United Kingdom 3D Cell Culture Market Size, Share, and COVID-19 Impact Analysis, By Technology (Scaffold-based, Scaffold-free, and Bioreactors), By Application (Stem Cell Research & Tissue Engineering, and Cancer Research), By End User (Biotechnology and Pharmaceutical Industries, Research Laboratories and Institutes, Hospitals and Diagnostic Centres, Others), and United Kingdom 3D Cell Culture Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareUnited Kingdom 3D Cell Culture Market Insights Forecasts to 2035

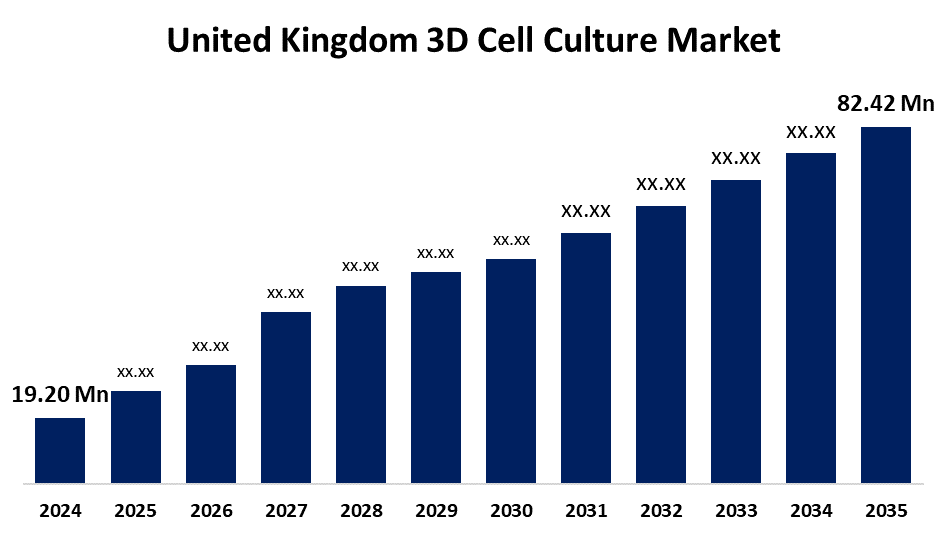

- The United Kingdom 3D Cell Culture Market Size was estimated at USD 19.20 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 14.16% from 2025 to 2035

- The United Kingdom 3D Cell Culture Market Size is Expected to Reach USD 82.42 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom 3D Cell Culture Market Size is Anticipated to reach USD 82.42 Million By 2035, Growing at a CAGR of 14.16% from 2025 to 2035. The market is driven by the expanding efforts to develop practical alternatives to animal testing, as well as the availability of financing programs for research.

Market Overview

The United Kingdom market for 3D cell culture is a business that uses laboratory techniques to grow cells in three dimensions, imitating the natural conditions of human body tissues. The market for 3D cell cultures is rapidly developing due to its realistic in vitro model for drug testing, regenerative medicine, and disease research. This method enhances therapeutic responsiveness, safety, and pharmacological efficacy research by replicating human tissue circumstances. The market is growing as a result of increased demand for personalized medicine, cancer research, and regenerative therapies, in addition to biotechnological advancements in bioprinting, scaffold materials, and organoid research. Pharmaceutical companies are investing in high-throughput drug screening to reduce their reliance on animal research, even as government and private funding continue to encourage innovation. Artificial intelligence (AI)-driven data analysis, animal-free testing techniques, and growing financing for stem cell research are some of the developments driving the sector. The market is also anticipated to grow during the projected period due to biopharmaceutical companies' ongoing R&D operations for medication with novel drug discovery, and their emphasis on using 3D cell cultures in cancer research.

Report Coverage

This research report categorizes the market for the United Kingdom 3D cell culture market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom 3D cell culture market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom 3D cell culture market.

United Kingdom 3D Cell Culture Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 19.20 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 14.16% |

| 2035 Value Projection: | USD 82.42 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | By Technology, By Application, By End User and COVID-19 Impact Analysis |

| Companies covered:: | AstraZeneca, GSK, Oxford Biomedica, Symbiosis, Quell Therapeutics, Abzena, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for UK 3D cell culture is driven by the demand for advanced 3D cell culture models for drug testing has grown in response to growing ethical concerns and scientific limitations of animal toxicity screening. Moreover, using animals in experiments is usually costly and time-consuming, and the results are never trustworthy. The regulatory bodies, such as EMA, have also issued encouraging guidelines to promote the use of 3D cell culture platforms and technologies for safety evaluation, toxicity testing, and drug screening. The rising demand for cell-based vaccines and antiviral drug development as a result of the rising incidence of infectious diseases like tuberculosis (TB) is another factor driving market expansion.

Restraining Factors

The primary impediment to the 3D cell culture market is the difficulty of handling 3D cell cultures as opposed to 2D cell cultures. 3D systems require special attention because they are significantly more vulnerable to environmental changes such as pH, oxygen, and nutrient availability.

Market Segmentation

The United Kingdom 3D cell culture market share is classified into technology, application, and end user.

- The scaffold-based segment held the highest share in 2024 and is anticipated to grow at a significant CAGR over the forecast period.

The United Kingdom 3D cell culture market is segmented by technology into scaffold-based, scaffold-free, and bioreactor. Among these, the scaffold-based segment held the highest share in 2024 and is anticipated to grow at a significant CAGR over the forecast period. The increased attribute may be that it provides a structured and supportive environment that is very comparable to the extracellular matrix (ECM) seen in live tissues. Its ability to enhance cell adhesion, proliferation, and differentiation makes it excellent for use in tissue engineering, regenerative medicine, and cancer research.

- The stem cell research segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom 3D cell culture market is differentiated by application into stem cell research, tissue engineering, and cancer research. Among these, the press-and-sinter segment held a significant share in 2024 and is anticipated to grow at a rapid pace during the forecast period. This is due to the biopharmaceuticals as a result of effective therapies such as cell and gene therapy, as well as a rise in innovation, which has resulted in more approvals. Furthermore, technological breakthroughs, favorable government regulations, and greater financing for stem cell research have accelerated the introduction of 3D culture models.

- The research laboratories and institutes segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period.

The United Kingdom 3D cell culture market is classified by end user into biotechnology and pharmaceutical industries, research laboratories and institutes, hospitals and diagnostic centres, and others. Among these, the research laboratories and institutes segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period. This is because an increase in research activities, a rise in industry-academia partnerships, and an emphasis on drug modeling and screening by research institutions. Further, this invention tackles important health issues in the area by offering a platform for a more in-depth understanding of host-pathogen interactions and medication efficacy.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom 3D cell culture market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AstraZeneca

- GSK

- Oxford Biomedica

- Symbiosis

- Quell Therapeutics

- Abzena

- Others

Recent Developments:

- In April 2022, Cell Guidance Systems and Manchester BIOGEL collaborated to launch PODS-PeptiGels, a new solution for 3D cell culture. This innovative kit combines synthetic peptide hydrogels (PeptiGels) with sustained-release growth factors (PODS) to create a customizable, reproducible, and adaptable environment for cell research.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom 3D cell culture market based on the below-mentioned segments

United Kingdom 3D Cell Culture Market, By Technology

- Scaffold-based

- Scaffold-free

- Bioreactors

United Kingdom 3D Cell Culture Market, By Application

- Stem Cell Research

- Tissue Engineering

- Cancer Research

United Kingdom 3D Cell Culture Market, By End User

- Biotechnology and Pharmaceutical Industries

- Research Laboratories and Institutes

- Hospitals and Diagnostic Centres

- Others

Need help to buy this report?