United Kingdom Blood Collection Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Needles and Syringes, Blood Collection Tubes, Blood Lancets, Blood Bags, and Others), By Application (Diagnostics, and Treatment), By End User (Hospitals, Diagnostic Centers, Blood Banks, and Others), and UK Blood Collection Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Blood Collection Market Forecasts to 2035

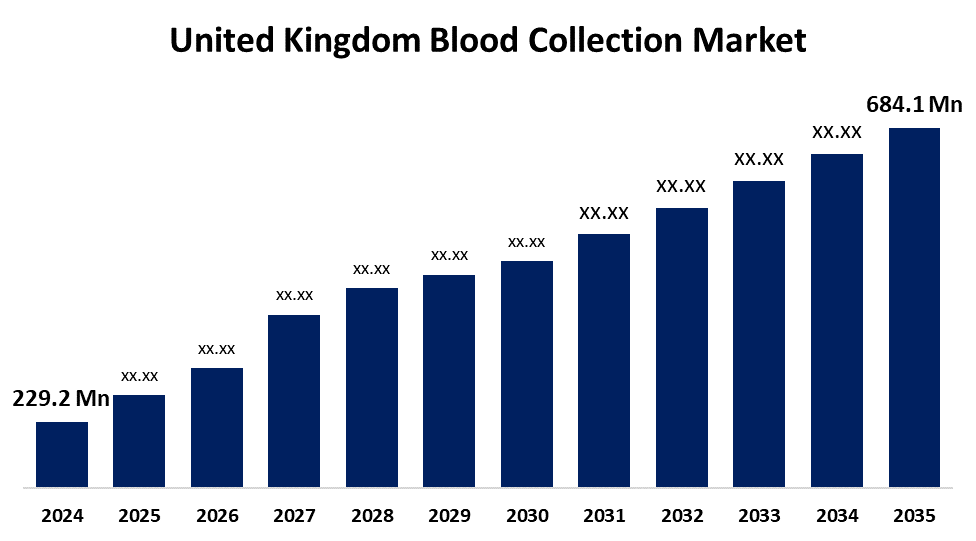

- The United Kingdom Blood Collection Market Size Was Estimated at USD 229.2 Million in 2024

- The UK Blood Collection Market Size is Expected to Grow at a CAGR of around 10.45% from 2025 to 2035

- The UK Blood Collection Market Size is Expected to Reach USD 684.1 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the UK Blood Collection Market Size is anticipated to reach USD 684.1 Million by 2035, Growing at a CAGR of 10.45% from 2025 to 2035. The UK blood collection market is expanding due to the increasing healthcare needs among the masses, the rising demand for affordable and precise diagnostic tests, and continual advancements in collection technologies.

Market Overview

The blood collection market refers to an essential step in healthcare, used for diagnosis, treatment, and research. Depending on the purpose of the sample, it is commonly obtained by taking blood from a vein (venipuncture), a capillary (fingerstick), or an artery. This method is crucial in medical practice since it aids in the diagnosis of diseases, the monitoring of health, the administration of medications, and the conduct of research. Moreover, the market is driven by the increasing prevalence of chronic diseases such as diabetes, cancer, and cardiovascular disorders, which necessitate frequent blood testing and monitoring. Increased healthcare infrastructure investments, particularly in emerging nations, as well as rising demand for improved diagnostic techniques, all help to drive market expansion. Increased blood donation campaigns and awareness programs about blood shortages favorably influence demand. Technological advancements in blood collection technologies, such as minimally invasive procedures, improve patient comfort and safety, increasing their use. Furthermore, the growing elderly population, as well as the rise in surgical procedures and personalised medicine, are increasing the demand for blood collection services. Regulatory support and financing for research and healthcare breakthroughs are accelerating industry growth

The COVID-19 pandemic favored the blood collection sector, as it did for several other medical device industries. Diagnostic procedures have been impacted by the COVID-19 epidemic, as has almost every other side of healthcare delivery. But when the number of COVID-19 cases rose, governments looked into whether they might allow labs to use more blood testing methods. The need for goods used in blood collection rises as a result. For instance, data from the World Health Organisation (WHO) highlights the significance of being ready and acting promptly, and it outlines the essential steps that blood services should take to lower the risk to the safety and sufficiency of the blood supply during the pandemic.

Report Coverage

This research report categorizes the market for the UK blood collection market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom blood collection market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom blood collection market.

United Kingdom Blood Collection Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 229.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.45% |

| 2035 Value Projection: | USD 684.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 199 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Application, By End User |

| Companies covered:: | Grifols S.A., Bio-Rad Laboratories, Becton, Dickinson and Company., Merck KGaA, Quotient Limited, Abbott Laboratories, Thermo Fisher Scientific, Nipro Corp, FL Medical, Terumo Corp, Qiagen NV, Medtronic PLC, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The UK blood collection sector is quickly expanding as a result of the growing number of surgical procedures, such as C-sections or difficult operations, as well as the rising prevalence of chronic diseases. Data as of now indicates that there are around 385,000 new cases of cancer being registered in the United Kingdom every year. Consequently, the demand for blood collection for diagnosis and treatment is increasing. Various governments' initiatives to enhance awareness about voluntary blood donation have assisted market expansion by maintaining a consistent supply for normal and emergency medical needs. Furthermore, technology breakthroughs are transforming the sector, enhancing efficiency, comfort, and diagnostic accuracy. Automated systems and push-button blood collection equipment have been designed to optimize operations and improve preventive care. Continuous R&D also leads to the development of sophisticated devices that meet the demand of modern health care and push the market forward.

Restraining Factors

The UK blood collection market is hampered by factors such as disturbing services with cybersecurity risks, increasing the operation complexity by stringent regulatory demands, and a workforce shortage. Supply chain issues and transfusion-transmitted infection risks also pose challenges to the sectors of efficacy and safety, hampering service delivery consistency and delaying the adoption of technologically advanced blood collection solutions. This factor hampers the UK blood collection market during the forecast period.

Market Segmentation

The United Kingdom blood collection market share is classified into product type, application, and end user.

- The needles and syringes segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom blood collection market is segmented by product type into needles and syringes, blood collection tubes, blood lancets, blood bags, and others. Among these, the needles and syringes segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. For taking blood samples, transfusions, and diagnostic tests. Needles and syringes are used in a wide range of medical operations, including routine blood testing and emergency care, as well as the treatment of chronic diseases like diabetes and cancer. Medical professionals like them are regarded as dependable, simple to use, and economical. Furthermore, developments in needle technology include ultra-thin needles and safety-engineered devices that eliminate the possibility of needlestick injuries. Growing prevalence of chronic diseases, increased surgical interventions, and an increasing emphasis on preventive care are also driving the demand for needles and syringes.

- The diagnostics segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom blood collection market is segmented by application into diagnostics and treatment. Among these, the diagnostics segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Diagnostics is the largest product segment in the UK blood collection market, driven by an increase in chronic diseases and the resulting demand for early and precise diagnosis. Blood diagnostics are used in modern medicine to diagnose a wide range of disorders, including cancer, diabetes, cardiovascular disease, and infectious diseases. The growing trend of regular health check-ups to monitor lifestyle-related illnesses is driving increased demand for diagnostic technologies. Technological advancements, such as automated analysers and rapid diagnostic kits, are increasing the speed and accuracy of blood testing, cementing their market dominance.

- The hospitals segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom blood collection market is segmented by end user into hospitals, diagnostic centers, blood banks, and others. Among these, the hospitals segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Hospitals that specialise in surgery, trauma, chronic illnesses, and emergency treatments require blood collection products to diagnose conditions as soon as possible and treat patients properly. Increasing surgical procedures requiring complex organ transplants and cancer surgery are increasing the demand for blood collection solutions. Hospitals also serve as essential centres for blood banks and transfusion services; therefore, they play a vital part in the supply chain of blood and its components. Furthermore, the increased frequency of chronic diseases and lifestyle-related diseases necessitates regular blood testing in hospital labs, hence strengthening its market position.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom blood collection market and a with comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Grifols S.A.

- Bio-Rad Laboratories

- Becton, Dickinson and Company.

- Merck KGaA

- Quotient Limited

- Abbott Laboratories

- Thermo Fisher Scientific

- Nipro Corp

- FL Medical

- Terumo Corp

- Qiagen NV

- Medtronic PLC

- Others

Recent Developments:

- In January 2025, The UK Biobank has announced the commencement of the world's most comprehensive study of the proteins that circulate in human bodies, which will alter illness research and therapy. This groundbreaking study aims to analyse up to 5,400 proteins in 600,000 samples, including those from half a million UK Biobank members and 100,000 second samples collected up to 15 years later.

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom blood collection market based on the below-mentioned segments:

United Kingdom Blood Collection Market, By Product Type

- Needles and Syringes

- Blood Collection Tubes

- Blood Lancets

- Blood Bags

- Others

United Kingdom Blood Collection Market, By Application

- Diagnostics

- Treatment

United Kingdom Blood Collection Market, By End User

- Hospitals

- Diagnostic Centers

- Blood Banks

- Others

Need help to buy this report?