United Kingdom Biobank Market Size, Share, and COVID-19 Impact Analysis, By Biospecimen Type (Tissues, Organs, Stem Cells, Other Biospecimen), By Biobanks Type (Real, Virtual), and United Kingdom Biobank Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareUnited Kingdom Biobank Market Insights Forecasts to 2035

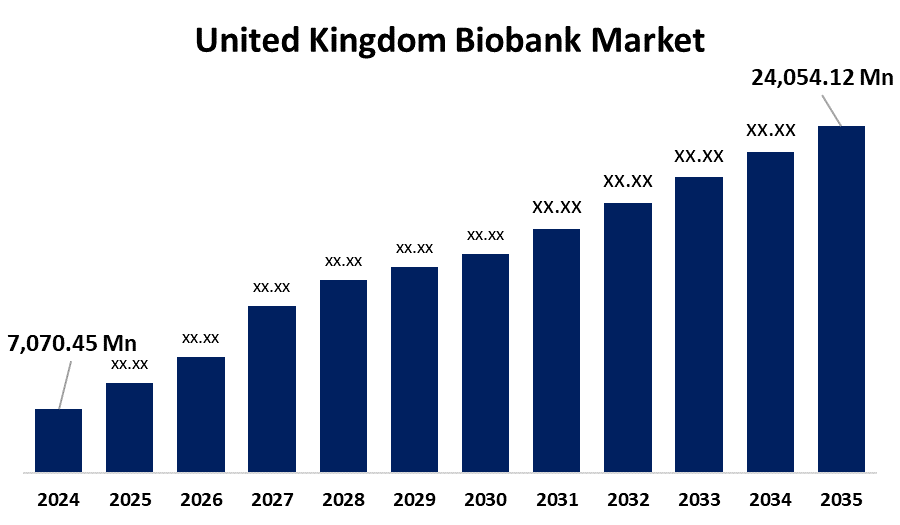

- The United Kingdom Biobank Market Size was estimated at USD 7,070.45 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.77% from 2025 to 2035

- The United Kingdom Biobank Market Size is Expected to Reach USD 24,054.12 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom Biobank Market Size is anticipated to reach USD 24,054.12 Million by 2035, growing at a CAGR of 11.77% from 2025 to 2035. The preservation of cord blood stem cells, a focus on genetic testing and precision medicine, attractive funding for regenerative medicine research, and growing investments and funding for biobanks are the main factors propelling the market's expansion.

Market Overview

The United Kingdom biobank market refers to the industry focused on the organization and application of collecting, storing, and distributing human samples. They encompass blood, plasma, serum, urine, tissues, cells, and more. The biobank industry has undergone remarkable change with development in the healthcare sector. Traditional biobanks have evolved into virtual biobanks through the integration of cutting-edge technology, data analytics, and automation, creating a market with revolutionary potential. Biobanks come in a variety of forms, including disease-oriented, population-based, tissue, and blood banks, all of which are driving the market's expansion. This market is expanding due in large part to rising drug development expenditures and the rising incidence of debilitating illnesses like cancer, respiratory conditions, Alzheimer's disease, and others. The market has been significantly influenced by the growing acceptance of genetic testing and precision/personalized medicine. As a consequence, there is now a greater need for biospecimens from clinical laboratories to create genetic testing. In the biobanking industry, partnerships between public and private organizations have been essential to the growth of the market.

Report Coverage

This research report categorizes the market for the United Kingdom biobank market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom biobank market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom biobank market.

United Kingdom Biobank Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7,070.45 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.77% |

| 2035 Value Projection: | USD 24,054.12 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 205 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Biospecimen Type (Tissues, Organs, Stem Cells, Other Biospecimen), By Biobanks Type (Real, Virtual) |

| Companies covered:: | UK Biobank, BioGrad, Merseyside BioBank, New UK Biobank HQ, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom biobank is driven by the growing application of artificial intelligence (AI), which helps with the creation of medications and therapies. The increase in revenue is driven by growing funding for genetic research, as scientists need high-quality biological samples and health data. The need for individualized therapy also drives revenue growth because biobanks are used to find genetic variants and biomarkers. The growing application of regenerative medicine, which replaces or repairs damaged body parts using cells and tissues, is another factor. The demand for properly managed biobanks is growing as regenerative medicine becomes more widespread.

Restraining Factors

The market growth could be restricted by a lack of uniformity and strict rules and regulations. Further, samples and sensitive personal data, which necessitate informed permission and stringent data protection precautions throughout storage and processing, might constrain the market growth. Biases can be introduced by differences in sample collection and processing between biobanks, which limit the generalizability of results and make comparing research challenging.

Market Segmentation

The United Kingdom biobank market share is classified into biospecimen type and biobanks type.

- The stem cells segment held a significant share in 2024 and is anticipated to grow at a rapid pace during the forecast period.

The United Kingdom biobank market is segmented by biospecimen type into tissues, organs, stem cells, and other biospecimen. Among these, the stem cells segment held a significant share in 2024 and is anticipated to grow at a rapid pace over the forecast period. This segment growth is driven by their promising uses of stem cells in drug research, developmental biology, toxicology, regenerative medicine, and cell therapy. Stem cell banking was adopted mostly due to the preservation of cellular properties, prevention of contamination and deterioration, use in fundamental and translational research, and future and existing usage in clinical applications.

- The virtual segment accounted for a significant share in 2024 and is anticipated to grow at a rapid pace over the forecast period.

The United Kingdom biobank market is segmented by process into real, and virtual. Among these, the virtual segment accounted for a significant share in 2024 and is anticipated to grow at a rapid pace over the forecast period. This is because to address the problems related to the accessibility of biospecimen. Moreover, the potential to fulfill the need for biospecimens and the ability to trace and obtain rare samples improve with virtual biobanking. Also, easy accessibility associated with virtual biobanks contributes to the lucrative growth of the segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom biobank market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- UK Biobank

- BioGrad

- Merseyside BioBank

- New UK Biobank HQ

- Others

Recent Developments:

- In May 2025, the new UK Biobank headquarters officially reached the "topping out" stage, marking a major milestone in its construction. This facility accelerated biomedical research and fostered collaboration with life science businesses, universities, and the NHS.

- In January 2025, Illumina launched a pilot proteomics program in collaboration with the UK Biobank and several biopharma partners to analyze 50,000 samples. This initiative enhanced biomarker discovery for diseases like cancer and cardiovascular conditions and improved understanding of protein function in health and disease.

- In November 2024, Oxford Nanopore and UK Biobank partnered to create the world’s first large-scale epigenetic dataset, aiming to uncover the causes of cancer, dementia, and other complex diseases. This dataset became publicly available, offering a valuable resource for scientists studying genomics and disease progression.

- In July 2024, AWS contributed £8 million worth of cloud computing credits to support the UK Biobank, a leading biomedical database. This funding was matched by the UK government, bringing the total investment to £16 million. The support helped UK Biobank securely store and manage its vast health data, enabling researchers worldwide to access and analyze it using AI and machine learning.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom biobank market based on the below-mentioned segments:

United Kingdom Biobank Market, By Biospecimen Type

- Tissues

- Organs

- Stem Cells

- Other Biospecimen

United Kingdom Biobank Market, By Biobanks Type

- Real

- Virtual

Need help to buy this report?