. PET is the largest segment of the Bottled Water Production in the UK. PET water bottles are relatively cheap, particularly when compared to other materials like glass or aluminium, which is an important distinction in the bottled water industry. PET's cost advantages have also made it the most common water packaging material and enabled manufacturers to offer bottled water products at prices accessible to a broader range of consumers.

Get more details on this report -

Table of Contents

Chapter 1: About this industry

Industry definition:

The bottled water industry includes the production, distribution, and sale of bottled drinking water, which is most often made in plastic or glass. This encompasses every step of the process from the source and purification to the bottling, packaging, and delivery. It includes all water forms, including spring, purified water, mineral water, and sparkling water.

What's included in this industry?

The UK's bottled water production industry includes the manufacturing of a range of bottled beverages, including spring water, natural mineral water, and other bottled drinking water. This is an important part of the larger soft drinks and bottled water industry and includes both still, carbonated, and flavoured water types.

Chapter-2: Performance

In this chapter

- Current Performance

- Outlook

- Volatility

- Life Cycle

Key metrics

- Annual Revenue, Recent Growth, Forecast, Revenue Volatility

- Number of Employees, Recent Growth, Forecast, Employees per Business

- Number of Businesses, Recent Growth, Forecast

- Total Profit, Profit Margin, Profit per Business

Charts

- Revenue, including historical (2020-2024) and forecast (2025-2035)

- Employees, including historical (2020-2024) and forecast (2025-2035)

- Businesses, including historical (2020-2024) and forecast (2025-2035)

- Profit, including historical (2020-2024)

- Industry Volatility vs. Revenue Growth

- Industry Life Cycle

Detailed analysis

- Trends in supply, demand, and current events that are driving current industry performance

- Expected trends, economic factors, and ongoing events that drive the industry's outlook

- Key success factors for businesses to overcome volatility

- How contribution to GDP, industry saturation, innovation, consolidation, and technology and systems influence the industry's life cycle phase.

Chapter-3: Products and Markets

In this chapter

- Products & Services

- Major Markets

Key metrics

- Largest market segment and value in 2024

- Product innovation level

Charts

- Products & services segmentation in 2024

- Major market segmentation in 2024

Detailed analysis

- Trends impacting the recent performance of the industry's various segments

- Innovations in the industry's product or service offering, specialization or delivery method

- Key factors that successful businesses consider in their offerings

- Buying segments and key trends influencing demand for industry products and services

Chapter-4: Competitive Forces

In this chapter

- Barriers to Entry

- Substitutes

- Buyer & Supplier Analysis

Key metrics

- Industry competitive rivalry level

- Industry competition level and trend

- Barriers to entry level and trend

- Substitutes level and trend

- Buyer power level and trend

- Supplier power level and trend

Charts

- Market share concentration among the top 4 suppliers from 2020-2024

- Supply chain including upstream supplying industries and downstream buying industries, flow chart

Chapter-5: Top Key Companies

In this chapter

- Market Share

- Companies

Charts

- Industry market share by company in 2020 through 2024

- Major companies in the industry, including market share, revenue, profit and profit margin in 2024

Chapter-6: External Environment

In this chapter

- External Drivers

- Regulation & Policy

Need help to buy this report?