United Kingdom Biorationals Market Size, Share, and COVID-19 Impact Analysis, By Source (Botanicals, Semiochemicals, and Others), By Crop Type (Cereals and Grains, Fruits and Vegetables, and Others), and United Kingdom Biorationals Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureUnited Kingdom Biorationals Market Insights Forecasts to 2035

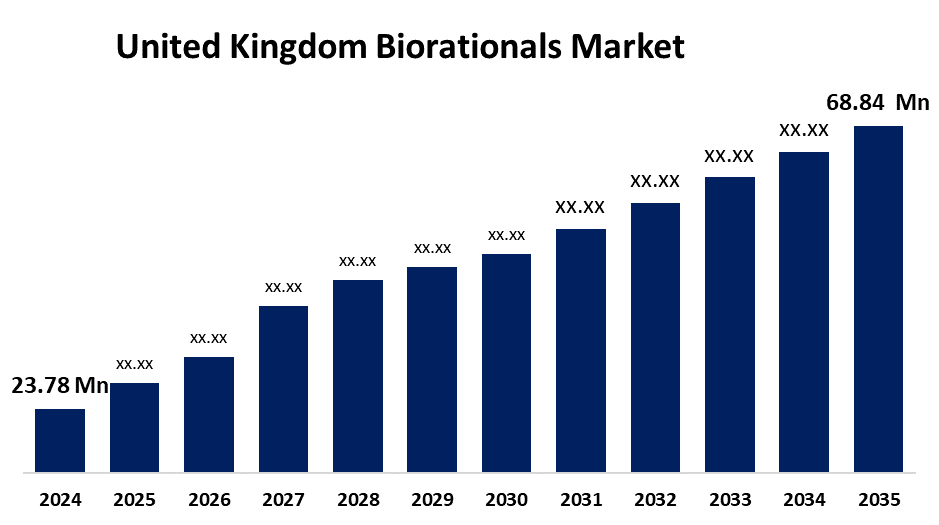

- The United Kingdom Biorationals Market Size was estimated at USD 23.78 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.15% from 2025 to 2035

- The United Kingdom Biorationals Market Size is Expected to Reach USD 68.84 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the United Kingdom Biorationals Market is anticipated to reach USD 68.84 million by 2035, growing at a CAGR of 10.15% from 2025 to 2035. The market demand has grown as a result of the growing need for a high agricultural yield and the creation of organic seeds to lessen the harmful chemical residues in grains and agricultural products.

Market Overview

The United Kingdom biorationals market refers to the business focused on the production and application of chemical or medical solutions for a healthy crop environment. Biorationals are insecticides effective against the target pest, but less harmful to natural enemies. These products are obtained from natural sources such as plant extracts and pathogens. The biorational products are widely used in structural pest control, agriculture, public health, forestry, turf, aquaculture, and home and garden. In addition, biorational products are typically derived from natural as well as biological methods. Moreover, a rise in the usage of environmental pest control technologies helps the end users achieve agricultural sustainability, and it maximizes the quality of crops. Recently, the government launched some programs for agriculture and related accessories, which could uplift the market for biorationals. For instance, the UK Pesticides National Action Plan (NAP) 2025 outlines how the government will collaborate with farmers to minimize the environmental and human health impacts of pesticide use while ensuring agricultural productivity. The plan aims to reduce environmental risks by 10% over the next five years and supports the development of biopesticides and precision application technologies.

Report Coverage

This research report categorizes the market for the United Kingdom biorationals market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom biorationals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom biorationals market.

United Kingdom Biorationals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 23.78 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.15% |

| 2035 Value Projection: | USD 68.84 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Source, By Crop Type and COVID-19 Impact Analysis |

| Companies covered:: | BASF SE, Bayer AG, Gowan Company LLC, Isagro S.p.A., Koppert B.V., Marrone Bio Innovations Inc., Rentokil Initial plc, Russell IPM Ltd, Sumitomo Chemical Co. Ltd., Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The market for United Kingdom biorationals is driven by the growing agriculture sector due to rising demand for food and growing health-conscious consumers with their changing eating habits. Biorational therapy is being used more and more in the agricultural production sector to increase resistance against insects and pests. The production of agricultural products is eventually increased by using biorational methods to eradicate the typical lifecycle of insects and pests and to keep healthy soil and crop ecosystems. The market is anticipated to increase in the upcoming years due to the increasing use of biorationals and bio-based pesticides and insecticides in agricultural operations as a repellent against diseases that are spread by leaves, soils, and seeds.

Restraining Factors

Market faces some obstacles during growth, such as high production and R&D expenditures, too much toxicity, and cutting-edge biotechnology equipment upkeep expenses, which can take away from small and medium-sized farming firms. Biorationals frequently need intricate fermentation, microbial culturing, and extraction techniques, which raises production costs in contrast to synthetic pesticides, which have delays the certain periods for crop development, which raises their purchasing cost.

Market Segmentation

The United Kingdom biorationals market share is classified into source and crop type.

- The botanicals segment accounted for the largest market share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The United Kingdom biorationals market is divided by source into botanicals, semiochemicals, and others. Among these, the botanicals segment accounted for the largest market share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This segment makes its position dominantly due to a growing inclination for organic farming and growing public awareness of the negative consequences of chemical pesticides are driving the trend toward biorational products and providing efficient pest control. Furthermore, the advantages of biorational products are being matched by the increased focus on lowering agricultural runoff and promoting crop safety, which is encouraging their use in a variety of agricultural industries.

- The fruits and vegetables segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom biorationals market is segmented by crop type into cereals and grains, fruits and vegetables, and others. Among these, the fruits and vegetables segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because the popularity of fruits and vegetables industry, and it serves as a dessert after dinner and lunchtime. So, there is a necessity for efficient, environmentally friendly pest management solutions, and the growing acceptance of sustainable agriculture methods which is the main driver of this rise. Besides, growing consumer demand for residue-free and organic produce is driving farmers to use biorational solutions, which offer a safer substitute for traditional chemical pesticides.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom biorationals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Bayer AG

- Gowan Company LLC

- Isagro S.p.A.

- Koppert B.V.

- Marrone Bio Innovations Inc.

- Rentokil Initial plc

- Russell IPM Ltd

- Sumitomo Chemical Co. Ltd.

- Others

Recent Developments:

- In April 2024, Bayer partnered with UK-based AlphaBio Control to develop a pioneering biological insecticide. The agreement granted Bayer exclusive rights to market the insecticide, which was expected to launch in 2028. The product is designed for arable crops like oilseed rape and cereals and aimed to combat pests such as the cabbage stem flea beetle (CSFB), a major threat to oilseed rape in the UK and Europe.

- In April 2024, Sumitomo Chemical launched two new cereal fungicides in the UK as part of its strategy to strengthen its market presence in Europe. The company, known for its biorational agricultural products, focused on sustainable farming by integrating conventional chemistry with innovative biorational solutions. The new fungicides targeted key diseases such as Septoria, net blotch, ramularia, and rusts, and were undergoing trials with organizations like NIAB and ADAS to optimize their effectiveness.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom biorationals market based on the below-mentioned segments:

United Kingdom Biorationals Market, By Source

- Botanicals

- Semiochemicals

- Others

United Kingdom Biorationals Market, By Crop Type

- Cereals and Grains

- Fruits and Vegetables

- Others

Need help to buy this report?