United Kingdom Animal Identification Market Size, Share, and COVID-19 Impact Analysis, By Animal Type (Companion Animals, Livestock Animals, Other Animals), By Solution (Hardware, Software, Services), By Procedure (Wearables, Microchipping, Ear Notching, Tattooing, and Other Methods), and United Kingdom Animal Identification Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyUnited Kingdom Animal Identification Market Insights Forecasts to 2035

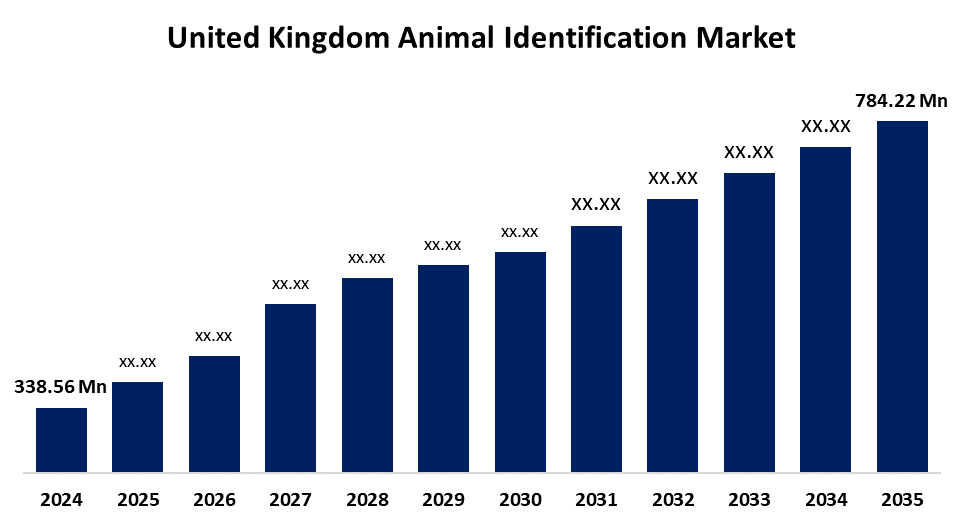

- The United Kingdom Animal Identification Market Size was Estimated at USD 338.56 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.94% from 2025 to 2035

- The United Kingdom Animal Identification Market Size is Expected to Reach USD 784.22 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Animal Identification Market Size is anticipated to reach USD 784.22 Million by 2035, growing at a CAGR of 7.94% from 2025 to 2035. The market is expanding due to several factors, including the growing need for precise livestock management, strict disease control protocols, adherence to food safety regulations, and a dedication to moral agricultural methods and conscientious pet ownership.

Market Overview

The United Kingdom animal identification market refers to the industry focused on developing and supplying technologies and solutions for identifying and tracking animals. This market plays a crucial role in agriculture, livestock management, pet ownership, and wildlife monitoring by ensuring traceability, health surveillance, and regulatory compliance. They included several processes such as tagging, monitoring, and controlling animals using a variety of identifying techniques. The quantity of farm animals, their cost, performance indicators, and their financial tracking unit sales are all made simple for farmers by this system. Additionally, government programs stimulate market growth through various incentives. For instance, the UK government has announced a £200 million investment to bolster protection against dangerous animal diseases. This funding will be used to upgrade the Animal and Plant Health Agency's (APHA) laboratories at Weybridge, which play a crucial role in managing threats from animal diseases. The improvements will enhance biosecurity facilities, increase the ability to prevent, detect, and respond to disease outbreaks, and safeguard the livelihoods of farmers and rural communities. The move is part of the government's broader strategy to protect the farming and food sector while maintaining the UK's world-leading scientific and veterinary capabilities.

Report Coverage

This research report categorizes the market for the United Kingdom animal identification market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom animal identification market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom animal identification market.

United Kingdom Animal Identification Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 338.56 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 7.94% |

| 2035 Value Projection: | USD 784.22 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 253 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Animal Type, By Solution and By Procedure |

| Companies covered:: | Shearwell Data Ltd, World Animal Protection, Datamars UK, Allflex Identification, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom animal identification is driven by the country's rapid growth of the agriculture and related businesses sector. Besides, technological advancements in animal healthcare have enabled farmers and other animal owners to use real-time tracking systems that simplify the monitoring processes with early emergency detection. The market is driven by strict regulations for better health status in the veterinary sector. While advancements in RFID and DNA-based identifying techniques improve precision and efficiency in animal management, initiatives such as the demand for livestock tagging, welfare monitoring, and fulfilling international trade standards drive market expansion.

Restraining Factors

Privacy and data security are growing issues as a result of the massive volumes of data that animal identification systems gather and keep. Moreover, gaining trust and meeting regulatory standards requires the sector to tackle the complicated task of ensuring compliance. Besides, the installation cost of animal identification systems is one of the main obstacles to their widespread adoption, specifically for smaller and medium-scale farmers.

Market Segmentation

The United Kingdom Animal Identification Market share is classified into animal type, solution, and procedure.

- The livestock animals segment dominated the market in 2024 and is projected to grow at a substantial CAGR over the forecast period.

The United Kingdom animal identification market is segmented by animal type into companion animals, livestock animals, and other animals. Among these, the livestock animals segment dominated the market in 2024 and is projected to grow at a substantial CAGR over the forecast period. The governments have required livestock animals to have official identification systems before they can be transported across state lines or interstate for public sale or other purposes. Consumer demands for sustainability and transparency, as well as the variety of needs of livestock animals and the integration of technology, have a substantial impact on the market. The market is expected to keep expanding and innovating.

- The hardware segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom animal identification market is divided by solution into hardware, software, and services. Among these, the hardware segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because electronic hardware, visual hardware, and consumables or applicators used in animal identification procedures are also included in this section. The use of GPS-based identifying collars for pets is growing, and government participation in requiring electronic or RFID tags to control livestock movement within or across state lines is expanding.

- The microchipping segment held a significant share in 2024 and is anticipated to grow at a rapid pace during the forecast period.

The United Kingdom animal identification market is classified by procedure into wearables, microchipping, ear notching, tattooing, and other methods. Among these, the microchipping segment held a significant share in 2024 and is anticipated to grow at a rapid pace during the forecast period. This expansion is ascribed to the development of microchip technology, which is used to permanently brand the animals for the purposes of lifetime identification. The recovery database of implanted animals has the owners' most recent contact details thanks to a registered microchip ID system.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom animal identification market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Shearwell Data Ltd

- World Animal Protection

- Datamars UK

- Allflex Identification

- Others

Recent Developments:

- In June 2025, the UK Department for Environment, Food & Rural Affairs (Defra) announced the introduction of an electronic identification (eID) system for cattle to modernize traceability and improve disease control. Defra officials emphasized that this move aligned England with global best practices and helped the livestock industry boost productivity, food security, and international trade.

- In July 2024, Sainsbury’s became the first retailer to adopt a new AI-powered veterinary technology developed by Vet Vision AI, a spinout from the University of Nottingham. This innovative system uses low-cost, portable cameras to monitor cattle behavior, analyzing video footage to provide real-time insights into animal welfare. It was trialed on 30 farms within Sainsbury’s Dairy Development Group, and the technology aimed to enhance farming efficiency by promoting healthier, more productive cows. The retailer planned to expand its use across more farms.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom animal identification market based on the below-mentioned segments:

United Kingdom Animal Identification Market, By Animal Type

- Companion Animals

- Livestock Animals

- Other Animals

United Kingdom Animal Identification Market, By Solution

- Hardware

- Software

- Services

United Kingdom Animal Identification Market, By Procedure

- Wearables

- Microchipping

- Ear Notching

- Tattooing,

- Other Methods

Need help to buy this report?