United Kingdom Artificial Intelligence in Finance Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution and Services), By Deployment Mode (On-premise and Cloud), and United Kingdom Artificial Intelligence in Finance Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyUnited Kingdom Artificial Intelligence in Finance Market Insights Forecasts to 2035

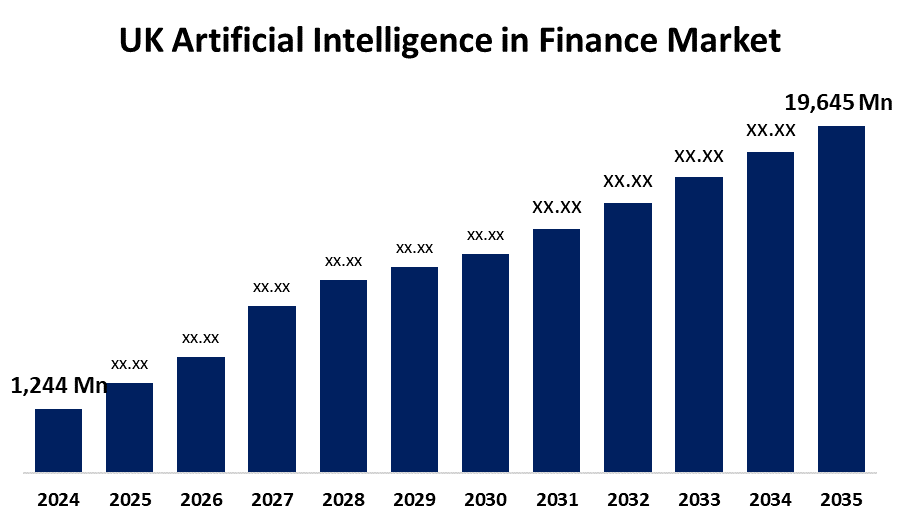

- The United Kingdom Artificial Intelligence in Finance Market Size Was Estimated at USD 1,244 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 28.51% from 2025 to 2035

- The United Kingdom Artificial Intelligence in Finance Market Size is Expected to Reach USD 19,645 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Artificial Intelligence in Finance Market Size is anticipated to reach USD 19,645 Million by 2035, growing at a CAGR of 28.51% from 2025 to 2035. The increasing demand for automated trading, risk management, personalized banking, and fraud detection. AI is employed by financial institutions to improve customer satisfaction, operational effectiveness, and decision-making.

Market Overview

The United Kingdom artificial Intelligence in finance market refers to the industry the development and adoption of AI technologies in the financial services sector of the United Kingdom, including machine learning and advanced algorithms. This includes applications designed to improve productivity, decision-making, and customer experience in domains including as fraud detection, risk management, algorithmic trading, personalized banking, and regulatory compliance. The integration of AI to fraud detection, regulatory compliance, and customized banking. AI can be used by financial companies to enhance credit risk assessment, automate customer support, and optimize trading strategies. There is an increasing need for AI-driven insights as open banking and digital finance develop, which presents profitable opportunities for startups and established businesses to innovate, work together, and build an edge over their competitors. Chatbots based on artificial intelligence, robo-advisors for individualized financial planning, automated fraud detection systems, and predictive analytics for investment choices. Innovative machine learning models improve credit scores, while natural language processing tools streamline reporting and compliance, increasing productivity and revolutionizing consumer interaction.

Report Coverage

This research report categorizes the market for the United Kingdom artificial intelligence in finance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom artificial intelligence in finance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom artificial intelligence in finance market.

United Kingdom Artificial Intelligence in Finance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,244 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 28.51% |

| 2035 Value Projection: | USD 19,645 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 254 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Component and By Deployment Mode |

| Companies covered:: | Workiva, FIS, Zoho, Microsoft Corporation, IBM Corporation, SAP SE, NetApp, Highradius, Intel Corporation, AWS (Amazon Web Services), and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rapid digitalization of financial services, the rise in demand for individualized client care, and the expanding need for improved risk management and fraud detection. To increase decision-making accuracy, cut expenditures, and streamline processes, financial institutions are making significant investments in AI. Additional factors driving industry expansion include the emergence of open banking, fintech partnerships, and government encouragement of innovation. Financial companies can additionally leverage real-time insights, automate procedures, and stay competitive in a rapidly changing financial sector because of developments in big data analytics, cloud computing, and machine learning technology.

Restraining Factors

The regulatory complexity, high implementation costs, and data protection issues. Adoption is further hampered by traditional institutions' reluctance to technological change and a shortage of qualified AI specialists. Transparency and trust are also hampered by computational biases and ethical concerns.

Market Segmentation

The United Kingdom Artificial Intelligence In Finance Market share is classified into component and deployment mode.

- The solution segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom artificial intelligence in finance market is segmented by component into solution and services. Among these, the solution segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to growing need for fraud detection, automation, real-time data, and individualized customer support. Data-driven technologies are given top priority by financial institutions with the objective to improve operational efficiency, accuracy, and customer engagement.

- The cloud segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom artificial intelligence in finance market is segmented by deployment mode into on-premise and cloud. Among these, the cloud segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of its ability to scale, its reduced initial costs, and its quick access to innovative processing power. For more operational flexibility, simpler updates, and rapid AI integration, financial institutions favor cloud solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom artificial intelligence in finance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Workiva

- FIS

- Zoho

- Microsoft Corporation

- IBM Corporation

- SAP SE

- NetApp

- Highradius

- Intel Corporation

- AWS (Amazon Web Services)

- Others.

Recent Developments:

• In June 2025, Starling Bank has launched an AI-powered “Spending Intelligence” feature, developed with Google Gemini, allowing users to ask natural language questions about their spending. The tool categorizes transactions into 50+ custom groups and delivers graphs and insights to improve financial awareness.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom artificial intelligence in finance market based on the below-mentioned segments:

United Kingdom Artificial Intelligence in Finance Market, By Component

- Solution

- Services

United Kingdom Artificial Intelligence in Finance Market, By Deployment Mode

- On-premise

- Cloud

Need help to buy this report?