United Kingdom Arts Promoter Market Size, Share, and COVID-19 Impact Analysis, By Revenue Source (Media Rights, Merchandising, Tickets, and Sponsorship), By End-user (Individuals and Companies), and United Kingdom Arts Promoter Market Insights, Industry Trend, Forecasts to 2035.

Industry: Information & TechnologyUnited Kingdom Arts Promoter Market Insights Forecasts to 2035

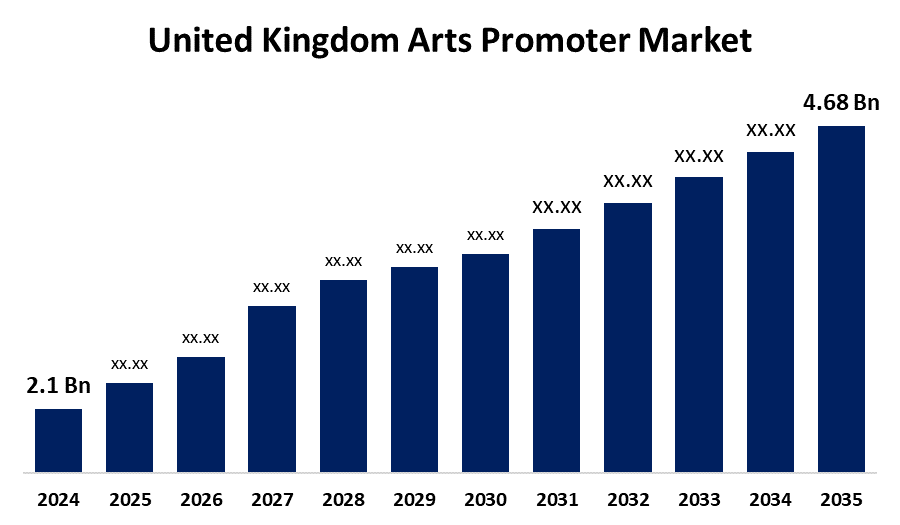

- The United Kingdom Arts Promoter Market Size was estimated at USD 2.1 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.56% from 2025 to 2035

- The United Kingdom Arts Promoter Market Size is Expected to Reach USD 4.68 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Arts Promoter Market Size is Anticipated to reach USD 4.68 Billion By 2035, Growing at a CAGR of 7.56% from 2025 to 2035. The increasing government backing, expanding public interest in cultural events, growing demand for live entertainment, and improved event accessibility are attributable to digital media. Together, these elements propel consistent audience engagement and market growth.

Market Overview

The United Kingdom arts promoter market refers to the industry that includes the organizations and individuals in charge of planning, promoting, and overseeing live arts events like plays, concerts, festivals, and exhibitions. By organizing logistics, obtaining venues, and boosting ticket sales, these promoters are essential in bringing artists and audiences together. The market boosts public access to a wide range of artistic experiences, fosters the expansion of the cultural sector, and makes a substantial economic contribution to the UK through tourism and entertainment. Increasing interest for cultural activities and a variety of live events. Wider audiences are drawn in by growing interest in immersive performances, theater, and music festivals. Reach and engagement are increased through virtual event platforms and digital ticketing. Market expansion is additionally supported by government programs that assist the arts industry and growing tourism. In the dynamic entertainment industry, these elements open up the possibility to new collaborations, creative event designs, and increased revenue sources. The application of virtual reality (VR) and augmented reality (AR) in conjunction with virtual and hybrid events to improve audience experiences. Mobile apps simplify tickets and engagement, allowing for more individualized and accessible live arts experiences, while advanced data analytics enhance targeted marketing.

Report Coverage

This research report categorizes the market for the United Kingdom arts promoter market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom arts promoter market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom arts promoter market.

United Kingdom Arts Promoter Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.1 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.56% |

| 2035 Value Projection: | USD 4.68 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 106 |

| Segments covered: | By Revenue Source, By End-user and COVID-19 Impact Analysis |

| Companies covered:: | Live Nation Entertainment, AEG Presents, ATG (Ambassador Theatre Group), SJM Concerts, Trafalgar Releasing, The O2 (AEG), Metropolis Music, Eventim UK, Kilimanjaro Live, Noel Gay Entertainment, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing demand from the public for a variety of live entertainment, including theater, music festivals, and cultural events. Market expansion is also fueled by increased government support and funding for the arts sector. Reaching a wider range of demographics is made easier by the growth of digital platforms and social media, which improve audience engagement and event marketing. The expansion of the tourism sector also increases the number of individuals who attend art events. Another important factor is shifting consumer preferences toward immersive experiences and community-driven events, which pushes promoters to come up with new ideas and provide a wide range of immersive cultural experiences throughout the UK.

Restraining Factors

The high operating expenses, inconsistent public funding, and stringent safety and event licensing regulations. Furthermore, unpredictabilities like recessions and public health issues (like pandemics) can lower attendance, which can affect earnings and restrict the possibility for live arts events to expand.

Market Segmentation

The United Kingdom arts promoter market share is classified into revenue source and end-user.

- The tickets segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom arts promoter market is segmented by revenue source into media rights, merchandising, tickets, and sponsorship. Among these, the tickets segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to because live performances, including plays, concerts, and festivals, draw sizable crowds. This revenue source is dependable and significant due to the direct correlation between tickets and attendance, which is stimulated by the strong desire for immersive, in-person cultural events.

- The individuals segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom arts promoter market is segmented by end-user into individuals and companies. Among these, the individuals segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because to the public's passionate appreciation for live arts, their increasing awareness of other cultures, and the ease with which they can purchase tickets online. Individual engagement is further increased by personalized experiences and social media influence, which maintains consistent market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom arts promoter market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Live Nation Entertainment

- AEG Presents

- ATG (Ambassador Theatre Group)

- SJM Concerts

- Trafalgar Releasing

- The O2 (AEG)

- Metropolis Music

- Eventim UK

- Kilimanjaro Live

- Noel Gay Entertainment

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom arts promoter market based on the below-mentioned segments

United Kingdom Arts Promoter Market, By Revenue Source

- Media Rights

- Merchandising

- Tickets

- Sponsorship

United Kingdom Arts Promoter Market, By End user

- Individuals

- Companies

Need help to buy this report?