United Kingdom Biofertilizers Market Size, Share, and COVID-19 Impact Analysis, By Type (Nitrogen Fixing, Phosphate Solubilizing, and Others), By Crop Type (Cereals & Grains, Pulses & Oilseeds, Fruits & Vegetables), By Microorganism (Rhizobium, Azotobacter, Azospirillum, Pseudomonas, Bacillus, VAM, Others), and UK Biofertilizers Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureUnited Kingdom Biofertilizers Market Forecasts to 2035

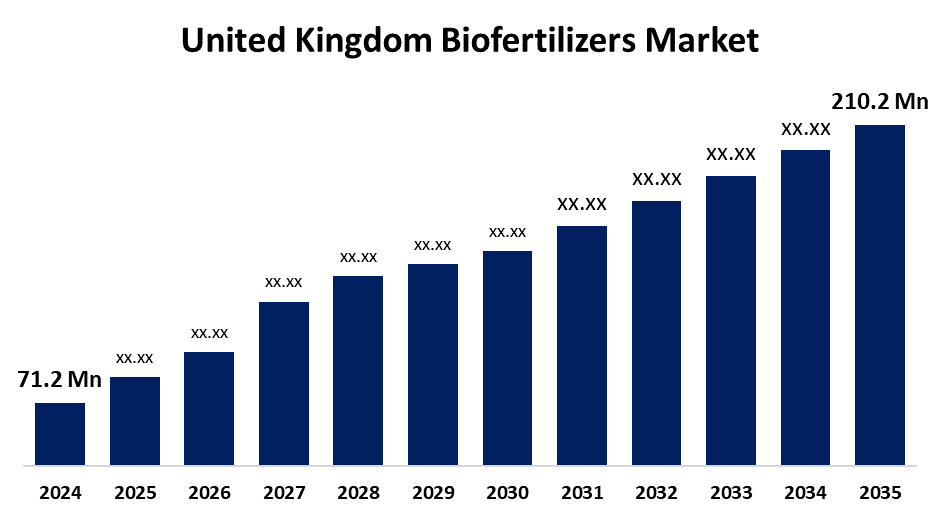

- The United Kingdom Biofertilizers Market Size Was Estimated at USD 71.2 Million in 2024

- The UK Biofertilizers Size is Expected to Grow at a CAGR of around 10.34% from 2025 to 2035

- The UK Biofertilizers Market Size is Expected to Reach USD 210.2 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the UK Biofertilizers Market Size is Anticipated to Reach USD 210.2 Million by 2035, Growing at a CAGR of 10.34% from 2025 to 2035. The growing demand for sustainable agriculture methods, increased awareness of environmental concerns, government programs supporting organic farming, and the desire to reduce chemical fertiliser usage are among the primary factors driving the market.

Market Overview

The UK biofertilizers market is experiencing growth, increasing focus on environment-friendly farming methods and durable agricultural practices. Biofertilizers are a sustainable way to improve soil fertility and plant growth while lowering dependency on chemical fertilisers. Biofertilizers, which are made from live organisms, bacteria, fungi, or algae that fix atmospheric nitrogen, solubilise phosphorus, and increase nutrient availability through a variety of processes. These microbes form a symbiotic connection with plants, promoting nutrient absorption and plant growth. Biofertilizers have various benefits, including improved soil structure, increased nutrient efficiency, and reduced environmental contamination. They also help to ensure the sustainability of agricultural methods and can be employed in organic farming. Farmers are getting more aware of the benefits of biofertilizers, especially to increase soil fertility and crop yields without relying on synthetic chemicals. This change is being further encouraged towards greenery input by government policies to reduce carbon emissions and support the initiative of organic farming. Additionally, the UK's ambitious climate goals are stimulating interest in biological options that can contribute to environmental goals. The growing consumer preference for organically cultivated products is motivating farmers to adopt biofertilizer as a practical option for traditional chemical-based approaches. The rise of urban farming and community gardening, especially in metropolitan areas such as London, is also opening new avenues for market expansion, as these producers want a permanent solution for food production. Technological advancements in the production and distribution of biofertilizers are creating more market opportunities for businesses. A growing trend is the use of biofertilizers in conjunction with traditional fertilizers to increase crop output and soil health. Many farmers are now using integrated approaches to increase both productivity and soil quality. In addition, investment in research and development is increasing, with a focus on the discovery of new microbial strains and specific crop needs. These innovations are increasing the effectiveness of biofertilizer in diverse agricultural sectors.

The UK government has launched various programs to promote agricultural sustainability, notably the Agriculture Act 2020, which focuses on environment-friendly farming practices. The UK Department for Environment, Food, and Rural Affairs wants to reduce greenhouse gas emissions in agriculture by 30% by 2030. This focus on sustainability enhances the UK biofertilizers market.

Report Coverage

This research report categorizes the market for the UK biofertilizers market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom biofertilizers market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom biofertilizers market.

United Kingdom Biofertilizers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 71.2 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 10.34% |

| 2035 Value Projection: | USD 210.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By Crop Type, By Microorganism and COVID-19 Impact Analysis. |

| Companies covered:: | Agri Tech Produits, Pivot Bio, BASF, Soil Bioengineering, SoilQuest, Yara International, Symborg, AgriLife, NutriTech Solutions, Alpha BioControls, Green Earth Ag and Turf, Novozymes, Nutrient Technologies, Bionema Group Ltd and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The UK biofertilizers market is experiencing strong growth driven by rising sustainability efforts, increasing awareness of soil health, and growing consumer demand for organic produce. Support from organizations like the National Farmers' Union and the Soil Association encourages farmers to adopt organic practices and biofertilizers. Technological advancements, such as improved microbial formulations, further enhance crop yields and reduce environmental impact, making biofertilizers a key component of the UK’s move toward sustainable agriculture.

Restraining Factors

There is limited awareness about the advantages of biofertilizers, and there is a pressing need for better infrastructure, enhanced technical expertise, and more effective marketing approaches. Furthermore, several challenges, such as short shelf life, difficulties in maintaining consistent quality, and specific storage needs, along with environmental factors, can affect their effectiveness and commercial viability. This factor hampered the UK biofertilizers market.

Market Segmentation

The United Kingdom biofertilizers market share is classified into type, crop type, and microorganisms.

- The nitrogen fixing segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom biofertilizers market is segmented by type into nitrogen fixing, phosphate solubilizing, and others. Among these, the nitrogen fixing segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. They reduce environmental impacts such as groundwater pollution and greenhouse gas emissions, while also improving soil fertility, structure, and microbial activity. These biofertilizers support sustainable agriculture, enhance plant growth and yields, and lower input costs for farmers. Their compatibility with other organic practices further boosts their effectiveness and long-term benefits. nitrogen-fixing biofertilizers are important because they improve soil fertility by turning atmospheric nitrogen into a form that plants can easily absorb, lowering reliance on synthetic fertilisers. This market is gaining pace as farmers become more aware of sustainable agriculture practices and demand for organic produce rises in the United Kingdom.

- The cereals & grains segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom biofertilizers market is segmented by crop type into cereals & grains, pulses & oilseeds, and fruits & vegetables. Among these, the cereals & grains segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The cereals & grains category is critical for food security and economic stability, as the UK is one of Europe's top producers of wheat and barley. Cereals and grains like wheat, rice, maize, and barley are key global staple crops, making up a large share of agricultural production and serving as a major food source. Their high demand and nutrient requirements present a strong market opportunity for biofertilizers. These eco-friendly inputs are especially effective in cereal and grain farming, as they enhance soil fertility and support the uptake of essential nutrients such as nitrogen, phosphorus, and potassium.

- The rhizobium segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom biofertilizers market is segmented by microorganism into rhizobium, azotobacter, azospirillum, pseudomonas, bacillus, VAM, and others. Among these, the rhizobium segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Rhizobium is especially important for its nitrogen-fixing activities, making it essential for legumes, which contribute to soil fertility. Its ability to efficiently fix atmospheric nitrogen is especially advantageous to legumes such as peas and beans. This makes it an important part of sustainable farming techniques and organic agriculture.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom biofertilizers market and a with comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Agri Tech Produits

- Pivot Bio

- BASF

- Soil Bioengineering

- SoilQuest

- Yara International

- Symborg

- AgriLife

- NutriTech Solutions

- Alpha BioControls

- Green Earth Ag and Turf

- Novozymes

- Nutrient Technologies

- Bionema Group Ltd

- Others

Recent Developments:

- In August 2023, Bionema Group Ltd. has launched a new range of biofertilizers in the United Kingdom, incorporating unique Incapsulex Technology. These products are intended to improve soil health and reduce the usage of synthetic fertilisers, representing a significant step towards advancing sustainable agriculture and supporting environmentally friendly farming practices.

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom biofertilizers market based on the below-mentioned segments:

United Kingdom Biofertilizers Market, By Type

- Nitrogen Fixing

- Phosphate Solubilizing

- Others

United Kingdom Biofertilizers Market, By Crop Type

- Cereals & Grains

- Pulses & Oilseeds

- Fruits & Vegetables

United Kingdom Biofertilizers Market, By Microrganisms

- Rhizobium

- Azotobacter

- Azospirillum

- Pseudomonas

- Bacillus

- VAM

- Others

Need help to buy this report?