United Kingdom Auto Loan Market Size, Share, and COVID-19 Impact Analysis, By Loan Type (New Vehicle Loans, Used Vehicle Loans, Lease Buyout Loans, and Refinancing Loans), By Loan Term (Short-Term Loans (Up to 3 Years), Medium-Term Loans (3-5 Years), and Long-Term Loans (Above 5 Years)), and United Kingdom Auto Loan Market Insights, Industry Trend, Forecasts to 2035.

Industry: Banking & FinancialUnited Kingdom Auto Loan Market Insights Forecasts to 2035

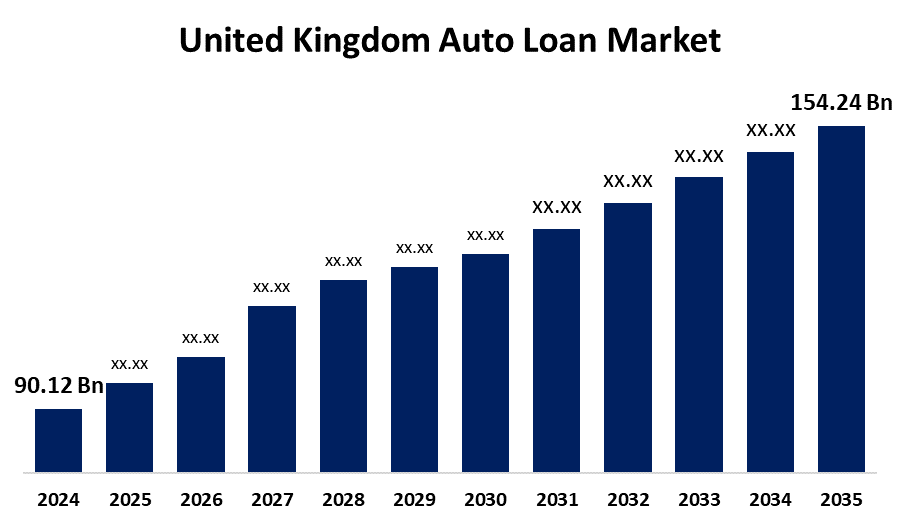

- The United Kingdom Auto Loan Market Size was estimated at USD 90.12 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.01% from 2025 to 2035

- The United Kingdom Auto Loan Market Size is Expected to Reach USD 154.24 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Auto Loan Market Size is Anticipated to reach USD 154.24 Billion By 2035, Growing at a CAGR of 5.01% from 2025 to 2035. The increasing car ownership, flexible financing alternatives, rising disposable incomes, and digital lending platforms that expedite approval procedures all contribute to the accessibility and desirability of auto loans to a broader range of consumers.

Market Overview

The United Kingdom auto loan market refers to the financial services industry, which provides loans to individuals and businesses so they can buy new or used cars. Banks, credit unions, car dealerships, and online lenders all offer services in this sector. It covers a range of loan kinds, including direct and indirect financing, and is essential to boosting car sales, improving consumer affordability, and energizing the UK's financial and automotive industries as a whole. The growing interest in flexible financing options including lease and balloon payments, expanding demand for electric automobiles, and the growth of internet lending platforms. Additionally, lenders are reaching underserved segments, providing customized loan solutions, and enhancing the customer experience across a range of demographics and credit profiles attributable to digital transformation and AI-driven credit assessment technologies. Mobile-based application platforms that improve customer convenience, paperless digital loan processing, and AI-powered credit rating. At auto dealerships, integrating blockchain technology for embedded finance alternatives, real-time loan approvals, and secure paperwork streamlines the borrowing process and raises consumer satisfaction.

Report Coverage

This research report categorizes the market for the United Kingdom auto loan market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom auto loan market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom auto loan market.

United Kingdom Auto Loan Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 90.12 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.01% |

| 2035 Value Projection: | USD 154.24 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 98 |

| Segments covered: | By Loan Type, By Loan Term and COVID-19 Impact Analysis |

| Companies covered:: | Black Horse Finance, Blue Motor Finance, Close Brothers Motor Finance, Lloyds Bank, Moneybarn, MotoNovo Finance, Nationwide Building Society, Northridge Car Finance, Royal Bank of Scotland, Zopa, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increase in auto loan applications is a result of rising customer demand for personal vehicles, particularly electric and hybrid versions. Access to car ownership is facilitated by the availability of customized financial packages, flexible payback schedules, and low-interest financing. Furthermore, the loan approval process is now quicker and easier thanks to developments in fintech and digital banking. Purchases of new vehicles are also encouraged by government scrappage programs and incentives promoting the adoption of electric vehicles. Additionally, continuous expansion is facilitated by urbanization and growing disposable incomes, particularly among younger consumers looking for reasonably priced mobility alternatives.

Restraining Factors

The high interest rates, stringent lending requirements, and high car prices, all of which could render loans less accessible. Both lenders and borrowers face difficulties due to economic instability, inflation, and changing financial rules, which have an impact on total loan acceptance rates and the possibility for market expansion.

Market Segmentation

The United Kingdom auto loan market share is classified into loan type and loan term.

- The new vehicle loans segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom auto loan market is segmented by loan type into new vehicle loans, used vehicle loans, lease buyout loans, and refinancing loans. Among these, the new vehicle loans segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to growing demand from consumers for contemporary cars with modern amenities and easily accessible financing alternatives. A wider market adoption is fueled by competitive interest rates and adjustable payback terms, which further enhance accessibility.

- The medium-term loans (3–5 years) segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom auto loan market is segmented by loan term into short-term loans (up to 3 years), medium-term loans (3–5 years), and long-term loans (above 5 years). Among these, the medium-term loans (3–5 years) segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of outstanding interest rates, moderate monthly installments, and a balanced repayment plan. The majority of borrowers accept them because they provide affordability without requiring a lengthy financial commitment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom auto loan market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Black Horse Finance

- Blue Motor Finance

- Close Brothers Motor Finance

- Lloyds Bank

- Moneybarn

- MotoNovo Finance

- Nationwide Building Society

- Northridge Car Finance

- Royal Bank of Scotland

- Zopa

- Others

Recent Developments:

- In April 2025, Auto Trader introduced the 'New Car Offers' feature, allowing dealers to display FCA-compliant finance examples directly on listings. This enhances transparency and helps consumers compare monthly payments easily

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom auto loan market based on the below-mentioned segments

United Kingdom Auto Loan Market, By Loan Type

- New Vehicle Loans

- Used Vehicle Loans

- Lease Buyout Loans

- Refinancing Loans

United Kingdom Auto Loan Market, By Loan Term

- Short-Term Loans (Up to 3 Years)

- Medium-Term Loans (3–5 Years)

- Long-Term Loans (Above 5 Years)

Need help to buy this report?