United Kingdom Biochips Market Size, Share, and COVID-19 Impact Analysis, By Product Type (DNA chip, Protein chip, Lab-on-a-chip), By Fabrication Techniques (Microarrays, Microfluidics), By End User (Biotechnology & Pharmaceutical companies, Hospitals and Diagnostics centres, Academic & Research Institutes, Others), and UK Biochips Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Biochips Market Forecasts to 2035

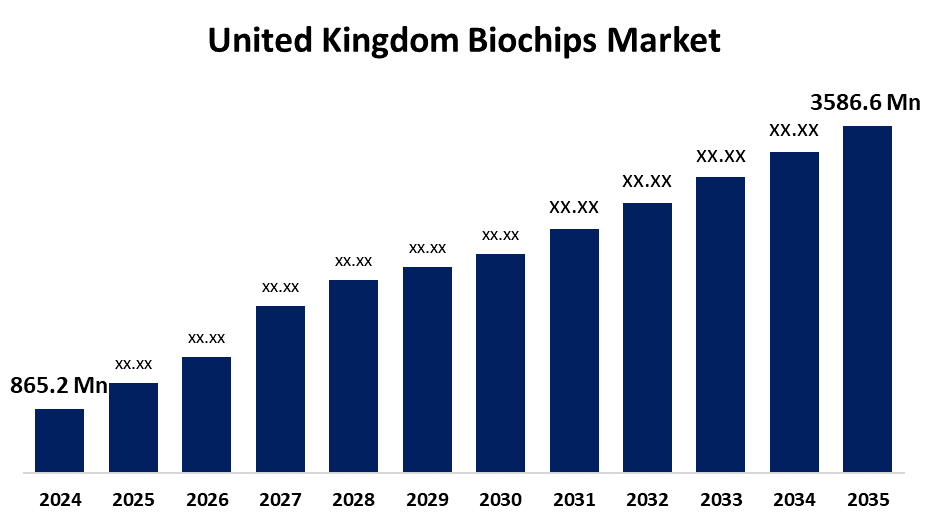

- The United Kingdom Biochips Market Size Was Estimated at USD 865.2 Million in 2024

- The United Kingdom Biochips Market Size is Expected to Grow at a CAGR of around 13.80% from 2025 to 2035

- The United Kingdom Biochips Market Size is Expected to Reach USD 3586.6 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The UK Biochips Market Size is anticipated to reach USD 3586.6 Million by 2035, growing at a CAGR of 13.80% from 2025 to 2035. The UK biochips market is expanding significantly due to advancements in genomics, proteomics, and diagnostics. The government's focus on improving healthcare services and providing funds for research and development is the main factor propelling this sector forward.

Market Overview

Biochips are an innovative type of miniaturized bio-security medical device designed for precise information tracking and widely utilized in molecular biology. These devices can carry out thousands of biological reactions within seconds. Market growth is being driven by factors such as increased spending on clinical research and a growing number of cancer patients. Emerging progress in bioinformatics science and nanotechnology is greatly enhancing the biochips' performance, which increases their efficiency and effectiveness in various applications, including personal medicine, drug discovery, and clinical diagnosis. In the UK, the increasing prevalence of chronic diseases is rapid and increasing the demand for accurate clinical equipment, and the status of biochips as essential components in healthcare settings. Increasing focus on personal medical and analogous treatments UK is creating new opportunities for the Biochip market. The growing focus on personalized medicine and tailored treatments is creating new opportunities for the UK biochip market. As the demand for individualized healthcare solutions increases, biochips play a crucial role in identifying genetic profiles and assessing disease risks. In addition, partnerships between UK-based biopharmaceutical companies and academic institutions are fostering innovation and facilitating the development of new biochip applications. The UK offers a dynamic environment for biochip research and development, supported by a strong network of universities actively engaged in this field. A notable trend is the expanding use of point-of-care testing, which aligns with public health strategies aimed at improving healthcare accessibility.

The COVID-19 pandemic highlighted the importance of rapid diagnostic methods, reinforcing the reliability of biochips as diagnostic tools among healthcare professionals. Furthermore, environmental concerns are driving advancements in biochip manufacturing toward more sustainable and eco-friendly processes, in accordance with the UK's goals for reducing carbon emissions and promoting environmental sustainability. Altogether, a combination of technological progress, healthcare demands, and governmental support is shaping a robust and evolving biochip industry in the United Kingdom.

Report Coverage

This research report categorizes the market for the UK biochip market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the UK biochips market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom biochips market.

United Kingdom Biochips Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 865.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 13.80% |

| 2035 Value Projection: | USD 3586.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 269 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Fabrication Techniques and By End User |

| Companies covered:: | Agilent Technologies, Bio-Rad Laboratories, Thermo Fisher Scientific., Cellix Ltd,, IBIOCHIPS, Randox Laboratories Ltd, F. HoffmannLa Roche, PerkinElmer, Qiagen, Genomatix, Singulex, Molecular Devices, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The UK biochips market is growing rapidly due to rising demand for personalized medicine, driven by advancements in genetic research and a surge in chronic diseases. The NHS's expansion of genomic services and the UK’s Genomic Health Strategy emphasize tailored treatments, increasing the need for biochips in diagnostics. Genomics-based cancer treatments are projected to boost survival rates by 10%, further supporting biochip adoption. Additionally, over £250 million in R&D funding is fostering innovation, with companies like Oxford Nanopore leading the way. the increasing prevalence of cancer approximately 400,000 new cases annually, is creating a strong demand for biochips, which support early diagnosis and personalized treatment. These factors collectively position the UK as a leading player in the global biochips market.

Restraining Factors

The expensive cost of biochip equipment and limited understanding of its usage and applications. One major obstacle is the high cost of biochip analysis, which includes personnel, reagents, and equipment. This can prevent biochips from being widely used due to regulatory barriers and expensive development costs, making them unaffordable for smaller labs and research institutes. provide challenges that stakeholders must overcome. Due to this, the expansion of the biochips market is expected to be hampered during the forecast period.

Market Segmentation

The UK Biochips Market share is classified into product type, fabrication techniques, and end user.

- The DNA chip segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UK biochips market is segmented by product type into DNA chip, protein chip, lab-on-a-chip. Among these, the DNA chip segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Their extensive application in personalised medicine, diagnostics, and genetic testing. They are crucial for drug development, clinical diagnostics, and research because of their quick and precise analysis of vast volumes of genomic data. In particular, DNA chips are essential for fields including pharmacogenomics, cancer genomics, and genetic screening, which are fuelling market demand.

- The microfluidics segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UK biochips market is segmented by fabrication techniques into microarrays, microfluidics. Among these, the microfluidics segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to its scalability in research applications, dependability, integration with medication development and illness research, and the capacity to conduct various analyses on a single chip. Additionally, it makes diagnostic equipment more effective, portable, and affordable, which is why it's a rapidly expanding market niche for biochips.

- The biotechnology & pharmaceutical companies segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UK biochips market is segmented by end user into biotechnology & pharmaceutical companies, hospitals and diagnostics centres, academic & research institutes, and others. Among these, the biotechnology & pharmaceutical companies segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. These companies use biochips for a number of purposes, such as target identification and validation, personalised treatment, and high-throughput screening of drug libraries. The demand in this market is driven by the fact that biochips are crucial instruments for clinical research, medication discovery, and biomarker identification.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK biochips market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Agilent Technologies

- Bio-Rad Laboratories

- Thermo Fisher Scientific.

- Cellix Ltd,

- IBIOCHIPS

- Randox Laboratories Ltd

- F. HoffmannLa Roche

- PerkinElmer

- Qiagen

- Genomatix

- Singulex

- Molecular Devices

- Others

Recent Developments:

- In October 2023, Thermo Fisher Scientific and Merck Group are broadening their market reach and improving their product offerings. The demand for biochips in diagnostics has grown significantly which has raised the valuation of businesses like Illumina and Qiagen.

- In September 2023, Biorad Laboratories announced a strategic acquisition, aimed at increasing its capabilities in biochip technology with the aim of increasing its capabilities. The UK government continues to support innovation in biochip technologies, for progress in personal medical and genetic research.

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the UK biochips market based on the below-mentioned segments:

United Kingdom Biochips Market, By Product Type

- DNA chip

- Protein chip

- Lab-on-a-chip

United Kingdom Biochips Market, By Fabrication Techniques

- Microarrays

- Microfluidics

United Kingdom Biochips Market, By End User

- Biotechnology & Pharmaceutical companies

- Hospitals and Diagnostics centres

- Academic & Research Institutes

- Others

Need help to buy this report?