United Kingdom Bottled Water Market Size, Share, By Product (Spring Water, Mineral Water, and Sparkling Water), By Packaging (PET, Cans), By Distribution Channel (On-trade, Off-trade), United Kingdom Bottled Water Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited Kingdom Bottled Water Market Insights Forecasts to 2035

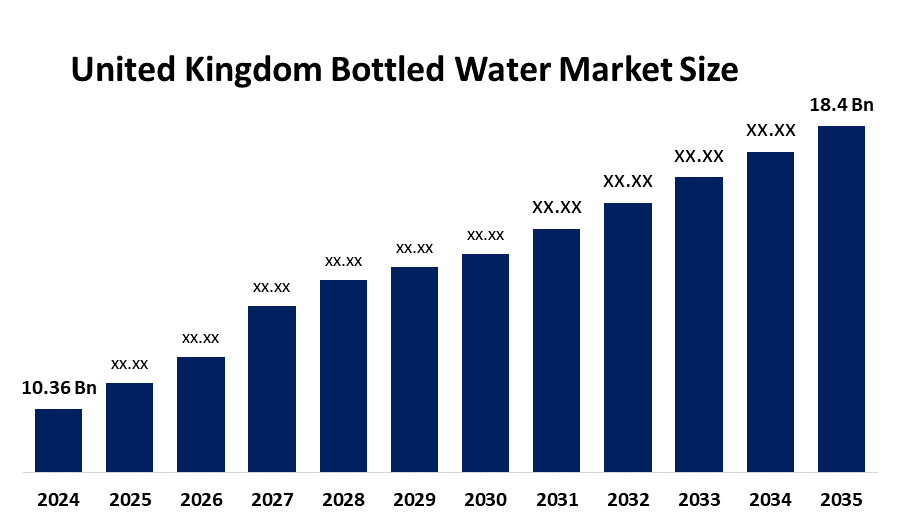

- United Kingdom Bottled Water Market Size 2024: USD 10.36 Billion

- United Kingdom Bottled Water Market Size 2035: USD 18.4 Billion

- United Kingdom Bottled Water Market CAGR 2024: 5.36%

- United Kingdom Bottled Water Market Segments: Product, Packaging, Distribution Channel

Get more details on this report -

The United Kingdom bottled water market is a dynamically evolving market in the beverage industry, including still, sparkling, flavored, functional, and the mineral water. The market is undergoing a transformation from conventional bottled water to high-quality, functional, and eco-friendly packaged water due to the growing health consciousness, urbanization, and the everyday lifestyle. The demand for the low-sugar drinks, electrolyte-enriched and alkaline water, greater product transparency, and the eco-friendly packaging solutions is fueling innovation. The preference for recyclable packaging materials, development of online grocery shopping, strong presence of private labels, and competition from local and global brands are propelling the market in the UK.

The United Kingdom bottled water market is moving steadily because of the rising health consciousness, demand for low-calorie and sugar-free drinks, and the need for a convenient beverage. Increasing number of consumers emphasizing purity, mineral properties, functionality, and sustainable packaging. The rising trends are for high-quality natural mineral water, flavored and functional water, and sustainable aluminium or recycled PET packaging that satisfies the environmental requirements. The use of advanced filtration technology, improved source traceability, and innovative packaging technology is enhancing product differentiation. The development of e-commerce platforms, supermarket brands, and premium brands is making the market more accessible, while sustainability requirements and recycling programs are influencing the competitive scenario despite cost concerns.

Market Dynamics of the United Kingdom Bottled Water Market

The UK bottled water market is being driven by the rising health awareness, growing disposable incomes, and the need for convenient and portable beverages. The demand for premium, functional, and sustainably packaged bottled water is being driven by consumer demands for purity, mineral content, and low sugar beverages. The market is witnessing a shift from traditional retail-based distribution channels to more varied channels such as online grocery shopping platforms, subscription services, and private labels, driven by digital product comparisons and sourcing information. The government’s emphasis on sustainability, plastic reduction targets, and recycling initiatives is encouraging innovation in packaging, investment in sustainable materials, and collaboration, making the UK an important player in the global bottled water value chain.

The United Kingdom bottled water market faces challenges including intense price competition from low-cost private-label and imported brands, rising raw material, packaging, energy, and logistics costs, and strict compliance with UK environmental regulations, plastic reduction targets, and recycling requirements.

The future outlook for the United Kingdom bottled water market appears bright and promising, because of the innovations in products, health awareness, and changing lifestyles. The trends which are emerging in the United Kingdom bottled water market includes high-end natural mineral water, functional and enhanced water, and eco-friendly packaging materials such as recycled PET and aluminium bottles. Innovations in advanced filtration, mineral enrichment, smart labeling, and traceability are enhancing the quality of products. On the other hand, the increasing adoption of e-commerce platforms, subscription-based delivery services, and online marketing campaigns is increasing market accessibility and improving distribution channels in the United Kingdom bottled water market.

United Kingdom Bottled Water Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 10.36 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.36% |

| 2035 Value Projection: | USD 18.4 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Product, By Packaging |

| Companies covered:: | Nestle, PepsiCo, The Coca-Cola Company, Danone, Primo Water Corporation, FIJI Water Company LLC, Highland Spring, VOSS WATER, Buxton, Crag Spring Water, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The United Kingdom bottled water market share is classified into product, packaging, and distribution channel.

By Product

The United Kingdom bottled water market is divided by product into spring water, mineral water, and sparkling water. Among these, the mineral water Waters segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because UK consumers are increasingly prioritizing health, turning away from sugary beverages toward "pure" and "natural" alternatives. Natural mineral water, rich in nutrients like calcium and magnesium, is perceived as healthier and more premium.

By Packaging

The United Kingdom bottled water market is divided by packaging into PET, cans. Among these, the PET segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because the PET bottles are lightweight, shatter-resistant, and, crucially, resalable. This makes them the ideal choice for on-the-go consumption.

By Distribution Channel

The United Kingdom bottled water market is divided by distribution channel into on-trade, off-trade. Among these, the off-trade segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because of the consumer convenience, competitive pricing, and the widespread availability of diverse brands for home consumption and on-the-go purchases.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom bottled water market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United Kingdom Bottled Water Market

- Nestle

- PepsiCo

- The Coca-Cola Company

- Danone

- Primo Water Corporation

- FIJI Water Company LLC

- Highland Spring

- VOSS WATER

- Buxton

- Crag Spring Water

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom bottled water market based on the below-mentioned segments:

United Kingdom Bottled Water Market, By Product

- Spring Water

- Mineral Water

- Sparkling Water

United Kingdom Bottled Water Market, By Packaging

- PET

- Cans

United Kingdom Bottled Water Market, By Distribution Channel

- On-trade

- Off-trade

Need help to buy this report?