United Kingdom Anti-Obesity Medication Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Prescription Drugs and Over-The-Counter Drugs), By Action Pathway (Peripherally Acting Drugs and Centrally Acting Drugs), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy and Online Pharmacy), and UK Anti-Obesity Medication Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Anti-Obesity Medication Market Forecasts to 2035

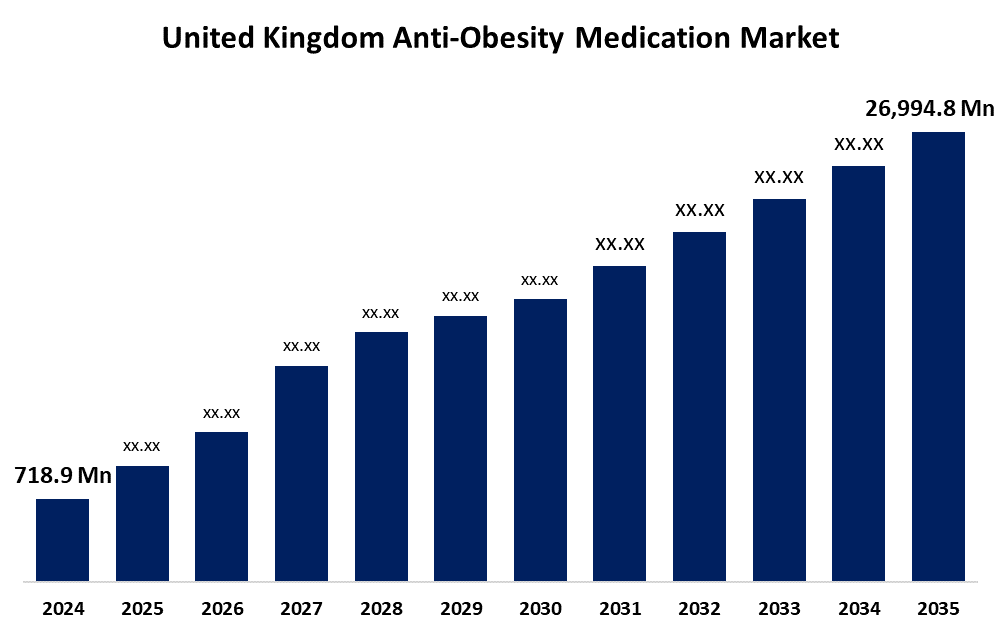

- The United Kingdom Anti-Obesity Medication Market Size Was Estimated at USD 718.9 Million in 2024

- The UK Anti-Obesity Medication Market Size is Expected to Grow at a CAGR of around 39.04% from 2025 to 2035

- The UK Anti-Obesity Medication Market Size is Expected to Reach USD 26,994.8 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the UK Anti-Obesity Medication Market Size is Anticipated to Reach USD 26,994.8 Million by 2035, Growing at a CAGR of 39.04% from 2025 to 2035. The increasing awareness regarding health and fitness and to reduce the prevalence of cardiovascular diseases due to obesity, demand for anti-obesity medication is on the rise, which is enhancing the growth of the anti-obesity medication market.

Market Overview

The United Kingdom anti-obesity medication market refers to the pharmaceutical sector focused on developing, manufacturing, and selling medications to treat overweight and obesity. Obesity is a condition of excessive body fat that raises the chances of health issues. It increases the risk of numerous debilitating ailments like diabetes, heart disease, and certain cancers. Obesity is caused by inherited, physiological, and environmental factors. Sedentary lifestyles and poor diets have raised the cases of obesity. Anti-obesity medications are effective through many mechanisms, like reducing appetite, increasing metabolism, or blocking the absorption of fat from the diet. They are divided into three primary classes based on their action: those inhibiting fat absorption in the gut, those reducing food intake, and those that raise energy expenditure. Many people find that food and exercise alone are insufficient to help them lose weight. As a result, many healthcare professionals suggest pharmaceutical support, including obesity medication. Rise in awareness of the severe health complications associated with obesity, such as type 2 diabetes, cardiovascular diseases, and certain types of cancer, drug-based treatment for weight loss is increasingly becoming the preferred solution. Health systems and insurance companies are starting to view obesity as a condition that requires long-term management and are increasing coverage for prescription medications. Such advances are making obesity medications more attractive to physicians as well as patients. Rise in awareness by government organizations that promote people to control their weight and healthy habits, further need for effective obesity treatment, and hence an increase in the United Kingdom anti-obesity medication market.

Report Coverage

This research report categorizes the market for the UK anti-obesity medication market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom anti-obesity medication market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom anti-obesity medication market.

United Kingdom Anti-Obesity Medication Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 718.9 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 39.04% |

| 2035 Value Projection: | USD 26,994.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Action Pathway, By Distribution Channel and COVID-19 Impact Analysis. |

| Companies covered:: | GlaxoSmithKline (GSK), Novo Nordisk, Eli Lilly, Roche, Astrazeneca, Boehringer Ingelheim., Amgen, Biocon, Pfizer and Others. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing concern for obesity treatment is likely to boost the market for anti-obesity drugs. Investments in R&D processes by pharma companies for developing more efficient anti-obesity medications can contribute to the growth of the market for anti-obesity medications. Increasing interest in holistic and personalized medicine, pharmaceutical firms are actively searching for various combination therapy drugs to develop effective treatment plans. Furthermore, regulatory agencies are focusing on evaluating the safety and efficacy of this anti-obesity medication in conjunction with antidepressants, anticonvulsants, glucocorticoids, and some migraine medications, which fuels demand for anti-obesity medications and increases the risk of weight gain.

Restraining Factors

A complex process of regulation restricts the investigational drug clinical trial study and hinders clinical trials. Such regulatory needs prevent the market participants from investing in drug development. Existing anti-obesity drugs are of limited efficacy and have substantial side effects, which weaken their safety and acceptability. This factor hampers the anti-obesity medication market during the forecast period.

Market Segmentation

The United Kingdom anti-obesity medication market share is classified into product type, action pathway, and distribution channel.

- The prescription drugs segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom anti-obesity medication market is segmented by product type into prescription drugs and over-the-counter drugs. Among these, the prescription drugs segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The rising number of individuals who are receiving treatment for weight loss, and more prescription medications are becoming available compared to OTC drugs, throughout the country. Prescription drugs are safer, effective, and new production for treatment. Prescription medications provide higher-strength medication and demand medical oversight to ensure adequate dosage and management of side effects.

- The centrally acting drugs segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom anti-obesity medication market is segmented by action pathway into peripherally acting drugs and centrally acting drugs. Among these, the centrally acting drugs segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Centrally acting medications have evolved from a single medication to reduced-dose combinations with more efficacy and fewer adverse effects compared to monotherapies of chronic diseases such as obesity and hypertension. Centrally acting pharmacotherapies increase effectiveness and represent an exciting treatment option for obesity that can be advanced through research.

- The retail pharmacy segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom anti-obesity medication market is segmented by distribution channel into hospital pharmacy, retail pharmacy, and online pharmacy. Among these, the retail pharmacy segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Retail pharmacies are an integral component of health systems. Retail pharmacies typically have contracts with private or public insurance providers to provide pharmaceuticals to public and private outpatients. These websites bring the medicine to the doorstep, and the process is cheaper than in a hospital. This convenience and ease of access are growing the patient population's preference for buying medicines from these websites.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom anti-obesity medication market and a with comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GlaxoSmithKline (GSK)

- Novo Nordisk

- Eli Lilly

- Roche

- Astrazeneca

- Boehringer Ingelheim.

- Amgen

- Biocon

- Pfizer

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom anti-obesity medication market based on the below-mentioned segments:

United Kingdom Anti-Obesity Medication Market, By Product Type

- Prescription Drugs

- Over-The-Counter Drugs

United Kingdom Anti-Obesity Medication Market, By Action Pathway

- Peripherally Acting Drugs

- Centrally Acting Drugs

United Kingdom Anti-Obesity Medication Market, By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

Need help to buy this report?