United Kingdom Agrochemicals Market Size, Share, and COVID-19 Impact Analysis, By Product (Fertilizers, Crop Protection Chemicals, Plant Growth Regulators, and Others), By Application (Cereal & Grains, Oilseeds & Pulses, Fruits & Vegetables and Others), and UK Agrochemicals Market Insights, Industry Trend, Forecasts to 2035.

Industry: AgricultureUnited Kingdom Agrochemicals Market Forecasts to 2035

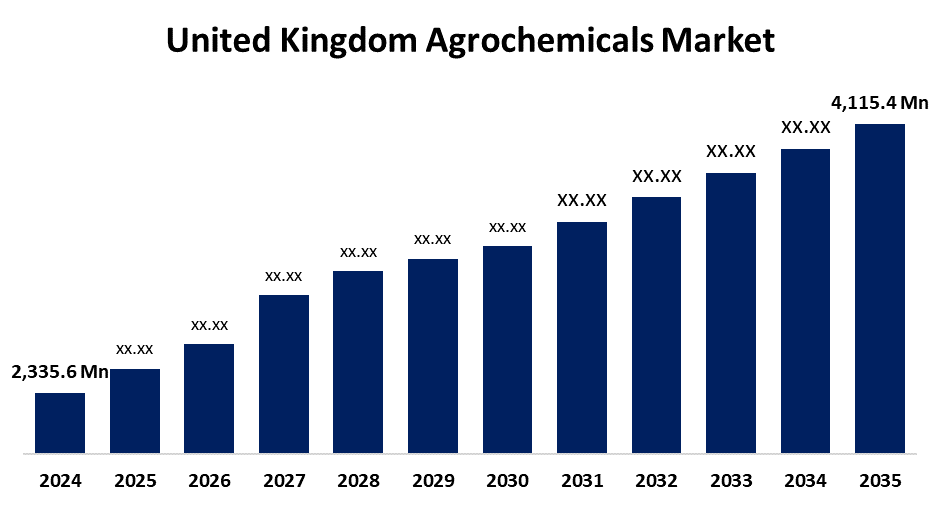

- The United Kingdom Agrochemicals Market Size Was Estimated at USD 2,335.6 Million in 2024

- The UK Agrochemicals Market Size is Expected to Grow at a CAGR of around 5.28% from 2025 to 2035

- The UK Agrochemicals Market Size is Expected to Reach USD 4,115.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom Agrochemicals Market Size is anticipated to reach USD 4,115.4 Million by 2035, growing at a CAGR of 5.28% from 2025 to 2035. The increasing agricultural activities, rising food demand, and the adoption of advanced farming techniques are contributing to productivity.

Market Overview

The UK agrochemicals market includes chemical or biological substances designed to enhance crop quality and productivity. Together, these agrochemicals play a vital role in modern agriculture by supporting healthy and efficient crop production. play a crucial role in boosting crop yield and quality by providing essential nutrients and protecting against pests and weeds. Significant growth is occurring in the agrochemicals market due to the increasing adoption of precision farming and dwindling supply of agricultural land to meet rising UK food demand, owing to the growth in population. Increased use of pesticides to boost agricultural productivity is further driving demand for agrochemicals, including fertilizers, plant growth promoters, and adjuvants. Adjuvants are added to crop protection chemicals to enhance their effectiveness, with different types serving specific purposes. Ongoing research and development efforts to provide high-quality products, agrochemicals, have emerged as essential elements of contemporary farming. Furthermore, during the projected period, the UK agrochemicals market is expanding due to the government's significant emphasis on agricultural development and food security. The agrochemicals sector is increasingly embracing sustainable agriculture by promoting eco-friendly fertilizers, pesticides, soil health, and water conservation. This shift emphasizes integrated pest management and reduced chemical use. Simultaneously, digital agriculture is transforming the industry through technologies like AI, IoT, and big data analytics, enabling precise application of inputs. These innovations help minimize environmental impact, reduce waste, and optimize resource use by providing real-time insights on crop health and soil conditions.

Report Coverage

This research report categorizes the market for the UK agrochemicals market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom agrochemicals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom agrochemicals market.

United Kingdom Agrochemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2,335.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.28% |

| 2035 Value Projection: | USD 4,115.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 241 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Application |

| Companies covered:: | BASF SE, Bayer AG, Syngenta Group, Croda Europe Ltd, Nufarm Ltd, Syngenta Ltd, Fargro Limited, Robinson Brothers, Certis Belchim UK, AGROSMART LIMITED, Sumi Agro Europe Ltd, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Effective agrochemicals are desperately needed to reduce crop loss and economic costs. Additionally, the use of artificial growth agents like hormones and adjuvants promotes healthy crop yields. As such, there is a great demand for agrochemicals in the UK, creating a profitable business. Ecological sustenance is threatened by chemical pests and disease inhibitors, although organic agrochemicals are becoming more popular in UK modern farming. Due to its effectiveness in controlling the growth and spread of agricultural pests and illnesses, organic farming is becoming more popular. At the same time, the UK agrochemical market has more opportunities due to the growing use of natural fertilisers and pesticides.

Restraining Factors

Strict regulatory and environmental limitations to chemical use, increasing public apprehension regarding ecological and health impacts, and an increasing resistance from pests and weeds necessitating higher doses or more frequent applications. Rising consumer demands for organic and pesticide-free produce also limit the use of conventional agrochemicals. These factors hamper the agrochemicals market during the forecast period.

Market Segmentation

The United Kingdom agrochemicals market share is classified into product and application.

- The fertilizers segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom agrochemicals market is segmented by product into fertilizers, crop protection chemicals, plant growth regulators, and others. Among these, the fertilizers segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is mostly because farmers are paying more attention to raising agricultural yields in a shorter amount of time. Farmers are using more fertiliser to boost the productivity and yields of a variety of crops as a result of the UK's growing demand for food and crops, placing strain on agricultural land.

- The cereal & grains segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom agrochemicals market is segmented by application into cereal & grains, oilseeds & pulses, fruits & vegetables, and others. Among these, the cereal & grains segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The increasing consumption of cereal and grains, including rice, wheat, rye, corn, oats, sorghum, and barley, in different parts of the world is the reason for this. Because of the extensive cultivation of wheat and maize in the United Kingdom, agrochemicals are primarily utilised for cereals and grains. Agrochemicals and non-ionic surfactants are generally advised for cereals and grains.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom agrochemicals market and a with comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Bayer AG

- Syngenta Group

- Croda Europe Ltd

- Nufarm Ltd

- Syngenta Ltd

- Fargro Limited

- Robinson Brothers

- Certis Belchim UK

- AGROSMART LIMITED

- Sumi Agro Europe Ltd

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom agrochemicals market based on the below-mentioned segments:

United Kingdom Agrochemicals Market, By Product

- Fertilizers

- Crop Protection Chemicals

- Plant Growth Regulators

- Others

United Kingdom Agrochemicals Market, By Application

- Cereal & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

Need help to buy this report?