United Kingdom Biosimilars Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Recombinant Human Growth Hormone (RHGH), Granulocyte Colony-Stimulating Factor, Interferon, Monoclonal Antibodies, Insulin, Erythropoietin, anticoagulants), By Application, (Offsite Treatment, Oncology, Chronic Disorder, Autoimmune Disease, and Others), and UK Biosimilars Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Biosimilars Market Forecasts to 2035

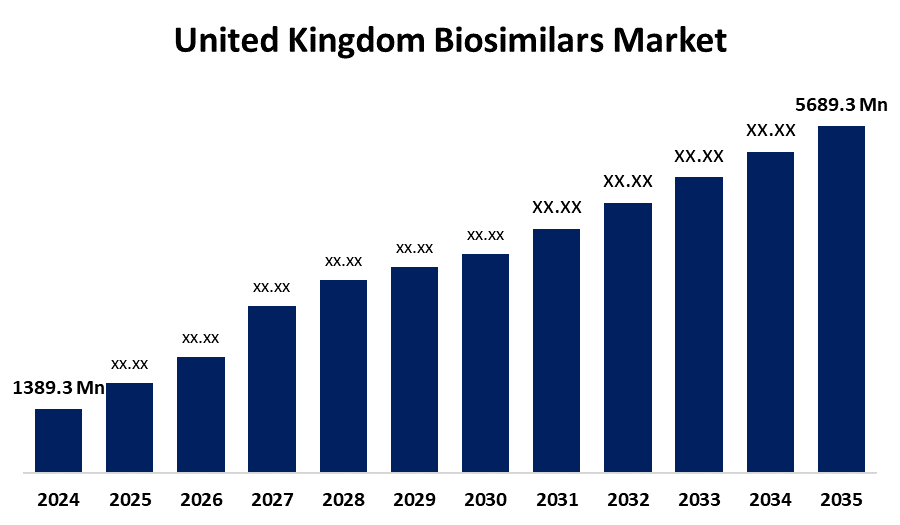

- The United Kingdom Biosimilars Market Size Was Estimated at USD 1389.3 Million in 2024

- The United Kingdom Biosimilars Market Size is Expected to Grow at a CAGR of around 13.67% from 2025 to 2035

- The United Kingdom Biosimilars Market Size is Expected to Reach USD 5689.3 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The UK Biosimilars Market Size is anticipated to reach USD 5689.3 Million by 2035, Growing at a CAGR of 13.67% from 2025 to 2035. The rising demand for treatment of chronic diseases, such as cancer and autoimmune disorders, that creates access to affordable and effective treatments. Growing government support for their use. Patient and healthcare professional awareness, and competition need to be addressed to fully realize the potential of biosimilars in the UK healthcare system.

Market Overview

The biosimilars market represents a set of industry players that work in the field of development, production, and approval of biosimilars. Biological medical products that are similar or identical copies of original biologics that are already allowed for marketing and demonstration. With no clinically meaningful differences in terms of safety, purity, and potency. The UK biosimilars market is expanding, a competitive pricing is inspired by a strong emphasis on the environment, education and sharing of best practices between the Regional Health Services Commissioners. A prominent example of this is NHS England, which is increasing the use of both national and regional tenders for biosimilars.

Historically, most of the NHS's savings from biosimilars came from the patent expirations of a few high-cost drugs, such as Mabthera, Herceptin, Enbrel, Remicade, and Humira. However, over the next 4 to 5 years, the UK biosimilars market is expected to enter a new phase, with roughly three times as many original biologic drugs losing market exclusivity. While many of these upcoming products are expected to be of lower individual value, major cancer treatments like Opdivo and Keytruda are also anticipated to become available as biosimilars, offering substantial cost-saving opportunities when their exclusivity ends. As more biologic medications lose their patent protection and biosimilar producers continue to develop and enhance their products, the UK biosimilar industry is anticipated to expand. Additionally, anticipated to fuel market expansion in the upcoming years are the government's continued efforts to encourage the usage of biosimilars. The industries in the UK are adopting various technological advancements, which in turn, intensify the manufacturing process as well as the research conducted on biosimilars. This also increases the collaboration between industries.

Report Coverage

This research report categorizes the market for the UK biosimilars market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the UK biosimilars market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom biosimilars market.

United Kingdom Biosimilars Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1389.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 13.67% |

| 2035 Value Projection: | USD 5689.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 269 |

| Tables, Charts & Figures: | 109 |

| Segments covered: | By Product Type and By Application |

| Companies covered:: | Pfizer, Sandoz, Celltrion, Biogen, Samsung Bioepis, Mylan, Amgen, Teva, Fresenius Kabi, Accord Healthcare, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The expiration of patents on original biologic drugs has enabled the entry of biosimilars, offering more affordable treatment options. With rising healthcare costs, governments like the UK are encouraging the adoption of biosimilars through supportive policies, price regulations, and reimbursement schemes. The increasing prevalence of chronic diseases has further boosted demand for cost-effective therapies. Regulatory bodies such as the MHRA provide a favorable framework for biosimilar approval and use. As a result, competition in the pharmaceutical market has intensified, driving down prices and improving patient access to essential treatments. Biosimilars are thus playing a key role in sustainable healthcare delivery.

Restraining Factors

Competition in the UK biosimilar market has intensified as both biosimilar manufacturers and promoter biologic companies compete for market share. Developing biosimilars is highly complex and expensive, requiring advanced technical expertise, rigorous clinical trials, and strict regulatory compliance. Originator companies often counter new biosimilar entries by launching improved versions of their products, adjusting formulations or dosages, and employing competitive pricing. These defensive strategies have posed challenges to the growth of the UK biosimilars market during the forecast period.

Market Segmentation

The UK Biosimilars Market share is classified into product type and Application.

- The monoclonal antibodies segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UK biosimilars market is segmented by product type into recombinant human growth hormone (RHGH), granulocyte colony-stimulating factor, interferon, monoclonal antibodies, insulin, erythropoietin, and anticoagulants. Among these, the monoclonal antibodies segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to their high revenue potential, established regulatory pathways, and the technological feasibility of producing biosimilars, particularly in the face of rising demand for affordable treatments for diseases like cancer and autoimmune disorders. Furthermore, advancements in understanding diseases at a molecular level have led to a focus on mAbs as a rapid route to clinical proof-of-concept for new targets.

- The oncology segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UK biosimilars market is segmented by application into offsite treatment, oncology, chronic disorder, autoimmune disease, and others. Among these, the oncology segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to the availability of biosimilars at a lower cost than novel biologics, as well as the high number of cancer patients. The availability of biosimilars in oncology has reduced pricing, making cancer therapy more reasonable and accessible. Furthermore, due to the high incidence and prevalence of cancer, healthcare systems around the world are focusing on reducing the cancer burden by implementing cost-effective treatment alternatives. In this scenario, biosimilar pharmaceuticals may become widely adopted in major markets such as the United Kingdom. Given these concerns, as well as the increased competition from biosimilars, many big biologic pharmaceutical companies are investing heavily in biosimilar medicine research and approval.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK biosimilars market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pfizer

- Sandoz

- Celltrion

- Biogen

- Samsung Bioepis

- Mylan

- Amgen

- Teva

- Fresenius Kabi

- Accord Healthcare

- Others

Recent Developments:

- In June 2024, STADA and Alvotech expanded their strategic alliance to include AVT03, a proposed biosimilar referencing Amgen’s Prolia and Xgeva (denosumab). This collaboration focuses on treatments for osteoporosis and cancer-related bone loss.

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the UK biosimilars market based on the below-mentioned segments:

United Kingdom Biosimilars Market, By Product Type

- Recombinant Human Growth Hormone (RHGH)

- Granulocyte Colony-Stimulating Factor

- Interferon

- Monoclonal Antibodies

- Insulin

- Erythropoietin

- Anticoagulants

United Kingdom Biosimilars Market, By Application

- Offsite Treatment

- Oncology

- Chronic Disorder

- Autoimmune Disease

- Others

Need help to buy this report?