United Kingdom Bariatric Surgery Market Size, Share, and COVID-19 Impact Analysis, By Device (Assisting Devices, Implantable Devices, and Others), By Procedure (Sleeve Gastrectomy, Gastric Bypass, and Others), By End User (Hospitals and Others), and United Kingdom Bariatric Surgery Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited Kingdom Bariatric Surgery Market Insights Forecasts to 2033

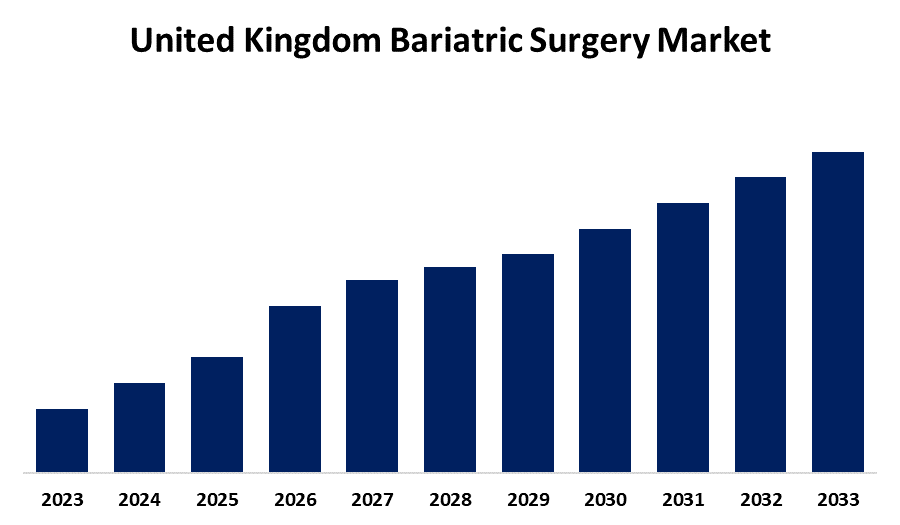

- The United Kingdom Bariatric Surgery Market Size is Growing at a CAGR of 6.45% from 2023 to 2033

- The United Kingdom Bariatric Surgery Market Size is Expected to hold a significant share by 2033

Get more details on this report -

The United Kingdom Bariatric Surgery Market Size is anticipated to hold a significant share by 2033, Growing at a CAGR of 6.45% from 2023 to 2033. The increasing burden of diabetes & heart diseases, the rise in obesity among people, and government initiatives are driving the growth of the bariatric surgery market in the UK.

Market Overview

The bariatric surgery market refers to the market encompassing the surgical procedures aimed at treating obesity and related health conditions. Bariatric surgery is a weight loss surgery or metabolic surgery that may be achieved through alteration of gut hormones, physical reduction of stomach size, reduction of nutrient absorption, or a combination of these. The prevalence of obesity, as well as the recognition of bariatric surgery as a viable and effective long-term solution, has significantly escalated the market growth. The increasing popularity and demand for minimally invasive procedures, including laparoscopic sleeve gastrectomy, owing to their lower risk complications, shorter recovery time, and reduced hospital stays, are escalating the market growth opportunity.

Report Coverage

This research report categorizes the market for the UK bariatric surgery market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom bariatric surgery market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK bariatric surgery market.

United Kingdom Bariatric Surgery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.45% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Device, By Procedure, By End User and COVID-19 Impact Analysis |

| Companies covered:: | Apollo Endosurgery Inc., B. Braun SE, Conmed Corporation, Intuitive Surgical Inc., Johnson and Johnson, Medtronic PLC, Olympus Corporation, Reshape Lifesciences Inc., Cook Medical, Teleflex (Standard Bariatrics Inc.), and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The increasing burden of diabetes & heart diseases is responsible for driving demand for bariatric surgery for significantly improving outcomes for individuals with both type 2 diabetes and heart disease. 64.0% of adults aged 18 years and over in England are estimated to be overweight or living with obesity during the period 2022 to 2023. Government initiatives, including publicly funded weight management (WM) programmes contributing to driving the bariatric surgery market growth.

Restraining Factors

The increased procedure cost and uncertainty in the healthcare regulatory environment are restraining the bariatric surgery market. Further, the postoperative challenges associated with bariatric surgery and the lack of skilled personnel may hamper the market growth.

Market Segmentation

The United Kingdom bariatric surgery market share is classified into device, procedure, and end user.

- The assisting devices segment held the largest share of the bariatric surgery market in 2023 and is anticipated to grow at the fastest CAGR during the projected timeframe.

The United Kingdom bariatric surgery market is segmented by device into assisting devices, implantable devices, and others. Among these, the assisting devices segment held the largest share of the bariatric surgery market in 2023 and is anticipated to grow at the fastest CAGR during the projected timeframe. Bariatric surgery assisting devices are specialized instruments used in procedures such as gastric bypass and sleeve gastrectomy. The rising popularity of minimally invasive procedures, along with technological advancements, is driving the market growth.

- The sleeve gastrectomy segment dominated the market with the largest market share in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom bariatric surgery market is segmented by procedure into sleeve gastrectomy, gastric bypass, and others. Among these, the sleeve gastrectomy segment dominated the market with the largest market share in 2023 and is expected to grow at a significant CAGR during the projected period. Sleeve gastrectomy involves the removal of about 80% of the stomach, leaving a cylindrical or sleeve-shaped stomach. The safety, effectiveness, affordability, and limited complications of sleeve gastrectomy are responsible for driving the market growth.

- The hospitals segment dominated the market with the largest market share in 2023 and is expected to grow at the fastest CAGR during the projected period.

The United Kingdom bariatric surgery market is segmented by end user into hospitals and others. Among these, the hospitals segment dominated the market with the largest market share in 2023 and is expected to grow at the fastest CAGR during the projected period. Bariatric surgery procedures are commonly used in hospitals for treating morbid obesity and related health conditions. The presence of well-resourced diagnostic rooms, availability of highly qualified healthcare practitioners, and growing health coverage from several private and group insurance programs are escalating the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. bariatric surgery market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Apollo Endosurgery Inc.

- B. Braun SE

- Conmed Corporation

- Intuitive Surgical Inc.

- Johnson and Johnson

- Medtronic PLC

- Olympus Corporation

- Reshape Lifesciences Inc.

- Cook Medical

- Teleflex (Standard Bariatrics Inc.)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2022, Medtronic, a global leader in healthcare technology, announced that it had received CE market approval for the Hugo robotic-assisted surgery (RAS) system to be used in general surgery procedures in Europe.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Bariatric Surgery Market based on the below-mentioned segments:

UK Bariatric Surgery Market, By Device

- Assisting Devices

- Implantable Devices

- Others

UK Bariatric Surgery Market, By Procedure

- Sleeve Gastrectomy

- Gastric Bypass

- Others

UK Bariatric Surgery Market, By End User

- Hospitals

- Others

Need help to buy this report?