United Kingdom Benzene Market Size, Share, and COVID-19 Impact Analysis, By Derivative (Ethylbenzene, Cumene, Cyclohexane, Nitrobenzene, Linear Alkylbenzene, Maleic Anhydride, and Others), By Process (Pyrolysis Steam Cracking of Naphtha, Catalytic Reforming of Naphtha, Toluene Hydrodealkylation, Toluene Disproportionation, and Biomass), and United Kingdom Benzene Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited Kingdom Benzene Market Insights Forecasts to 2035

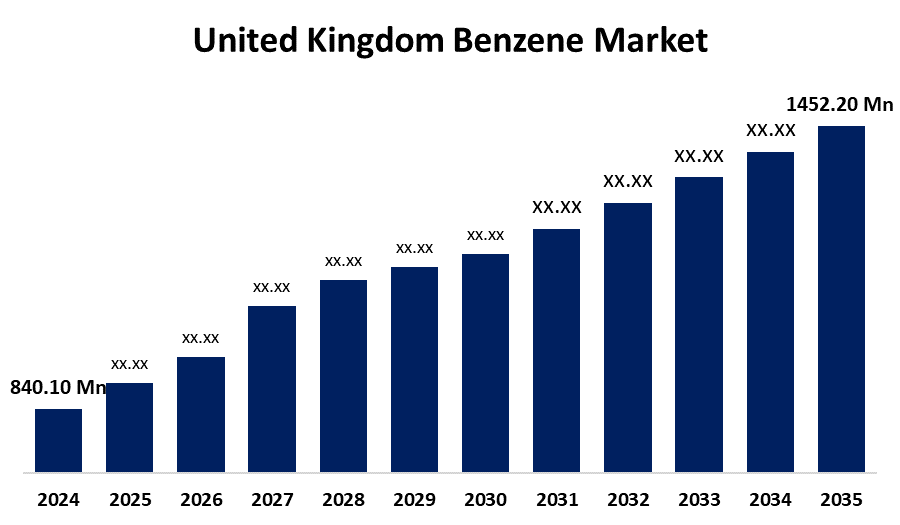

- The United Kingdom Benzene Market Size was Estimated at USD 840.10 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.10% from 2025 to 2035

- The United Kingdom Benzene Market Size is Expected to Reach USD 1452.20 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Benzene Market Size is anticipated to reach USD 1452.20 Million by 2035, growing at a CAGR of 5.10% from 2025 to 2035. The implementation of severe environmental and health regulations, the growing investment in research and development, and the increasing demand for improved agricultural production are among the important drivers driving the market expansion.

Market Overview

The United Kingdom benzene market refers to the industry focused on the production and application of benzene, which is a colorless, flammable liquid and an essential aromatic hydrocarbon. The manufacturing of rubber, polymers, resins, and synthetic fibers all depends on these materials. The production of popular plastics like nylon, polystyrene, and polyurethane requires benzene, which is why it is vital to the packaging, electronics, automotive, and construction industries. With the growing demand for robust, lightweight materials, benzene-derived products are finding increased use in electrical devices, insulating materials, and automotive components, where they perform as a vital component. The substance is also necessary for the production of synthetic rubber, which is used in tires, belts, and hoses, especially in automobile accessories.

Report Coverage

This research report categorizes the market for the United Kingdom benzene market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom benzene market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom benzene market.

United Kingdom Benzene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 840.10 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.10% |

| 2035 Value Projection: | USD 1452.20 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 276 |

| Tables, Charts & Figures: | 103 |

| Segments covered: | By Derivative and By Process |

| Companies covered:: | BP plc, Huntsman Corporation, EET Fuels (Stanlow Refinery), and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom benzene is primarily driven by the expanding auto sector, particularly for electric vehicles, and the usage of styrene in tires and body parts. Benzene is also used to make other derivatives, including phenol, nitrobenzene, and aniline, which are used in the paint, dye, and pharmaceutical industries. The rapid industrialization and urbanization of developing countries increase demand for benzene by driving up demand for consumer products, building materials, and other commodities.

Restraining Factors

The market growth could be restricted due to stricter regulations and heightened environmental awareness have resulted in tighter controls on the handling, transportation, and disposal. The cost of making benzene may increase if crude oil prices rise, but overall earnings may increase if they fall, and global economic uncertainty might have an impact on the country's benzene market.

Market Segmentation

The United Kingdom Benzene Market share is classified into derivative and process.

- The ethylbenzene segment held the highest share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The United Kingdom benzene market is segmented by derivative into ethylbenzene, cumene, cyclohexane, nitrobenzene, linear alkylbenzene, maleic anhydride, and others. Among these, the ethylbenzene segment held the highest share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This is due to an essential component for numerous polymers and plastics, and is also important for the petrochemical industry. The expansion of the worldwide polystyrene market is a major factor driving the need for ethylbenzene derivatives. Furthermore, the demand for polystyrene is directly correlated due to widely utilized in toys, electronics, packaging, and many other consumer items. The demand for styrene-based polymers, such as ABS (Acrylonitrile Butadiene Styrene), which are used for automobile exteriors and interiors, is also being impacted by the growing automotive sector.

- The pyrolysis steam cracking of naphtha segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period.

The United Kingdom benzene market is segmented by process into pyrolysis steam cracking of naphtha, catalytic reforming of naphtha, toluene hydrodealkylation, toluene disproportionation, and biomass. Among these, the pyrolysis steam cracking of naphtha segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period. This is because rising demand for olefins and aromatics used in polymer manufacture, such as propylene and ethylene, is one of the main factors driving this process's expansion. Additionally, the toluene disproportionation process is driven by the increasing demand for xylene. Additionally, the growing usage of xylene in petrochemicals highlights the significance of this process, which is essential to supplying the world's needs for aromatic compounds.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom benzene market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BP plc

- Huntsman Corporation

- EET Fuels (Stanlow Refinery)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom benzene market based on the below-mentioned segments:

United Kingdom Benzene Market, By Derivative

- Ethylbenzene

- Cumene

- Cyclohexan

- Nitrobenzene

- Linear Alkylbenzene

- Maleic Anhydride

- Others

United Kingdom Benzene Market, By Process

- Pyrolysis Steam Cracking of Naphtha

- Catalytic Reforming of Naphtha

- Toluene Hydrodealkylation

- Toluene Disproportionation

- From Biomass

Need help to buy this report?