United Kingdom Benzenoid Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Benzaldehyde, Benzoic Acid, Toluene, Xylene, Styrene, and Others), By Application (Flavor and Fragrance, Food and Beverages, Pharmaceuticals, Polymers and Plastics, Paints and Coatings, and Others), and UK Benzenoid Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited Kingdom Benzenoid Market Forecasts to 2035

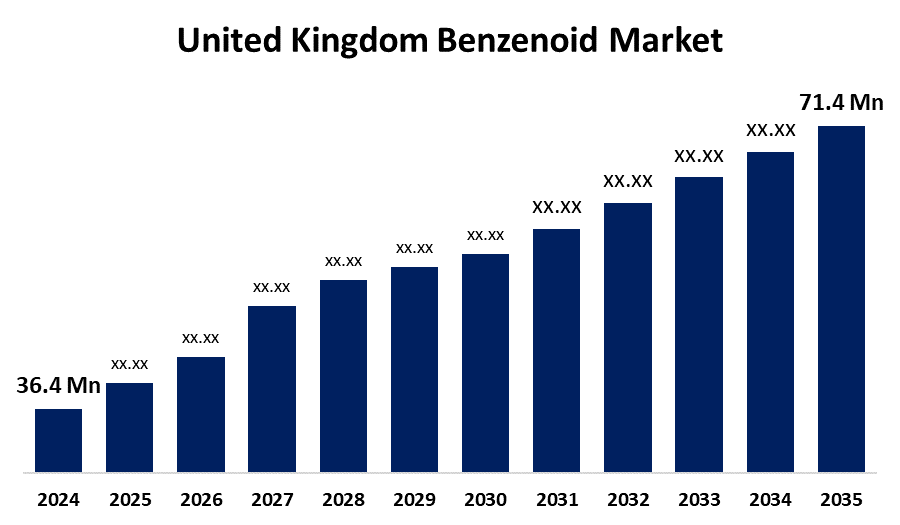

- The United Kingdom Benzenoid Market Size Was Estimated at USD 36.4 Million in 2024

- The UK Benzenoid Market Size is Expected to Grow at a CAGR of around 6.32% from 2025 to 2035

- The UK Benzenoid Market Size is Expected to Reach USD 71.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The UK Benzenoid Market Size is anticipated to reach USD 71.4 Million by 2035, growing at a CAGR of 6.32% from 2025 to 2035. The UK benzenoid market is growing due to rising demand in the fragrance and personal care industries, pharmaceutical manufacturing expansion, and a shift toward eco-friendly, bio-based ingredients driven by sustainability trends and strict environmental regulations encouraging greener chemical alternatives.

Market Overview

The UK benzenoid market refers to aromatic chemicals having benzene rings that are found in nature and are used for their unique scent and aroma in food, soaps, cosmetics, and home products. The growing need for flavours and perfumes across a range of industries is propelling the UK benzenoid market's notable expansion. Perfumes, cosmetics, personal care goods, and food and drink items all include benzenoids, which are vital aromatic chemicals. Manufacturers are investing in benzenoid-based formulations to improve sensory experiences as a result of consumers' growing desire for premium, perfumed, and natural products. The market is expanding due to the growth of the luxury perfume industry as well as the rising demand for high-end skincare and haircare products. The demand for scented and flavoured products is also being driven by urbanisation and rising disposable incomes, particularly in emerging economies.

A notable development is the trend toward bio-based and sustainable benzenoids due to increasing concern about the environment and laws promoting bio-based over synthetic chemicals. Manufacturers are introducing renewable, plant-based substitutes based on their use of essential oils and natural extracts. New biotechnological methods and advances in green chemistry are now allowing for high-purity bio-benzenoids to be produced and commercialised. These compounds are being incorporated into natural fragrances, organic food additives, and pharmaceuticals to satisfy a growing taste for eco-friendly products.

Report Coverage

This research report categorizes the market for the UK benzenoid market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom benzenoid market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom benzenoid market.

United Kingdom Benzenoid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 36.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 6.32% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 277 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Product Type and By Application |

| Companies covered:: | Croda International plc, Elementis plc, Johnson Matthey plc, Chemoxy International Ltd, INEOS Group Ltd, BP Chemicals, Givaudan, Solvay, Tennants Fine Chemicals Ltd., Emerald Kalama Chemical, BASF, Firmenich, IFF (International Flavors & Fragrances), Symrise, and Others |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Driving Factors

In the pharmaceutical industry, benzenoids are useful because they can be used as flavouring agents in oral therapies and also as intermediates in drug production. For example, phenol, aniline and benzoic acid are all used in the production of paracetamol, as well as treatments for fungal infections and sore throats. Benzenoids such as toluene and benzoic acid enhance flavour and act as preservatives for the food and drinks industry. This range of uses plays a significant part in the growth of the UK benzenoid market in both industries.

Restraining Factors

Benzenoid compounds, which are comprised of benzene, toluene, xylene, and ethylbenzene, are hazardous air pollutants causing secondary aerosol generation and sickness, such as blood disorders, various forms of cancer. The environmental and health effects associated with fuel use and industrial emissions, as well as their volatility. These factors hamper the benzenoid market during the forecast period.

Market Segmentation

The United Kingdom benzenoid market share is classified into type and application.

- The benzaldehyde segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom benzenoid market is segmented by type into benzaldehyde, benzoic acid, toluene, xylene, styrene, and others. Among these, the benzaldehyde segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Benzaldehyde is used as a precursor for various benzene derivatives and is applied in the synthesis of several active pharmaceutical ingredients (APIs). The UK pharmaceutical industry is focused on the manufacture of new medications as a result of increasing chronic diseases, which increases demand for benzaldehyde as a building block for the manufacture of APIs.

- The flavor and fragrance segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom benzenoid market is segmented by application into flavor and fragrance, food and beverages, pharmaceuticals, polymers and plastics, paints and coatings, and others. Among these, the flavor and fragrance segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. As consumers grow increasingly aware of their sensory experiences, there is greater demand for household goods, cosmetics, and personal care items that are fun to use and appropriately scented. The preference for high-quality, long-lasting scents in products such as perfumes, shampoos, deodorants, and air fresheners continues to grow.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom benzenoid market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Croda International plc

- Elementis plc

- Johnson Matthey plc

- Chemoxy International Ltd

- INEOS Group Ltd

- BP Chemicals

- Givaudan

- Solvay

- Tennants Fine Chemicals Ltd.

- Emerald Kalama Chemical

- BASF

- Firmenich

- IFF (International Flavors & Fragrances)

- Symrise

- Others

Recent Developments:

- In June 2025, UK chemical wholesaler Bowden Chemicals was awarded a Smart Grant by Innovate UK to create bio-based unsaturated polyester resins (UPR) with more than 50% renewable content over 18 months.

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom benzenoid market based on the below-mentioned segments:

United Kingdom Benzenoid Market, By Product Type

- Benzaldehyde

- Benzoic Acid

- Toluene

- Xylene

- Styrene

- Others

United Kingdom Benzenoid Market, By Application

- Flavor and Fragrance

- Food and Beverages

- Pharmaceuticals

- Polymers and Plastics

- Paints and Coatings

- Others

Need help to buy this report?