United Kingdom Animal Biotechnology Market Size, Share, and COVID-19 Impact Analysis, By Product (Diagnostics Tests, Vaccines, Drugs, Reproductive and Genetic, Feed Additives), By Application (Diagnosis and Treatment of Animal Diseases, Preventive Care of Animals, Drug Development, Others), and United Kingdom Animal Biotechnology Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Animal Biotechnology Market Insights Forecasts to 2035

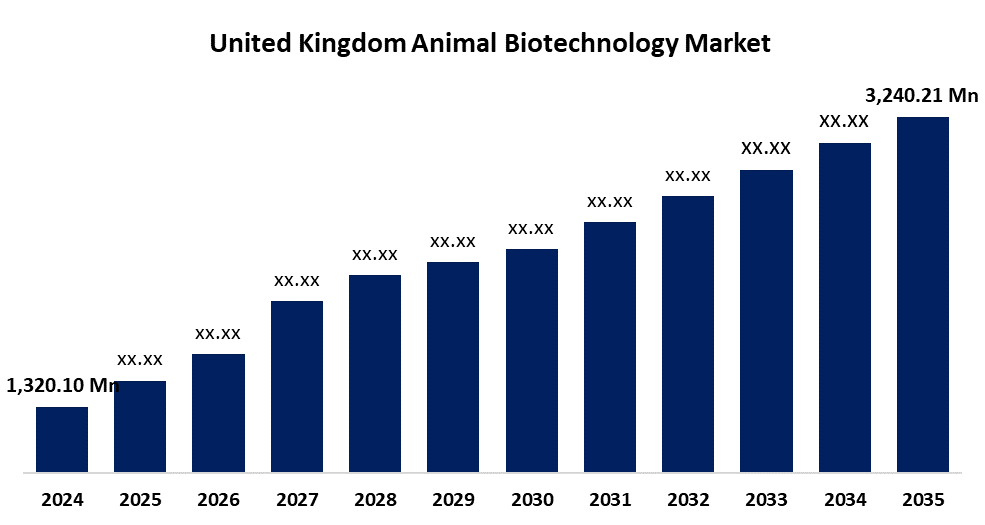

- The United Kingdom Animal Biotechnology Market Size was estimated at USD 1,320.10 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.51% from 2025 to 2035

- The United Kingdom Animal Biotechnology Market Size is Expected to Reach USD 3,240.21 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the United Kingdom Animal Biotechnology Market is anticipated to reach USD 3,240.21 million by 2035, growing at a CAGR of 8.51% from 2025 to 2035. This growth is driven by a variety of factors, including the growing demand for commodities made from animals, advancements in gene editing technologies, and growing government support for research on animal biotechnology.

Market Overview

The United Kingdom animal biotechnology market refers to the business emphasis on the production, application, and distribution of biological techniques or methods for overall animal health. Animal biotechnology utilizes molecular biology techniques to modify the genomes of animals or genetically engineer them to enhance their suitability for industrial, medical, or agricultural applications. Recent breakthroughs in animal biotechnology have become simpler due to advancements in metabolic cell profiling, gene expression, and animal genome sequencing. Animal genetic modifications that improve agricultural output, health and well-being, and disease resistance are now easier to create thanks to recent developments in genome editing technologies. At the same time, animal biotechnology employs various techniques to diagnose different animal illnesses, facilitate their treatment through a range of therapeutic approaches, develop animal medications, and provide veterinary vaccinations for preventive care. The increasing ownership of pets with consideration like family members opens up a wide range of opportunities the market growth. The need for genetically modified therapeutic proteins, the use of animals to cure cancer, and the increase in pet preventative care are further growth drivers.

Report Coverage

This research report categorizes the market for the United Kingdom animal biotechnology market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom animal biotechnology market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom animal biotechnology market.

United Kingdom Animal Biotechnology Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,320.10 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.51% |

| 2035 Value Projection: | USD 3,240.21 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis |

| Companies covered:: | ECO Animal Health Group, Genus plc, Felcana, FOLIUM, Smartbell - Animal Monitoring, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The market for United Kingdom animal biotechnology is primarily driven by the country's growing healthcare industry, with substantial investments and high-skilled professionals. Further, the UK is a key centre in business trade within this region, that heightened the market expansion for such emerging businesses. Moreover, the growing incidence of zoonotic diseases and the necessity to guarantee food safety are also motivating businesses to engage in the development of innovative vaccines and treatments for animal illnesses. The need to ensure food safety and the rising prevalence of zoonotic diseases are also driving companies to explore novel vaccines and treatments for animal diseases. There is enormous potential for enhancing animal production and health through the development of cutting-edge methods like genome editing and gene therapy, that concluded the market novel opportunities.

Restraining Factors

The market growth could be hindered by delays from regulatory feedback, regular checkups might create a time-consuming procedure, initial cost barriers could be avoided for small and medium-sized farmers and organizations.

Market Segmentation

The United Kingdom animal biotechnology market share is classified into product and application.

- The vaccines segment accounted for the largest market share in 2024 and is projected to grow at a substantial CAGR over the forecast period.

The United Kingdom animal biotechnology market is segmented by product into diagnostics tests, vaccines, drugs, reproductive and genetic, and feed additives. Among these, the vaccines segment accounted for the largest market share in 2024 and is projected to grow at a substantial CAGR over the forecast period. This segment's growth is driven by their work being better and safer than traditional immunizations. Biotechnology has contributed to the strengthening and targeting of immune responses to vaccines, and there are fewer side effects.

- The preventive care of animals segment held a significant share in 2024 and is anticipated to grow at a rapid pace over the forecast period.

The United Kingdom animal biotechnology market is segmented by application into diagnosis and treatment of animal diseases, preventive care of animals, drug development, and others. Among these, the preventive care of animals segment held a significant share in 2024 and is anticipated to grow at a rapid pace over the forecast period. This is because preventive care is essential for a financial advantage to farmers, and it reduces the long-term costs associated with illness treatment. In many cases, preventing illnesses is less costly than treating them, and a growing focus on healthy cattle has better growth rates, higher rates of reproduction, and higher-quality products (milk, meat, eggs, etc.).

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom animal biotechnology market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ECO Animal Health Group

- Genus plc

- Felcana

- FOLIUM

- Smartbell - Animal Monitoring

- Others

Recent Developments:

- In February 2024, the Pirbright Institute strengthened its animal disease partnership with India by co-signing a Memorandum of Understanding (MoU) with India’s National Institute of Animal Biotechnology (NIAB). This collaboration aims to create an animal disease and zoonosis laboratory partnership between the UK and India. The MoU, signed in Hyderabad, supports the UK Government's commitments in the 2030 India-UK Roadmap.

- In June 2023, the Thai-UK research collaboration successfully developed biotechnological products for animal health, focusing on vaccines, biopharmaceuticals, and microalgal-based technology for shrimp disease control. The partnership included BIOTEC-NSTDA, King Mongkut’s University of Technology Thonburi (KMUTT), the University of Kent, and University College London (UCL).

- In March 2023, the UK Centre for Veterinary Vaccine Innovation and Manufacturing (CVIM) is set to improve global animal health by accelerating the development and deployment of vaccines for neglected and emerging livestock and zoonotic diseases. Based at The Pirbright Institute, CVIM aims to bridge the gap between early-stage scientific discoveries and large-scale vaccine production.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom animal biotechnology market based on the below-mentioned segments:

United Kingdom Animal Biotechnology Market, By Product

- Diagnostics Tests

- Vaccines

- Drugs

- Reproductive and Genetic

- Feed Additives

United Kingdom Animal Biotechnology Market, By Application

- Diagnosis and Treatment of Animal Diseases

- Preventive Care of Animals

- Drug Development

- Others

Need help to buy this report?