UK Washing Machine Market Size, Share, and COVID-19 Impact Analysis, By Type (Front Load Automatic, Top Load Automatic, Semi-Automatic), By Machine Capacity (Below 6 kg, 6.1 to 8 kg, Above 8 kg), By Technology (Smart Connected, Conventional), By End Use (Commercial, Residential), and UK Washing Machine Market Insights Forecasts 2023 – 2033

Industry: Consumer GoodsUK Washing Machine Market Insights Forecasts to 2033

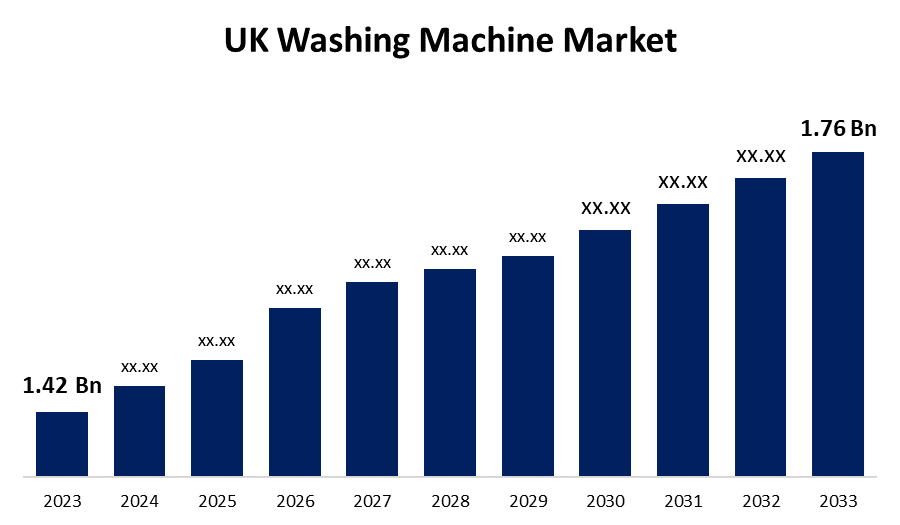

- The UK Washing Machine Market Size was valued at USD 1.42 Billion in 2023.

- The Market Size is Growing at a CAGR of 2.17% from 2023 to 2033.

- The UK Washing Machine Market Size is Expected to Reach USD 1.76 Billion by 2033.

Get more details on this report -

The UK Washing Machine Market Size is Expected to Reach USD 1.76 Billion by 2033, at a CAGR of 2.17% during the forecast period 2023 to 2033.

Market Overview

A washing machine is an electronic appliance that uses water as its main medium and spins the laundry. Water, detergent, and agitation (centrifugal force) are commonly used to remove dirt, stains, and odors from laundry. Washing machines are available in a variety of sizes and capacities, and they also have features and functionalities that make cleaning more effective. Modern washing machines include a variety of settings and options to accommodate different fabric types and laundry loads. They typically consist of a drum or tub into which clothes are loaded and are available in both top-loading and front-loading configurations. Washing machines have now gained widespread acceptance as an essential part of daily life, providing convenience and efficiency in maintaining cleanliness and hygiene for various clothing items. Furthermore, the increasing pace of modern lifestyles has increased the demand for time-saving appliances such as washing machines, which will drive market growth over the forecast period. Furthermore, rapid urbanization and the significant expansion of urban households are driving market growth, as more people appreciate the convenience of automated laundry. The growing electronics industry, the expansion of laundromats and dry-cleaning services, the widespread adoption of smart home appliances, and rising disposable income levels are all driving the washing machine market growth.

Report Coverage

This research report categorizes the market for the UK washing machine market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the UK washing machine market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK washing machine market.

UK Washing Machine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.42 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 2.17% |

| 2033 Value Projection: | USD 1.76 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Machine Capacity, By Technology, By End Use |

| Companies covered:: | Hotpoint, Samsung, Bosch, Beko, Indesit, Hoover, Whirlpool, LG, Haier, AEG, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Consumer behavior has shifted significantly as a consequence of the rapid pace of urbanization and changing lifestyles around the world. Aside from that, numerous technological advancements in washing machine design, such as smart features, energy efficiency, and innovative cleaning techniques, have fueled market growth. Furthermore, increased awareness of environmental sustainability has accelerated the adoption of energy-efficient models, in line with the shifting consumer preference for eco-friendly options. Furthermore, innovative technological advancements, such as the integration of the Internet of Things (IoT), artificial intelligence (AI), and smartphone applications to facilitate automated washing machine functions, are creating lucrative growth opportunities for the market. The need to replace outdated or inefficient laundry equipment, and also the desire to upgrade to new models with expanded functionality, are driving market demand as consumers seek improved performance, durability, and energy efficiency.

Restraining Factors

Economic fluctuations and uncertainties, such as recessions and currency fluctuations, can influence consumer spending habits and willingness to invest in laundry equipment like washing machines. Also, rapid technological advancements such as the incorporation of smart features, IoT integration, and automation create obstacles for manufacturers in terms of product development, compatibility, and customer acceptance. Compliance with stringent energy efficiency, safety, and environmental impact regulations and standards increases the complexity and cost of manufacturing processes, potentially affecting product affordability.

Market Segment

- In 2023, the top-load automatic segment accounted for the largest revenue share over the forecast period.

Based on the type, the UK washing machine market is segmented into front-load automatic, top-load automatic, and semi-automatic. Among these, the top-load automatic segment has the largest revenue share over the forecast period. Top-load washing machines are known for their ergonomic design, which makes it easier to load and unload laundry than front-load models, a feature that appeals to consumers looking for convenience. Furthermore, top-load automatic machines are frequently less expensive, which appeals to budget-conscious customers. Their energy-efficient models have also become popular, reflecting the UK's strong environmental consciousness. Top-loading machines are also known for their durability and larger capacity, making them ideal for families with large laundry loads.

- In 2023, the 6.1 to 8 kg segment accounted for a significant revenue share over the forecast period.

Based on the machine capacity, the UK washing machine market is segmented into below 6 kg, 6.1 to 8 kg, and above 8 kg. Among these, the into 6.1 to 8 kg segment accounted for a significant revenue share over the forecast period. Washing machines with capacities ranging from 6.1 to 8 kg are popular due to their versatility and widespread appeal. This capacity bracket strikes a balance between serving smaller households with lighter laundry loads and larger families with medium-sized batches. It meets the requirements of urban living, where space constraints frequently dictate appliance size, making it an excellent choice for apartments and small homes.

- In 2023, the smart connected segment accounted for the largest revenue share over the forecast period.

Based on the technology, the UK washing machine market is segmented into smart connected, and conventional. Among these, the smart connected segment has the largest revenue share over the forecast period. Smart connected technology has emerged as a key driver, transforming user experience and functionality. The integration of IoT capabilities enables users to remotely control and monitor their machines using smartphone apps, providing unparalleled convenience and flexibility. This technology enables customized wash cycles, real-time notifications, and energy-efficient scheduling.

- In 2023, the commercial segment accounted for a significant revenue share over the forecast period.

Based on the end use, the UK washing machine market is segmented into commercial, and residential. Among these, the commercial segment accounted for a significant revenue share over the forecast period. The commercial sector includes a wide range of end users including laundromats, schools, and industrial facilities. The growing demand for heavy-duty, dependable, and efficient washing machines to handle large volumes of laundry daily emphasizes their significance in maintaining operations, favoring segment growth. Laundromats require washing machines that can handle a variety of customer loads, whereas educational institutions need machines that can be used frequently for uniforms and linens, increasing product demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK washing machine market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hotpoint

- Samsung

- Bosch

- Beko

- Indesit

- Hoover

- Whirlpool

- LG

- Haier

- AEG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2023, AEG announced the launch of its new Care product line, which includes washing machines, washer dryers, and tumble dryers with a sleek new design and new care and connectivity capabilities. The new range of AEG washing machines includes features such as the new PowerClean program for complete stain removal and ProSense, which automatically adjusts the time, water, and energy of each load.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the UK washing machine market based on the below-mentioned segments:

UK Washing Machine Market, By Type

- Front Load Automatic

- Top Load Automatic

- Semi-Automatic

UK Washing Machine Market, By Machine Capacity

- Below 6 kg

- 6.1 to 8 kg

- Above 8 kg

UK Washing Machine Market, By Technology

- Smart Connected

- Conventional

UK Washing Machine Market, By End Use

- Commercial

- Residential

Need help to buy this report?