United Kingdom Baby Toiletries Market Size, Share, and COVID-19 Impact Analysis, By Product (Skin Care Products, Diapers, Hair Care Products, Wipes, and Bathing Products), By Distribution Channel (Hypermarkets, Chemist & Pharmacy Stores, and E-commerce), and UK Baby Toiletries Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited Kingdom Baby Toiletries Market Forecasts to 2035

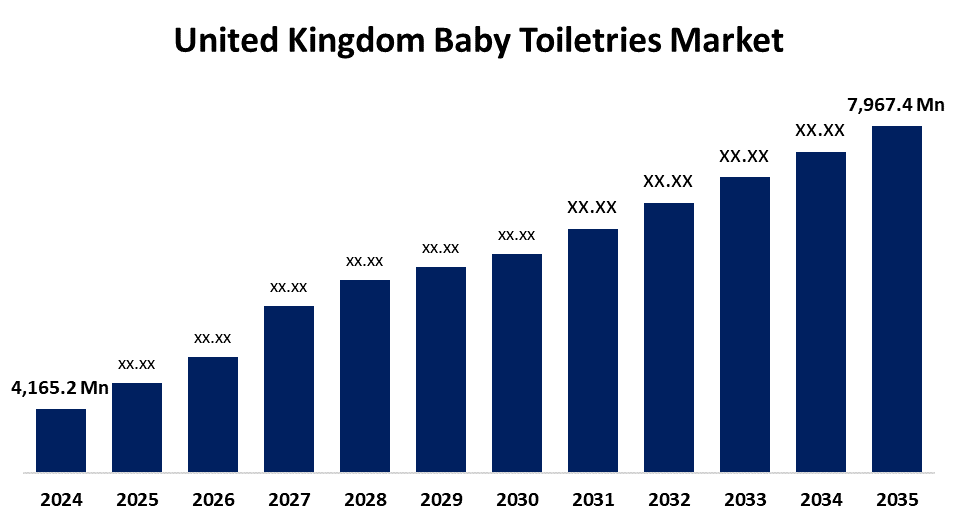

- The United Kingdom Baby Toiletries Market Size Was Estimated at USD 4,165.2 Million in 2024

- The UK Baby Toiletries Market Size is Expected to Grow at a CAGR of around 6.07% from 2025 to 2035

- The UK Baby Toiletries Market Size is Expected to Reach USD 7,967.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The UK Baby Toiletries Market Size is anticipated to reach USD 7,967.4 Million by 2035, growing at a CAGR of 6.07% from 2025 to 2035. Growing parental awareness of infant cleanliness, increased desire for organic and chemical-free baby products, and breakthroughs in dermatologically evaluated formulations. Boosts the UK baby toiletries market growth.

Market Overview

The UK baby toiletries market refers to the production, marketing, and distribution of personal care and hygiene goods. These consist of soft, hypoallergenic, and safe products such as infant shampoos, soaps, wipes, nappies, lotions, powders, and oils. Increase in disposable income and the popularity of online shopping are the main factors driving the child toileting market. The novel construction, environmentally friendly accessories that address the unique skincare requirements of infants and toddlers, present opportunities for investigation and acquisition. In addition, the growing popularity of e-commerce platforms is giving new businesses a chance to increase their market share and connect with new customers. Additionally, the skin of newborns has to be preserved from contact with dirt, as it is usually delicate. Due to the cleanliness of the child and increasing awareness about general health, people are more likely to be in favor of skin care products. Additionally, children are more likely to acquire microorganisms that cause infections and chronic diseases. Many businesses have come up with creative methods to reveal how important baby hygiene is and how it can affect their health. Many organizations develop new items to develop their consumer base. The presence of famous and local businesses, as well as effective marketing campaigns, all contribute to the increased demand. In addition, the impact of social media and parenting blogs in specific baby care items marketing plays an important role in changing customer options in the UK. The developments help the market to diversify its offerings and to sell its goods, which accelerates growth.

Report Coverage

This research report categorizes the market for the UK baby toiletries market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom baby toiletries market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom baby toiletries market.

United Kingdom Baby Toiletries Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4,165.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 6.07% |

| 2035 Value Projection: | USD 7,967.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 256 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Product and By Distribution Channel |

| Companies covered:: | Johnson & Johnson, Kimberly-Clark Corporation, Procter & Gamble, Beiersdorf AG, Unilever, Himalaya Wellness, Citta World, The Honest Company, Danone, Weleda, Nala’s Baby, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing birth rate and growing awareness of newborn hygiene are driving growth in the UK baby toiletry market. Parents seek safe, delicate, and generally premium or biological items for their children, which is driven by increased disposable income in emerging countries. The demand for natural and organic baby toiletries is also rising as a result of parents avoiding harsh chemicals to protect their kids' delicate skin. Markets are also benefiting from the expansion of online retail channels, which provide convenience, product diversity, and discounts. Online shopping is an important contribution to market development due to the availability and increase in smartphone usage.

Restraining Factors

The addition of hazardous chemicals in infant toiletry products, such as phthalates and formaldehyde in lattices, inhibits the expansion of the baby toiletry business. These products are dangerous for children and can cause skin allergies and asthma. Many components in baby wipes have a toxin with formaldehyde, serious health consequences. These factors hamper the UK baby toiletries market during the forecast period.

Market Segmentation

The United Kingdom Baby Toiletries Market share is classified into product and distribution channel.

- The diapers segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom baby toiletries market is segmented by product into skin care products, diapers, hair care products, wipes, and bathing products. Among these, the diapers segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Rising awareness among parents, as well as disposable diapers, plays an important role in the need for hygiene. In addition, in advance of NAPPY technology, such as biodegradable and environmentally friendly options, have ecologically minded customers. The increasing demand for premium and high-quality diapers. Additionally, parents can now easily obtain and purchase these essential supplies due to the growing availability of nappies through online retail channels, which has helped the market grow.

- The hypermarkets segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom baby toiletries market is segmented by distribution channel into hypermarkets, chemist & pharmacy stores, and e-commerce. Among these, the hypermarkets segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Hypermarkets allow customers to stock a large variety of infant toilets under one roof and facilitate a one-stop purchase. Additionally, they frequently offer sales and discounts, which makes them a desirable choice for parents on a limited budget. Additionally, baby product sections are often found in hypermarkets, which improves the shopping experience by simplifying it for various brands and accessories and conversely. The physical places of these retailers allowed customers to personally examine and select things, which is particularly important for the child-related items. In addition, the increasing presence of hypermarkets in both urban and rural places has increased their access to a wide range of people, strengthening their market dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom baby toiletries market and a with comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Johnson & Johnson

- Kimberly-Clark Corporation

- Procter & Gamble

- Beiersdorf AG

- Unilever

- Himalaya Wellness

- Citta World

- The Honest Company

- Danone

- Weleda

- Nala's Baby

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom baby toiletries market based on the below-mentioned segments:

United Kingdom Baby Toiletries Market, By Product

- Skin Care Products

- Diapers

- Hair Care Products

- Wipes

- Bathing Products

United Kingdom Baby Toiletries Market, By Distribution Channel

- Hypermarkets

- Chemist & Pharmacy Stores

- E-commerce

Need help to buy this report?