United Kingdom Antiviral Drugs Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Protease Inhibitors, Polymerase Inhibitors, Integrase Inhibitors, Combination Drugs, Reverse Transcriptase Inhibitors, and Others), By Drug Type (Branded and Generic), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Online Channel), and UK Antiviral Drugs Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareUnited Kingdom Antiviral Drugs Market Forecasts to 2035

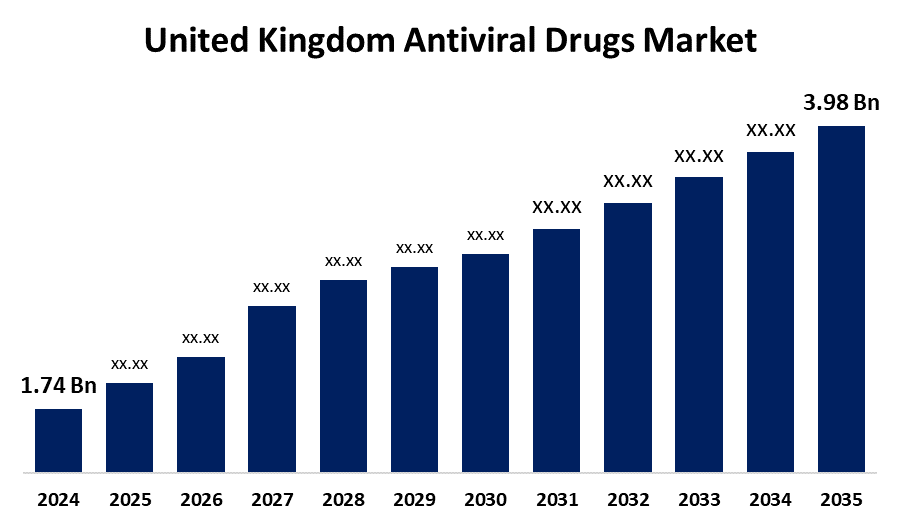

- The United Kingdom Antiviral Drugs Market Size Was Estimated at USD 1.74 Billion in 2024

- The UK Antiviral Drugs Market Size is Expected to Grow at a CAGR of around 7.81% from 2025 To 2035

- The UK Antiviral Drugs Market Size is Expected to Reach USD 3.98 Billion By 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The UK Antiviral Drugs Market Size is Anticipated to reach USD 3.98 Billion By 2035, Growing at a CAGR of 7.81% from 2025 to 2035. The UK antiviral drugs market is growing due to a high burden of viral infections like HIV and hepatitis, especially among an aging population. Strong healthcare infrastructure and government-funded R&D initiatives support early diagnosis and new drug development. Rising public awareness and preventive healthcare measures further drive demand for antiviral treatments.

Market Overview

Antiviral drugs are medications that are used specifically to treat viral infections. Most antiviral medications, like antibiotics, treat specific viral infections, whereas a broad-spectrum antiviral treatment works against a wide range of viruses. Antiviral drugs not only kill their intended pathogen instead they prevent the viruses from reproducing. The UK antiviral medications market is expected to develop moderately in the pharmaceutical sector, driven by increased awareness, illness prevalence, and enhanced efficacy of new drugs. Combivir, Sustiva, Tenofovir, Tamiflu, Relenza, and Telbivudine are among the important patents set to expire over the projection period. The patent expirations of these blockbuster pharmaceuticals are projected to result in generic competition in the antiviral treatments industry, making it more competitive. Late-stage pipeline medications are projected to enter the market, with a beneficial impact. Antiviral drugs are widely recognized for their relative protection and are usually employed to manage various viral infections. They are different from the viricides, which are chemical agents capable of neutralizing or destroying the virus, but not intended for internal medical use. While the viricides can function on the virus particles both inside and outside the body, they are usually used in non-healing settings, such as disinfectants. In contrast, antiviral drugs are especially developed to treat infections in humans due to viruses such as herpes simplex, HIV, influenza A and B, and hepatitis B and C. These drugs work by disrupting the replication of the virus, which helps in controlling the progression of the disease.

Governments have established new grant programs to assist research into vaccines, treatments, and diagnostics. For instance, in March 2023, Gov.UK, a UK-based government agency, and four UK life sciences enterprises won the first tranche of £277 million ($305.78 million) from the Life Sciences Innovative Manufacturing Fund. This program is intended to attract an additional £260 million ($287.01 million) in private investment, create 320 new jobs, and protect 199 current ones.

Report Coverage

This research report categorizes the market for the UK antiviral drugs market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom antiviral drugs market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom antiviral drugs market.

United Kingdom Antiviral Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.74 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.81% |

| 2035 Value Projection: | USD 3.98 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 96 |

| Segments covered: | By Drug Class, By Drug Type and COVID-19 Impact Analysis |

| Companies covered:: | GlaxoSmithKline, Gilead Sciences, AbbVie, Merck & Co., Janssen Pharmaceuticals, Reddy’s Laboratories Ltd., Hoffmann-La Roche AG, Bristol-Myers Squibb Company, Johnson & Johnson Services, Inc., Cipla Inc., Aurobindo Pharma, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing spread of viral infections such as HIV, Hepatitis, Influenza, Zika, Ebola, and SARS-CoV-2, especially increases the strong demand for anti-viral drugs for chronic and immunocompromised cases. Governments and health agencies are investing more in monitoring, preparations, and research. In addition, technological progress in molecular biology, genomics, CRISPR, and AI is changing antiviral drug development. Tools such as high-lying screening and structure-based designs improve speed and accuracy, while innovations such as nanotechnology, MRNA platforms, and targeted distribution increase drug effectiveness and safety. These trends are intensifying the discovery of individual, powerful antivirals to complete the growing market.

Restraining Factors

High cost, limited efficacy of existing treatments, emergence of drug resistance, complex regulatory approval procedures, and an important R&D investment. In addition, the issues of vaccination and obtaining antiviral drugs, especially for people with specific risk factors, have an impact on the UK antiviral drugs market.

Market Segmentation

The United Kingdom antiviral drugs market share is classified into drug class, drug type, and distribution channel.

- The combination drugs segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom antiviral drugs market is segmented by drug class into protease inhibitors, polymerase inhibitors, integrase inhibitors, combination drugs, reverse transcriptase inhibitors, and others. Among these, the combination drugs segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. These are fixed-dose combinations of various antiviral medicines intended to target numerous phases in the viral replication cycle or to provide a broader range of protection. These combinations have been the most popular in the UK market due to their effectiveness and convenience.

- The branded segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom antiviral drugs market is segmented by drug type, into branded and generic. Among these, the branded segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment's dominance is attributed to widespread use of branded treatments due to their established efficacy, safety profile, and increasing endorsement by healthcare authorities. There are numerous branded antiviral medications on the market, each of which is designed to treat a specific virus. Furthermore, prominent market competitors are continuously working on creating novel therapies to prevent the transmission of viral infection.

- The hospital pharmacy segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom antiviral drugs market is segmented by distribution channel into hospital pharmacy, retail pharmacy, and online channel. Among these, the hospital pharmacy segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The increasing prevalence of diseases, the growing ageing population, and the rising number of hospitalisations are the primary drivers of the segment's growth. Hospital pharmacists are working to improve their supply chain management to ensure an adequate and constant supply of antiviral medications, particularly during periods of high demand and global health catastrophes. The extraordinary COVID-19 outbreak dramatically raised demand for antiviral medications in hospital settings, notably for drugs used to treat COVID-19, such as remdesivir and monoclonal antibodies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom antiviral drugs market and a with comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GlaxoSmithKline

- Gilead Sciences

- AbbVie

- Merck & Co.

- Janssen Pharmaceuticals

- Reddy's Laboratories Ltd.

- Hoffmann-La Roche AG

- Bristol-Myers Squibb Company

- Johnson & Johnson Services, Inc.

- Cipla Inc.

- Aurobindo Pharma

- Others

Recent Developments:

- In July 2024, Outlook Therapeutics obtained MHRA approval for LYTENAVA (bevacizumab gamma) to treat wet age-related macular degeneration (AMD). The business intends to introduce the product in the United Kingdom in the first quarter of 2025

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom antiviral drugs market based on the below-mentioned segments:

United Kingdom Antiviral Drugs Market, By Drug Class

- Protease Inhibitors

- Polymerase Inhibitors

- Integrase Inhibitors

- Combination Drugs

- Reverse Transcriptase Inhibitors

- Others

United Kingdom Antiviral Drugs Market, By Drug Type

- Branded

- Generic

United Kingdom Antiviral Drugs Market, By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Channel

Need help to buy this report?