United Kingdom Bar Soap Market Size, Share, and COVID-19 Impact Analysis, By Type (Organic, and Synthetic), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retailers, and Others), and United Kingdom Bar Soap Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited Kingdom Bar Soap Market Insights Forecasts to 2035

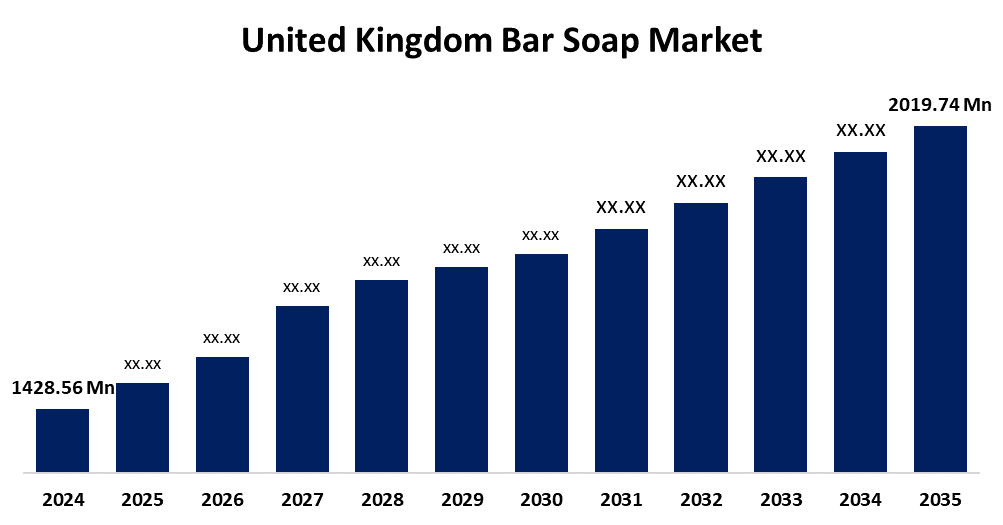

- The United Kingdom Bar Soap Market Size was Estimated at USD 1428.56 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.20% from 2025 to 2035

- The United Kingdom Bar Soap Market Size is Expected to Reach USD 2019.74 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Bar Soap Market Size is anticipated to reach USD 2019.74 Million by 2035, growing at a CAGR of 3.20% from 2025 to 2035. The market for bar soap is expanding due to the growing demand for cleanliness and personal hygiene. E-commerce sites are expanding rapidly, providing consumers with exposure to a wider range of bath soap businesses.

Market Overview

The United Kingdom bar soap market refers to the business related to the consumer good industry that focuses on the production and application of bar soap for the hygiene sector devoted to solid soap products, usually in bar form, that are used to cleanse skin. They have a solid shape and are often rectangular in shape. The primary ingredients of bar soap are oils or fats, water, alkali, and additives; each of these adds a particular characteristic to the finished product. Furthermore, some bar soaps, particularly those used by people and animals to clean body parts, are scented. Bar soaps are frequently used in homes and businesses, including restaurants, fitness facilities, corporate offices, schools, and colleges, to clean and maintain hygienic conditions. In addition to being long-lasting and skin-friendly for customers, the soaps can hydrate the skin more effectively than other cleaning products. Value sales have increased significantly in the personal care sector, mostly as a result of the items' easy accessibility through a variety of sales channels, such as pharmacies, beauty salons, and specialty shops. Furthermore, the market is anticipated to grow even more as male consumers place a higher priority on skincare and grooming in order to enhance their overall skin health and physical appearance. Moreover, the market benefits from higher R&D expenditures since they result in the launch of innovative and successful products that satisfy a range of customer needs and preferences.

Report Coverage

This research report categorizes the market for the United Kingdom bar soap market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom bar soap market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom bar soap market.

United Kingdom Bar Soap Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1428.56 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.20% |

| 2035 Value Projection: | USD 2478.98 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 179 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type and By Distribution Channel |

| Companies covered:: | Camay (Unilever), Lush, Yardley London, Bronnley, Scottish Fine Soaps, English Soap Company, Friendly Soap, and Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom bar soap is driven by the growing demand from consumers for sustainable and environmentally friendly personal care products. Moreover, the growing consumer awareness of skincare and hygiene issues brought on by health concerns and rising disposable incomes, the market for bath soap is expanding. Modern retail channels and urbanization increase the availability of high-quality, natural soap options, giving a new market expansion window for the major market players. The increasing demand for chemical free, organic products is encouraging innovation in the manufacturing and sourcing of ingredients. Further, specialty soaps with antibacterial or moisturizing qualities are becoming more and more popular and driving the market growth.

Restraining Factors

The market expansion could be restricted due to some obstacles, like the availability of alternatives like hand wash and sanitizers, the high cost of organic soaps, and the rising cost of their raw materials. Besides, surfactants and artificial emulsifiers found in soaps are bad for the skin, which might impact their revenue sales.

Market Segmentation

The United Kingdom bar soap market share is classified into type and distribution channel.

- The organic segment accounted for the highest market share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The United Kingdom bar soap market is segmented by material type into organic, and synthetic. Among these, the organic segment accounted for the highest market share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The reason for this is that consumers are increasingly choosing organic products. Consequently, the demand for natural soaps has grown, increasing the demand for soaps in general. By offering environmentally friendly products through environmentally friendly production procedures, numerous bar soap firms are satisfying consumer demands.

- The online retailers segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom bar soap market is segmented by process into supermarkets/hypermarkets, convenience stores, specialty stores, online retailers, and others. Among these, the online retailers segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because online marketplaces encourage competition, soap bar vendors are more likely to provide competitive prices. E-commerce websites that offer promotions and discounts may further persuade customers to buy products online.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom bar soap market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Camay (Unilever)

- Lush

- Yardley London

- Bronnley

- Scottish Fine Soaps

- English Soap Company

- Friendly Soap

- Others

Recent Developments:

- In March 2025, The Hygiene Bank and The Goodwash Company collaborated to produce the first edible soap in history. The product is a component of a campaign to increase awareness of the 5.3 million people in the UK who must choose between hygiene and food.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom bar soap market based on the below-mentioned segments:

United Kingdom Bar Soap Market, By Type

- Organic

- Synthetic

United Kingdom Bar Soap Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retailers

- Others

Need help to buy this report?