United Kingdom Ambulance Services Market Size, Share, and COVID-19 Impact Analysis, By Transport Vehicle (Ground Ambulance, Air Ambulance, and Water Ambulance), By Equipment (Advanced Life Support (ALS) Ambulance Services and Basic Life Support (BLS) Ambulance Services), and UK Ambulance Services Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Ambulance Services Market Forecasts to 2035

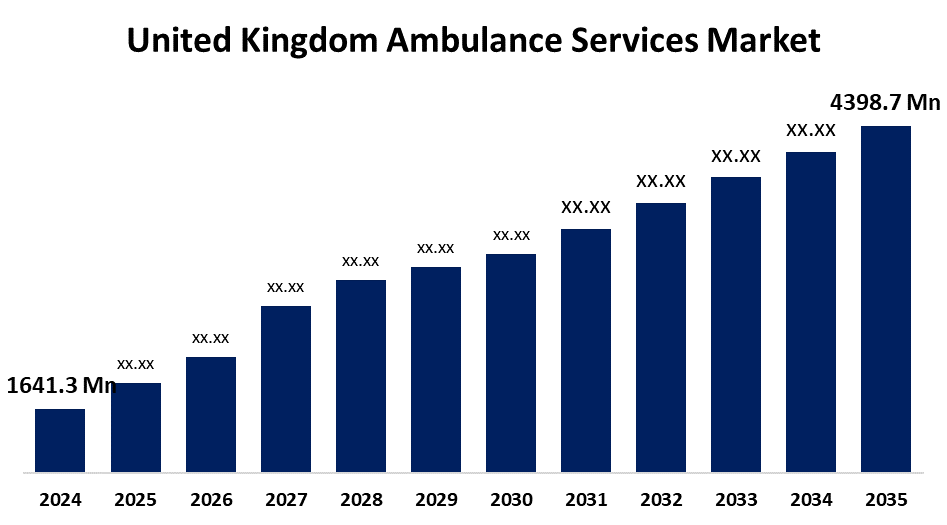

- The United Kingdom Ambulance Services Market Size Was Estimated at USD 1641.3 Million in 2024

- The UK Ambulance Services Market Size is Expected to Grow at a CAGR of around 9.38% from 2025 to 2035

- The UK Ambulance Services Market Size is Expected to Reach USD 4398.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the UK Ambulance Services Market is anticipated to reach USD 4398.7 million by 2035, growing at a CAGR of 9.38% from 2025 to 2035. The demand for ambulance services has increased as the number of persons suffering from various chronic conditions and the senior population has grown.

Market Overview

The UK ambulance services market focuses on emergency medical transport, offering specialized vehicles, trained staff, and equipment to safely move patients requiring urgent care, especially during critical or life-threatening situations. The ambulance services market is experiencing high and accelerating growth, driven by several key factors. A significant contributor is the increasing UK geriatric population, particularly those over 60, who are more susceptible to chronic conditions such as neurological disorders, cardiac issues, cancer, and spinal injuries. The rise in medical tourism, improved healthcare infrastructure, and favorable reimbursement policies further support market expansion. Additionally, the COVID-19 pandemic boosted demand for ambulance services. Technological advancements, including GPS navigation, telemedicine, and improved vehicle design, have enhanced emergency response efficiency and patient care, making ambulance services more effective and contributing to overall market growth.

The UK is a vital component of the healthcare market as it provides mobility and emergency medical services to patients. The provision of governmental and private ambulance services across the entire nation creates a highly competitive market. The NHS ambulance service is the principal provider of ambulance services in the UK with 10 NHS ambulance trusts in England, the Scottish Ambulance Service, and the Welsh and Northern Irish Ambulance Services. It also provides private ambulance services, particularly during non-emergency patient transportation.

Report Coverage

This research report categorizes the market for the UK ambulance services market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom ambulance services market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom ambulance services market.

United Kingdom Ambulance Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1641.3 Million |

| Forecast Period: | 2025-2035 |

| 2035 Value Projection: | USD 4398.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Transport Vehicle, By Equipment and COVID-19 Impact Analysis |

| Companies covered:: | AACE, Air Ambulance Kent Surrey Sussex, Ambulance Services UK, East Midlands Ambulance Service NHS Trust, Falck UK Ambulance Services, G4S Patient Transport Services, London Ambulance Service NHS Trust, Medstar UK Ambulance Services, Private Ambulance Service Ltd., St John Ambulance, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The ambulance service market is influenced by traffic accidents, lifestyle related and chronic diseases, and the number of trauma incidents occurring in the UK. Additionally, an evolving larger healthcare landscape, government activity to improve trauma care, technology advancements and the emergence of multispecialty ambulances which provide rapid diagnosis and management are also leading the market to expand.

Restraining Factors

With the ageing populations, chronic illnesses, and urbanisation, there is an increasing demand for ambulance services, which puts a strain on available resources and causes delays and stress among staff. Additionally, market expansion is hampered by difficulties in finding and maintaining talented workers because of job demands, poor compensation, and restricted opportunities for career growth. These factors hamper the ambulance services market during the forecast period.

Market Segmentation

The United Kingdom ambulance services market share is classified into transport vehicle and equipment.

- The ground ambulance segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom ambulance services market is segmented by transport vehicle into ground ambulance, air ambulance, and water ambulance. Among these, the ground ambulance segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In the UK, there is a rising number of patients requiring emergency medical care. Ground ambulances will continue to be the preferred means of transport for patients requiring urgent care and also the most cost-effective, especially in urban and suburban areas. Factors expected to drive the adoption of ground ambulances include an increase in the number of traffic accidents, an increase in chronic diseases, and an increase in the need for faster medical response times.

- The advanced life support (ALS) ambulance services segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom ambulance services market is segmented by equipment into advanced life support (ALS) ambulance services and basic life support (BLS) ambulance services. Among these, the advanced life support (ALS) ambulance services segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Services with Advanced Life Support (ALS) will likely grow as they provide high-level support and care while including transit airway management, drug therapy, cardiac monitoring, etc. There is also an increase in the number of heart attacks, strokes, and other critical conditions, forcing healthcare systems to prioritize ALS ambulances based on available evidence to improve emergency response and patient survival, as well as patient outcomes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom ambulance services market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AACE

- Air Ambulance Kent Surrey Sussex

- Ambulance Services UK

- East Midlands Ambulance Service NHS Trust

- Falck UK Ambulance Services

- G4S Patient Transport Services

- London Ambulance Service NHS Trust

- Medstar UK Ambulance Services

- Private Ambulance Service Ltd.

- St John Ambulance

- Others

Recent Development

- In January 2025, In South Wales, National Grid Electricity Distribution and St John Ambulance Cymru collaborated to provide more than 1,200 children and youth with basic first aid training. The first aid charity included crucial electrical safety messaging into this campaign, which ran from September to December 2024, to increase awareness of how to prevent mishaps involving electricity. The goal of St John Ambulance Cymru's Community Education Programme is to provide all Welsh children with life-saving first aid knowledge so that people are ready to act appropriately in an emergency.

- In July 2024, Shepherd Neame, the UK’s oldest brewer, announced a new partnership with Air Ambulance Charity Kent Surrey Sussex (KSS) as its Charity. Through its Sheps Giving initiative, the brewery will support KSS’s lifesaving emergency medical services by organizing fundraising and promotional activities across its 300 pubs and hotels. KSS operates 24/7, providing critical care to millions in Kent, Surrey, and Sussex.

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom ambulance services market based on the below-mentioned segments:

United Kingdom Ambulance Services Market, By Transport Vehicle

- Ground Ambulance

- Air Ambulance

- Water Ambulance

United Kingdom Ambulance Services Market, By Equipment

- Advanced Life Support (ALS)Ambulance Services

- Basic Life Support (BLS) Ambulance Services

Need help to buy this report?