UK Autonomous Off-Road Vehicles and Machinery Market Size, Share, and COVID-19 Impact Analysis, By Type (Tractors, Harvesters, Haul Trucks, Excavators, Loaders and Dozers, Graders, Drill, Rigs, and Compactors), By Application (Construction, Mining & Quarrying, Agriculture, Airport Handling & Logistics, Indoor Manufacturing Handling & Logistics, and E-Commerce & Warehouse Logistics), and UK Autonomous Off-Road Vehicles and Machinery Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationUK Autonomous Off-Road Vehicles and Machinery Market Size Insights Forecasts to 2035

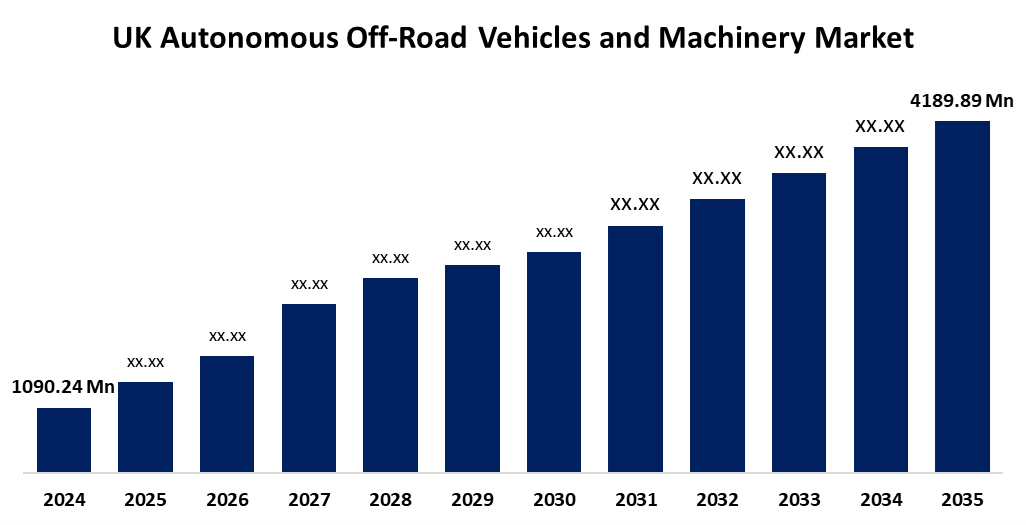

- The UK Autonomous Off-Road Vehicles and Machinery Market Size Was Estimated at USD 1090.24 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 13.02% from 2025 to 2035

- The UK Autonomous Off-Road Vehicles and Machinery Market Size is Expected to Reach USD 4189.89 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the UK Autonomous Off-Road Vehicles and Machinery Market Size is anticipated to reach USD 4189.89 Million by 2035, growing at a CAGR of 13.02% from 2025 to 2035. The developments in artificial intelligence (AI) and robotics, growing demand for automation in construction and agriculture, government support for innovation, a need to lower labour costs, and the growing use of smart technology for increased safety and efficiency.

Market Overview

The UK Autonomous Off-Road Vehicles and Machinery Market refers to the industry that includes self-operating machinery used in mining, forestry, construction, and agriculture. Advanced technologies, including artificial intelligence (AI), GPS, and sensors, are used by these vehicles and equipment to carry out operations without the need for human participation. They increase safety in difficult terrains, lower labor expenses, and improve operating efficiency. Autonomous tractors, excavators, and other equipment intended for off-road conditions are available on the market. labor shortages, increasing automation in construction and agriculture, and a major emphasis on sustainable operations. Real-time data utilization and precise control are made possible by developments in AI, IoT, and 5G connectivity. Potential is further increased by government funding for infrastructure renovation and smart farming. Growing uses in mining, environmental monitoring, and defense also create new opportunities for autonomous off-road technology development. The advanced sensor fusion for obstacle detection, real-time terrain mapping, and AI-powered navigation systems. These technologies improve safety, accuracy, and efficiency in difficult-to-reach areas that include construction, industry, and agriculture.

Report Coverage

This research report categorizes the market for the UK autonomous off-road vehicles and machinery market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the UK autonomous off-road vehicles and machinery Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK autonomous off-road vehicles and machinery market.

United Kingdom Autonomous Off-Road Vehicles and Machinery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1090.24 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 13.02% |

| 2035 Value Projection: | USD 4189.89 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 176 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Komatsu Ltd., Sandvik AB, John Deere, Liebherr Group, Jungheinrich AG, Daifuku Co. Ltd., KION Group, NAVYA, Others., and key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The need for automation in mining, construction, and agriculture is growing, with the objective of increasing production and decreasing reliance on manual labor. Increased accuracy and dependability in autonomous operations have been made possible by technological developments in artificial intelligence, machine learning, and sensor systems. The adoption of smart infrastructure and precision farming is further supported by government funding. Further driving the trend toward autonomous solutions are personnel shortages, growing operating expenses, and the requirement for increased safety in hazardous environments. Moreover, environmental sustainability objectives encourage the deployment of autonomous machinery that is low-emission and energy-efficient.

Restraining Factors

The large initial investment costs, intricate regulatory environments, and minimal end-user awareness. Rapid adoption is further hampered by technical difficulties in guaranteeing performance, safety, and dependability in uncertain off-road conditions, particularly for small and medium-sized businesses with little funding.

Market Segmentation

The UK autonomous off-road vehicles and machinery market share is classified into type and application.

- The tractors segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UK autonomous off-road vehicles and machinery market is segmented by type into tractors, harvesters, haul trucks, excavators, loaders and dozers, graders, drill, rigs, and compactors. Among these, the tractors segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed because of government support for automation, growing labor shortages, advances in AI and robotics, and the need for safer, more effective operations in difficult conditions in the mining, building, and agricultural sectors.

- The construction segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UK autonomous off-road vehicles and machinery market is segmented by application into construction, mining & quarrying, agriculture, airport handling & logistics, indoor manufacturing handling & logistics, and e-commerce & warehouse logistics. Among these, the construction segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of growing infrastructure projects, a lack of employees, and developments in robotics and AI. In increasing productivity, accuracy, and safety, these technologies enable possible for self-governing robots to function effectively in dangerous construction environments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK autonomous off-road vehicles and machinery market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Komatsu Ltd.

- Sandvik AB

- John Deere

- Liebherr Group

- Jungheinrich AG

- Daifuku Co. Ltd.

- KION Group

- NAVYA

- Others.

Recent Developments:

- In May 2024, SoilEssentials has introduced the AgXeed AgBot to Scotland, marking a significant advancement in agricultural automation. Developed by AgXeed B.V. in the Netherlands, this autonomous tractor is now available for demonstrations across the UK, offering farmers innovative solutions for various field tasks.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the UK autonomous off-road vehicles and machinery market based on the below-mentioned segments

UK Autonomous Off-Road Vehicles and Machinery Market, By Type

- Tractors

- Harvesters

- Haul Trucks

- Excavators

- Loaders and Dozers

- Graders

- Drill

- Rigs

- Compactors

UK Autonomous Off-Road Vehicles and Machinery Market, By Application

- Construction

- Mining & Quarrying

- Agriculture

- Airport Handling & Logistics

- Indoor Manufacturing Handling & Logistics

- E-Commerce & Warehouse Logistics

Need help to buy this report?