United Kingdom Biometrics Market Size, Share, and COVID-19 Impact Analysis, By Authentication Type (Multi-factor Authentication and Single Factor Authentication), By Contact Type (Contact-Based System, Contact Less System, and Hybrid), By Technology (Face Recognition, Iris Recognition, Voice Recognition, Vein Recognition, Fingerprint Recognition, and Others), and UK Biometrics Market Insights, Industry Trend, Forecasts to 2035

Industry: Electronics, ICT & MediaUnited Kingdom Biometrics Market Forecasts to 2035

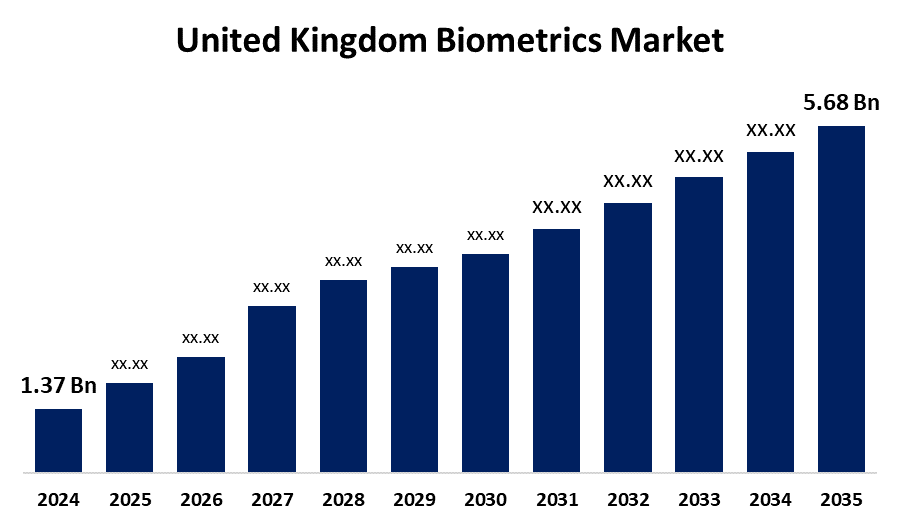

- The United Kingdom Biometrics Market Size Was Estimated at USD 1.37 Billion in 2024

- The UK Biometrics Size is Expected to Grow at a CAGR of around 13.80% from 2025 to 2035

- The UK Biometrics Market Size is Expected to Reach USD 5.68 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The UK Biometrics Market Size is anticipated to reach USD 5.68 Billion by 2035, growing at a CAGR of 13.80% from 2025 to 2035. The market is primarily driven by rising occurrences of cybercrime and terrorism, favourable government efforts, increased use of mobile banking and digital wallets, and different technological breakthroughs.

Market Overview

The growing use of biometrics in consumer electronics is a key factor driving expansion in the UK biometric system market. This trend is fueled by increasing security needs combined with user convenience. Fingerprint sensors and facial identification are usually used in smartphones, laptops, and other individual gadgets, increasing demand for biometric solutions. Additionally, the emergence of Biometrics-as-a-Service (BaaS) offers small and medium-sized enterprises (SMEs) scalable, cost-effective options without hefty upfront costs. However, challenges such as protecting sensitive biometric data, managing complex systems, and limited technical expertise hinder widespread adoption. Addressing security and privacy concerns is essential to build user trust and promote further market growth. In 2023, UK businesses faced around 7.78 million cyberattacks, driving increased demand for advanced security solutions and boosting growth in the UK biometrics market. Biometrics, such as fingerprint and facial recognition, provide secure, hard-to-copy methods for identity verification, reducing unauthorized access risks. Organizations are increasingly investing in biometric technologies to protect sensitive data and infrastructure, often incorporating them into multi-factor authentication systems alongside passwords or tokens for stronger security. This approach is especially critical in sectors like banking and finance, where safeguarding user data is vital. Biometric tech is also being integrated into broader security frameworks, including CCTV and access control, enhancing threat detection in both public and private sectors.

In March 2024, UK officials announced a plan to invest about 295 million USD in drones, facial recognition, and AI technologies to increase policing and public safety. Biometric systems are being deployed in airports, transit hubs, and large events to improve surveillance and threat identification. Government initiatives promote secure digital identity frameworks and partnerships with tech firms and research bodies to advance biometric solutions that comply with regulations. Efforts to regulate data protection and raise public awareness about biometrics' benefits are fostering trust, aiding widespread adoption, and supporting the expansion of the UK biometrics market.

Report Coverage

This research report categorizes the market for the UK biometrics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom biometrics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom biometrics market.

United Kingdom Biometrics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.37 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 13.80% |

| 2035 Value Projection: | USD 5.68 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 248 |

| Tables, Charts & Figures: | 97 |

| Segments covered: | By Authentication Type, By Contact Type and By Technology |

| Companies covered:: | Precise Biometrics:, iProov Limited:, Biometrics Ltd, Goode Intelligence, Fulcrum Biometrics (formerly Delaney Biometrics), Biometrics Institute, Suprema, Thales Group, IDEMIA, Fujitsu, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising use of biometric technology in consumer electronics is a key factor driving growth in the biometric system market. Devices such as smartphones, laptops, smart home products, and wearables now usually use fingerprint and facial identification to provide safe and convenient access. This change is inspired by the need for a spontaneous user experience without better safety and passwords, while progress in biometric techniques continues to improve accuracy and reliability. Another important opportunity is located in Biometric-e-Service (BAAS), a cloud-based model that enables businesses to reach biometric authentication without heavy upfront costs. BAAS provides easy integration, ongoing maintenance, and increased protection, which appeals to scalable, cost-effective solutions seeking organizations. Together, these trends are accelerating the increase in the biometric systems market.

Restraining Factors

High costs are a major barrier to the biometric system market, involving expensive hardware, software, installation, and ongoing maintenance. Small and medium-sized businesses often struggle with these upfront and operating expenses, including updates, data storage, and security. The complexity of integrating biometrics with existing systems requires specialized skills, adding to costs. Additionally, compliance with strict regulations and regular audits further increases expenses, discouraging widespread adoption across various industries. This factor can hamper the UK biometrics market during the forecast period.

Market Segmentation

The United Kingdom Biometrics Market share is classified into authentication type, contact type, and technology

- The multi-factor authentication segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom biometrics market is segmented by authentication type into multi-factor authentication and single-factor authentication. Among these, the multi-factor authentication segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Multi-factor authentication offers greater security than a single-factor authentication procedure by combining two or more verification methods, such as biometric identification (fingerprint, face, or iris) with passwords or tokens. In sectors where information leakage is very unwanted, such as banking and finance, healthcare, and government, this increased security becomes crucial. Given the growing number of cyberthreats and data breaches, organisations are seeking to use MFA solutions as an additional layer of protection for their systems and data. Additionally, firms are being forced by legal regulations and compliance needs to have more robust authentication techniques, which will further boost MFA's growth in the biometric system market.

- The contact-based system segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom biometrics market is segmented by contact type into contact-based system, contactless system, and hybrid. Among these, the contact-based system segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to their widespread use and efficacy, contact-based biometric systems currently occupy the biggest market share in the biometric systems sector. These technologies include fingerprints and palm recognition, which are widely applied in various industries, including time tracking, mobile device authentication, and access management. They are considered excessive for their accuracy, reliability, and ease of integration in diverse infrastructure. Because contact-based biometrics are tactile, correct data is obtained, which lowers the possibility of error. Its dominant position in the market has mostly been attributed to this factor. Despite their rapid adoption, contactless systems are still the favoured option in many industries due to their proven functionality and affordability.

- The fingerprint recognition segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom biometrics market is segmented by technology into face recognition, iris recognition, voice recognition, vein recognition, fingerprint recognition, and others Among these, the fingerprint recognition segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. because it is widely used, simple to use, and reasonably priced when compared to other biometric technologies. Fingerprint scanning is a popular option for many applications, including consumer electronics, access control systems, and smartphones, because it offers an easy and dependable way to authenticate users.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom biometrics market and a with comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Precise Biometrics:

- iProov Limited:

- Biometrics Ltd

- Goode Intelligence

- Fulcrum Biometrics (formerly Delaney Biometrics)

- Biometrics Institute

- Suprema

- Thales Group

- IDEMIA

- Fujitsu

- Others

Recent Developments:

- In September 2024, Fime, a French security consulting firm, purchased the UK-based consultancy Consult Hyperion to boost its presence in the payments, smart mobility, and digital identification sectors. This acquisition strengthens Fime's potential to develop in digital identification and payments, as the two companies share a commitment to creativity and collaboration

- In March 2024, IDEX Biometrics collaborated with UK-based fintech company Accomplish Financial to offer a biometric payment system for visually and memory-impaired people. This effort supports the European Accessibility Act 2025 by promoting inclusive payment alternatives.

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom biometrics market based on the below-mentioned segments:

United Kingdom Biometrics Market, By Authentication Type

- Multi-factor Authentication

- Single Factor Authentication

United Kingdom Biometrics Market, By Contact Type

- Contact-Based System

- Contactless System

- Hybrid

United Kingdom Biometrics Market, By Technology

- Face Recognition

- Iris Recognition

- Voice Recognition

- Vein Recognition

- Fingerprint Recognition

- Others

Need help to buy this report?