United Kingdom Audiology Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Hearing Aids, Cochlear Implants, BAHA/BAHS, and Diagnostic Devices), By Technology (Digital, and Analog), and United Kingdom Audiology Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Audiology Devices Market Insights Forecasts to 2035

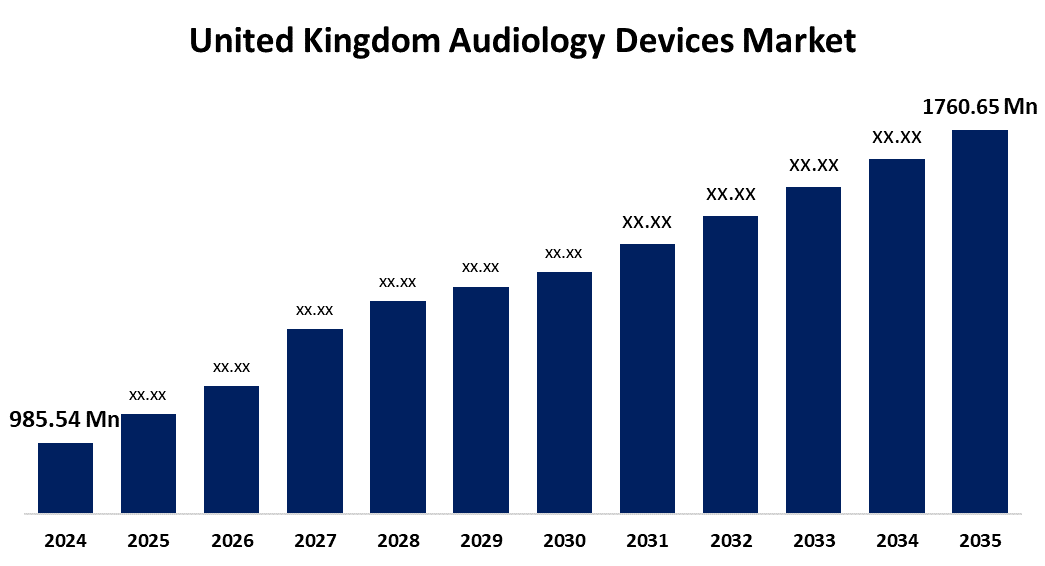

- The United Kingdom audiology devices Market Size was Estimated at USD 985.54 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.42% from 2025 to 2035

- The United Kingdom Audiology Devices Market Size is Expected to Reach USD 1760.65 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United Kingdom Audiology Devices Market Size is Anticipated to reach USD 1760.65 Million by 2035, Growing at a CAGR of 5.42% from 2025 to 2035. This growth can be attributed to factors such as the growing geriatric population, rising prevalence of hearing disorders, and supportive government initiatives for easy access to hearing aids.

Market Overview

The United Kingdom audiology devices market refers to the business focused on the development and application of the market for audiology equipment includes a range of medical devices used to diagnose, treat, and manage hearing and balance problems. ENT doctors, audiologists, and other hearing healthcare professionals use this technology to assess patients' hearing abilities, give treatments, and improve their auditory health. In clinics and hospitals, audiologists assess and treat patients with hearing and balance problems using these instruments. Manufacturers of audiology equipment are constantly thinking of new methods to improve hearing healthcare and develop new technology. Rehabilitation programs help persons with hearing loss enhance their quality of life and communication abilities by using equipment such as cochlear implants and hearing aids. Students who struggle with hearing can be evaluated and helped in educational settings by audiological equipment. There is also potential for growth in telehealth services, providing remote consultation and fitting, which can be particularly beneficial in areas with limited access to audiology professionals. Recent times have seen trends surrounding personalization and customization in audiological devices, with a focus on creating tailored solutions that cater to individual preferences and lifestyles.

Report Coverage

This research report categorizes the market for the United Kingdom audiology devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom audiology devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom audiology devices market.

United Kingdom Audiology Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 985.54 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.42% |

| 2035 Value Projection: | USD 1760.65 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Technology and COVID-19 Impact Analysis. |

| Companies covered:: | Oticon UK, Widex UK, Audeara UK, Amplifon UK, MedEl UK, Natus Medical UK, Sivantos UK and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom audiology devices is influenced by the because of a growing older population, improved healthcare infrastructure, and more awareness of hearing loss. The country's dominance in the market for audiology devices is a result of strong government initiatives and large investments in research and development. The emphasis on innovation and cutting-edge technology from local industry players, along with ongoing R&D expenditures and enhanced product functionality and quality. Healthcare facilities, non-profit organizations, and governments have all heavily pushed for hearing exams, early identification, and interventions, which open up wide market opportunities.

Restraining Factors

However, the market expansion could be shattered by some reasons such as limited accessibility, particularly for the older population, prolonged waiting periods, and delays in the NHS audiology regulatory authorities. Additionally, many consumers are discouraged from seeking assistance due to a lack of knowledge regarding hearing loss remedies and the social stigma attached to wearing hearing aids.

Market Segmentation

The United Kingdom audiology devices market share is classified into product, and technology.

- The hearing aids segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period.

The United Kingdom audiology devices market is segmented by product into hearing aids, cochlear implants, Baha/BAHs, and diagnostic devices. Among these, the hearing aids segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period. Digital signal processing, wireless networking, component shrinking, and sophisticated sound processing methods are some examples of these advancements. These advancements have significantly enhanced the efficacy and utility of hearing aids, making them the preferred choice for individuals with hearing loss.

- The digital segment held the largest share in 2024 and is anticipated to grow at a significant CAGR over the forecast period.

The United Kingdom audiology devices market is segmented by technology into digital, and analog. Among these, the digital segment held the largest share in 2024 and is anticipated to grow at a significant CAGR over the forecast period. Digital audiology technology outperforms analog systems in terms of sound quality, clarity, and customization. Digital devices often incorporate advanced capabilities, such as feedback cancellation, directional microphones, and noise reduction, that enhance speech understanding and overall hearing performance in noisy environments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom audiology devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Oticon UK

- Widex UK

- Audeara UK

- Amplifon UK

- MedEl UK

- Natus Medical UK

- Sivantos UK

- Others

Recent Developments:

- In February 2025, Apple indeed stepped into the hearing health space. With a recent update, AirPods Pro 2 now offer a clinical-grade Hearing Aid feature designed for people with mild to moderate hearing loss.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom audiology devices market based on the below-mentioned segments:

United Kingdom Audiology Devices Market, By Product

- Hearing Aids

- Cochlear Implants

- BAHA/BAHS

- Diagnostic Devices

United Kingdom Audiology Devices Market, By Technology

- Digital

- Analog

Need help to buy this report?