United Kingdom Biscuits Market Size, Share, and COVID-19 Impact Analysis, By Type (Crackers, Savory Biscuits, Sweet Biscuits), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialist Retailers, Online Retail, Others), and United Kingdom Biscuits Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited Kingdom Biscuits Market Insights Forecasts to 2035

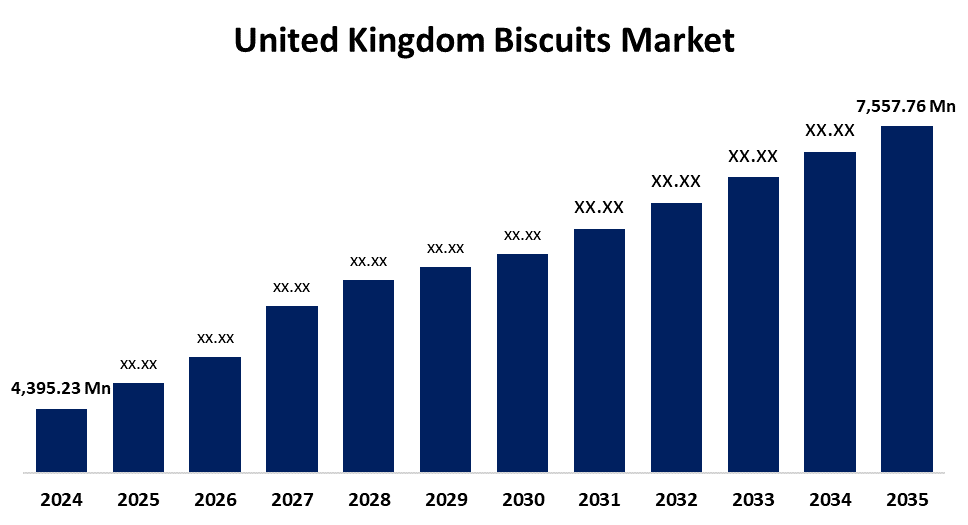

- The United Kingdom Biscuits Market Size was Estimated at USD 4,395.23 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.05% from 2025 to 2035

- The United Kingdom Biscuits Market Size is Expected to Reach USD 7,557.76 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Biscuits Market Size is anticipated to reach USD 7,557.76 Million by 2035, growing at a CAGR of 5.05% from 2025 to 2035. The market for the UK is driven by new products that are regularly introduced in the food industry, free-from substitutes, and some kinds of morning biscuits. The nation's appetite for healthier biscuits grew, which might have propelled the market growth.

Market Overview

The United Kingdom biscuits market refers to the marketplace related to the food industry that focuses on the production of biscuits, which is a flour-based baked and shaped food item. The majority of biscuits are usually hard, flat, and unleavened. The growing consumer demand is driving the market for fast snacks with wholesome ingredients. Food-on-the-go is the most recent and widespread trend that consumers need to take into account when buying food products, which might exceed the market revenue for biscuits. It now contributes significantly to the global biscuit industry's growth. The market has expanded as a result of regular product launches with innovative biscuit recipes, such as low-fat, gluten-free, low-carb, organic, and high-fiber biscuits. Additionally, portion-pack and single-serve items are becoming more and more popular among students and working professionals. The biscuit consumption is further fueled by customers' shifting eating habits brought on by time constraints and their convenience-seeking tendencies.

Report Coverage

This research report categorizes the market for the United Kingdom biscuits market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom biscuits market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom biscuits market.

United Kingdom Biscuits Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4,395.23 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.05% |

| 2035 Value Projection: | USD 7,557.76 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 233 |

| Tables, Charts & Figures: | 103 |

| Segments covered: | By Type and By Distribution Channel |

| Companies covered:: | Hill Biscuits, United Biscuits UK Ltd, Fox’s Biscuits Batley, Biscuit International UK, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom biscuits is primarily driven by sedentary lifestyles, increasing disposable income, and increased urbanization. The growth of supermarkets and shopping malls has increased the visibility of a wider range of biscuits in various tastes and shapes. Additionally, market expansion is being aided by creative concepts and marketing strategies like television ads, online platforms, and e-commerce platforms. Furthermore, sector and smaller biscuit manufacturers can offer distinctive items that are not easily found in local marketplaces and reach a wider audience through internet platforms. There is also an increasing demand for gourmet and premium biscuits with unique ingredients and opulent packaging.

Restraining Factors

The market expansions across the UK could be slowed down by a stringent regulatory environment, logistical delays, raw material price fluctuations, changes in the environment, and production process complexity.

Market Segmentation

The United Kingdom Biscuits Market share is classified into type and distribution channel.

- The sweet biscuits segment held a significant share in 2024 and is expected to grow at a substantial CAGR over the forecast period.

The United Kingdom biscuits market is divided by type into crackers, savory biscuits, and sweet biscuits. Among these, the sweet biscuits segment held a significant share in 2024 and is expected to grow at a substantial CAGR over the forecast period. The segment growth is driven by the rising need, desires, and consumption of plain sweet biscuits for special occasions and many more reasons. This type of biscuit is also more popular since consumers may eat it whenever it's convenient for them, which encourages segment growth.

- The specialist retailers segment held the highest share in 2024 and is expected to grow at a rapid pace during the forecast period.

The United Kingdom biscuits market is segmented by distribution channel into supermarkets/hypermarkets, convenience stores, specialist retailers, online retail, and others. Among these, the specialist retailers segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because specialty retailers include local cafes, kiosks, and home-based and artisanal bakers. These businesses sell a wide selection of biscuits because their product prices are lower, which leads to high-volume items that are usually purchased at lower price points. This promotes the expansion of specialty shops, particularly in developing countries like India, where biscuits are sold in cities, shopping centers, and airports by Frontier Biscuits and others.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom biscuits market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hill Biscuits

- United Biscuits UK Ltd

- Fox's Biscuits Batley

- Biscuit International UK

- Others

Recent Developments:

- In May 2025, Biscuiteers, the UK’s original hand-iced biscuit brand, partnered with The Savoy Hotel to offer a bespoke collection of hand-iced biscuits for guests. The collection included four single biscuits inspired by London’s cultural and theatrical heritage, featuring designs such as a Theatre Mask biscuit, The Savoy Shopping Bag biscuit, a Strand Red London Bus biscuit, and a biscuit of Kaspar the Cats.

- In August 2024, Mondelez International and Saica Group partnered to introduce paper-based multipack bags for Cadbury biscuits in the UK. This initiative aimed to reduce plastic waste and enhance recyclability, aligning with Mondelez’s sustainable packaging goals. The collaboration was part of Mondelez’s broader commitment to packaging sustainability, with a target to make 98% of its packaging recyclable.

- In September 2021, LU, the iconic French biscuit brand, officially launched in the UK with a creative campaign by Digitas UK. The campaign, titled "A Taste of France is Now Available in the UK," leverages LU’s distinctive branding and nostalgic French imagery to introduce the biscuits to a new audience. The launch includes four varieties: Le Petit Chocolat, Le Petit Beurre, Le Petit Biscotte, and Le Petit Citron, all available in UK supermarkets.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom biscuits market based on the below-mentioned segments:

United Kingdom Biscuits Market, By Type

- Crackers

- Savory Biscuits

- Sweet Biscuits

United Kingdom Biscuits Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialist Retailers

- Online Retail

- Others

Need help to buy this report?