United Kingdom Bariatric Beds Market Size, Share, and COVID-19 Impact Analysis, By Weight Capacity (500-700 lbs, 700-1000 lbs, and >1000 lbs), By End-use (Hospitals, Nursing Homes, and others), and United Kingdom Bariatric Beds Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Bariatric Beds Market Insights Forecasts to 2035

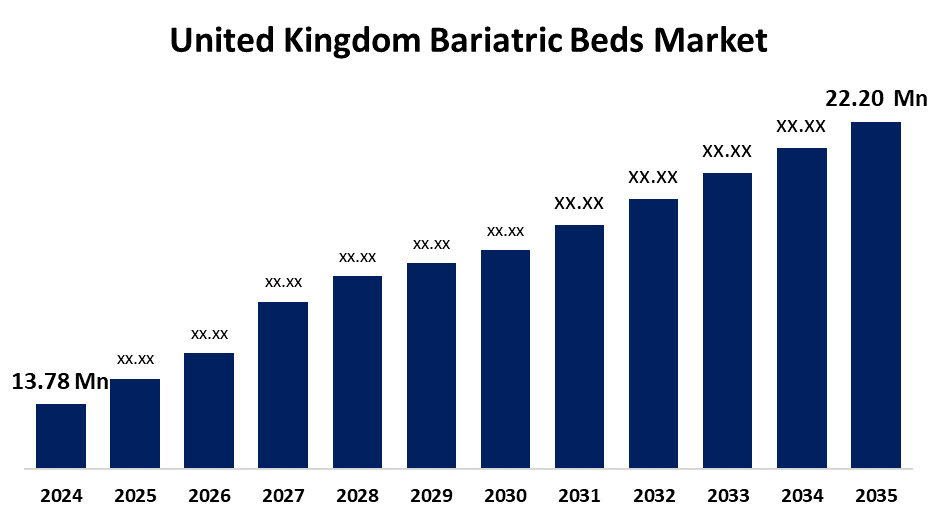

- The United Kingdom Bariatric Beds Market Size was Estimated at USD 13.78 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.43% from 2025 to 2035

- The United Kingdom Bariatric Beds Market Size is Expected to Reach USD 22.20 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom Bariatric Beds Market Size is Anticipated to Reach USD 22.20 Million by 2035, Growing at a CAGR of 4.43% from 2025 to 2035. The market development is growing due to substantial invest money on development and research to create cutting-edge healthcare beds with increased weight capacity, intelligent monitoring systems, and improved mobility characteristics. Moreover, in hospitals and long-term care facilities, putting automation and patient comfort first will boost adoption and create competitive distinction.

Market Overview

The United Kingdom bariatric beds market refers to the marketplace that is devoted to the production and distribution of hospital beds with a weight capacity of 226 kg to 500 kg or more. They are specifically made to support patient who are overweight or obese with greater body mass can benefit from improved comfort, safety, and functionality due to their size and structural strength differences from normal hospital beds. Specialized medical beds called bariatric beds are made to support and accommodate obese people while providing improved functioning, comfort, and safety. These beds are designed to accommodate the special requirements of bariatric patients by having wider sleeping surfaces, reinforced frames, and increased weight capacities. They are essential for helping to improve mobility, lower the risk of pressure ulcers, uphold patient dignity, and enable efficient caregiving. Bariatric beds, which are widely utilized in hospitals, long-term care facilities, and home healthcare settings, are crucial for managing problems associated with obesity, recovering from surgery, and providing chronic care. Worldwide, bariatric beds are being more and more included in contemporary patient care plans as the focus on inclusive and specialized healthcare infrastructure increases.

Report Coverage

This research report categorizes the market for the United Kingdom bariatric beds market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom bariatric beds market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom bariatric beds market.

United Kingdom Bariatric Beds Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 13.78 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.43% |

| 2035 Value Projection: | USD 22.20 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Weight Capacity, By End-use and COVID-19 Impact Analysis. |

| Companies covered:: | Orwood Mobility, Kinderkey Healthcare, PSCL Beds (Pascal Retail Ltd), Silentnight Group, Sleepeezee Limited, Airsprung Group plc and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom bariatric beds is influenced by the growing demand for bariatric surgeries for both preoperative and postoperative procedures. The market is growing as a result of the strong demand for sophisticated bariatric beds with high technical capabilities. The market expansion is increasing due to the healthcare system, which spurs technical developments in the medical field, which will propel the market for bariatric beds. The use of bariatric beds is anticipated to increase due to a number of variables, including favorable payment rules, rising government funding in long-term healthcare, and expanding infrastructure for healthcare research. The strong support by National Health Service (NHS) expenditures on treatments for obesity and specialist patient care. The rising demand for both public and private healthcare facilities is rising as a result of an increase in hospital admissions owing to obesity-associated diseases.

Restraining Factors

However, the primary factors that may impede the expansion of the UK bariatric beds market are the high initial acquisition costs of these beds and their higher upkeep costs. Moreover, the market growth could slow down due to diversifying in supply chain interruptions and variations in raw material costs.

Market Segmentation

The United Kingdom bariatric beds market share is classified into weight capacity, and end use.

- The 500-700 lbs segment accounted for the largest market share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The United Kingdom bariatric beds market is divided by weight capacity into 500-700 lbs, 700-1000 lbs, and >1000 lbs. Among these, the 500-700 lbs segment accounted for the largest market share in 2024 and is expected to grow at a substantial CAGR during the forecast period. This segment growth is propelled by due to their comfortable capacity, which weighs between 500 and 700 pounds, also allowing for positional adjustments, which significantly change the bed's structure. Another advantage is that side rails prevent patients from collapsing when undergoing surgery or when getting in or out of bed.

- The hospitals segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom bariatric beds market is differentiated by end use into hospitals, nursing homes, and others. Among these, the hospitals segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of a number of surgeries, including bariatric surgery, because of the convenience of managing any complications that may occur during surgical procedures and the availability of a wide range of treatment options.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom bariatric beds market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Orwood Mobility

- Kinderkey Healthcare

- PSCL Beds (Pascal Retail Ltd)

- Silentnight Group

- Sleepeezee Limited

- Airsprung Group plc

- Others

Recent Developments:

- In June 2023, Innova Care Concepts made a significant leap in bariatric care with its Interlude 500 ultra-low hospital bed, which was enhanced by VersaDrive technology. This motorised assist system, integrated into the footboard, used sensors and automation to help caregivers maneuver the bed with ease, an especially crucial feature in tight ward spaces or during urgent interventions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom bariatric beds market based on the below-mentioned segments:

United Kingdom Bariatric Beds Market, By Weight Capacity

- 500-700 lbs

- 700-1000 lbs

- >1000 lbs

United Kingdom Bariatric Beds Market, By End Use

- Hospitals

- Nursing Homes

- Others

Need help to buy this report?