United Kingdom Architectural, Engineering, and Construction Services Market Size, Share, and COVID-19 Impact Analysis By Service (Digital Services, Sustainability Service, Technical Engineering, City Planning Services, and Built Environmental Advisory), By Sector (Energy, Water & Environment, Resources, Transportation Infrastructure, and Real Estate), and United Kingdom Architectural, Engineering, And Construction Services Market Insights, Industry Trend, Forecasts to 2035.

Industry: Information & TechnologyUnited Kingdom Architectural, Engineering, and Construction Services Market Insights Forecasts to 2035

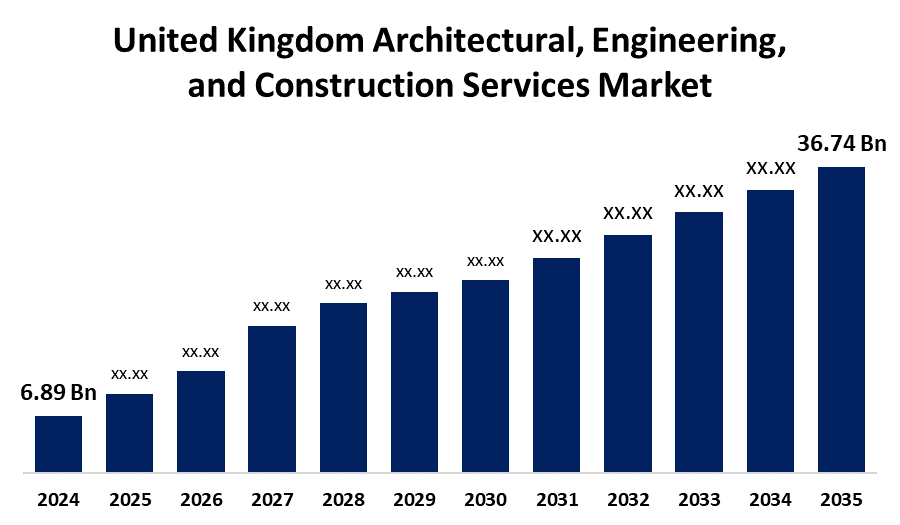

- The United Kingdom Architectural, Engineering, and Construction Services Market Size was estimated at USD 6.89 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 16.44% from 2025 to 2035

- The United Kingdom Architectural, Engineering, and Construction Services Market Size is Expected to Reach USD 36.74 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Architectural, Engineering, and Construction Services Market Sizeis Anticipated to reach USD 36.74 Billion by 2035, Growing at a CAGR of 16.44% from 2025 to 2035. The growing demand for sustainable construction solutions, government investments in significant endeavors, urbanization, infrastructure development, and technical innovations including Building Information Modeling (BIM).

Market Overview

The UK architectural, engineering, and construction services market refers to the industry providing engineering, planning, design, and construction services for commercial, residential, and infrastructural projects. It includes an extensive variety of fields, including project management, building design, civil engineering, and urban planning. Large-scale government infrastructure projects, rising demand for sustainable establishing, and technological advancements represent a few of the drivers supporting this industry. Large-scale infrastructure projects, digital transformation with BIM, and the rising need for sustainable solutions present numerous opportunities for innovation. Further market expansion is also driven by transportation development, renewable energy, and revitalization of cities. The adoption of modern technologies such as drones for surveying, 3D printing for construction, augmented reality (AR) for visualizing designs, Building Information Modeling (BIM), and sustainable materials to improve energy efficiency and reduce environmental impact.

Report Coverage

This research report categorizes the market for the UK architectural, engineering, and construction services market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the UK architectural, engineering, and construction services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK architectural, engineering, and construction services market.

United Kingdom Architectural, Engineering, and Construction Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.89 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 16.44% |

| 2035 Value Projection: | USD 36.74 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Service, By Sector and Construction Services Market Size |

| Companies covered:: | AVEVA Group Plc, Balfour Beatty, Kier Group, Laing O’Rourke, Morgan Sindall Group, Mott MacDonald, Skanska, WSP, Arcadis, Arup, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing urbanization, a strong pipeline for new building, and government-led initiatives for housing and transportation infrastructure. Design, planning, and construction efficiency are being improved by technological innovations like as robotics, artificial intelligence, and Building Information Modeling (BIM). Government rules on carbon emissions and environmental standards are also in line with the growing demand for eco-friendly construction methods and sustainable, energy-efficient structures. Projects for revitalizing towns and the transition toward smart cities also drive market expansion, leading to a dynamic and changing environment.

Restraining Factors

The high costs of materials, a lack of competent workers, and strict regulations. Project delays and costs are further impacted by inflation, economic concerns, and Brexit-related issues. Construction projects can be additionally hampered and market expansion may be constrained by supply chain interruptions and environmental compliance requirements.

Market Segmentation

The UK architectural, engineering, and construction services market share is classified into service and sector.

- The digital services segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UK architectural, engineering, and construction services market is segmented by service into digital services, sustainability service, technical engineering, city planning services, and built environmental advisory. Among these, the digital services segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to increasing use of BIM, laws, and the growing need for effective, sustainable infrastructure. In the UK AEC sector, these technologies promote teamwork, lower mistakes, and expedite the building process, which reduces costs and improves the outcome of the project.

- The real estate segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UK architectural, engineering, and construction services market is segmented by sector into energy, water & environment, resources, transportation infrastructure, and real estate. Among these, the real estate segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of the growing need for flexible, energy-efficient residences, shifting lifestyles, and an increase in remote employment. Investment in adjusted residential and commercial spaces has increased due to post-pandemic tendencies, which encouraged cooperation with AEC firms for creative, sustainable architectural solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK architectural, engineering, and construction services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AVEVA Group Plc

- Balfour Beatty

- Kier Group

- Laing O’Rourke

- Morgan Sindall Group

- Mott MacDonald

- Skanska

- WSP

- Arcadis

- Arup

- Others

Recent Developments:

- In December 2022, the Access Group introduced new construction management software solutions aimed at enhancing project lifecycle management. These tools focus on improving productivity, centralizing information, and controlling costs through robust cloud-based platforms.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the UK architectural, engineering, and construction services market based on the below-mentioned segments

UK Architectural, Engineering, and Construction Services Market, By Service

- Digital Services

- Sustainability Service

- Technical Engineering

- City Planning Services

- Built Environmental Advisory

UK Architectural, Engineering, and Construction Services Market, By Sector

- Energy

- Water & Environment

- Resources

- Transportation Infrastructure

- Real Estate

Need help to buy this report?