UK Dental Implants Market Size, Share, and COVID-19 Impact Analysis, By Material (Zirconium, Titanium), By End-Use (Dental Clinics, Hospitals, And Academic & Research Institutes), and UK Dental Implants Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUK Dental Implants Market Insights Forecasts to 2033

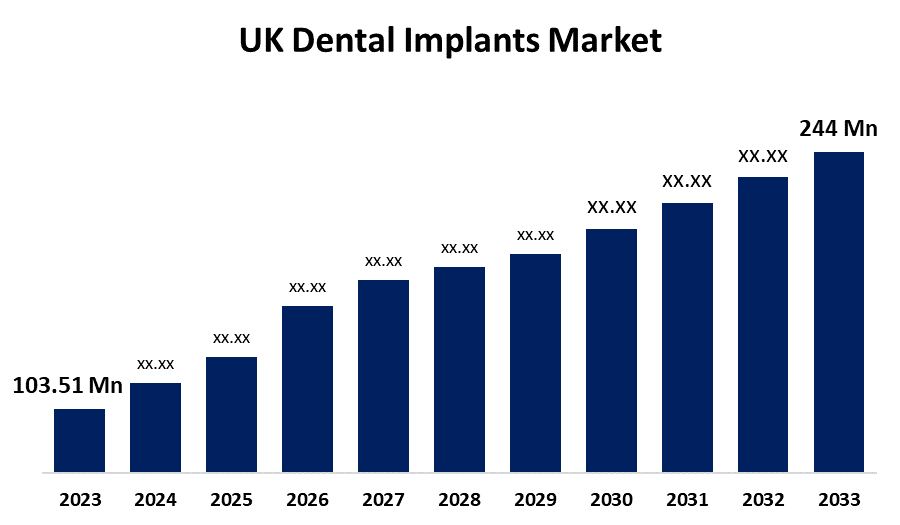

- The UK Dental Implants Market Size was valued at USD 103.51 Million in 2023.

- The Market Size is growing at a CAGR of 8.95% from 2023 to 2033

- The UK Dental Implants Market Size is expected to reach USD 244 Million by 2033

Get more details on this report -

The UK Dental Implants Market Size is anticipated to exceed USD 244 Million by 2033, growing at a CAGR of 8.95% from 2023 to 2033.

Market Overview

A dental implant is a surgical component that interfaces with the bone of the jaw or skull to support a dental prosthesis such as a crown, bridge, denture, or facial prosthesis, or to act as an orthodontic anchor. It serves as an artificial tooth root that is placed into the jawbone to replace a missing tooth or teeth. The emergence of software technologies to ease the manufacturing process, which was formerly covered by the process of die casting, is also increasing the demand for dental implants. CAD/CAM-based dental crowns and prostheses are more precise and can be made or planned in a single day, whereas traditional approaches require provisional restorations for several weeks while the final restoration is designed. An increasing need for cosmetic implants and cosmetic dental operations will fuel the expansion of the United Kingdom dental implants industry over the next five years. The country's growing senior population is helping to drive growth in the United Kingdom dental implants market. Growing financial aid and government initiatives aimed at advancing the entire healthcare industry, as well as investment procedures, are expected to boost the expansion of the United Kingdom dental implants market over the next five years. Rapidly rising research and technology developments in new manufacturing, as well as improvements to dental implants and their functionalities, are expected to support the growth of the United Kingdom dental implants market during the next five years.

Report Coverage

This research report categorizes the market for the UK dental implants market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the dental implants market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the dental implants market.

UK Dental Implants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 103.51 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.95% |

| 2033 Value Projection: | USD 244 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Material, By End-Use |

| Companies covered:: | Osstem Implant Co Ltd, Kyocera Corporation, BioHorizons IPH, Inc., Bicon, LLC, Dentium Co., Ltd., ARCH Medical Solutions Corp, Straumann Holding AG, Nobel Biocare Services AG, Dentsply Sirona Inc, Zimmer Biomet Holdings, Inc., Henry Schein UK Holdings Limited, Thommen Medical AG, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing desire for zirconia implants, combined with ongoing research into PEEK polymers as structures in orthodontics, has greatly increased market investment. Moreover, the steady rise in medical costs in the UK, as measured by the World Bank, has resulted in improved availability of dental procedures for UK residents. Major industry players are implementing computer-assisted design and production (CAD/CAM) techniques and additively made dentures. The use of innovative methods such as nanotechnology and plasma fusion in osseointegration, bioactive substances that promote tissue renewal, and smart technology to implant microscopic sensors in implants are predicted to increase market growth. A growing number of dentists and surgeons with expertise in dental implants are also supporting the development of the United Kingdom dental implants market throughout the forecast period. The usage of dental bridges and prosthetics has been reduced, and denturists and oral surgeons prefer dental implants because of technological developments and effective procedures. With new and inherent market players engaging in unique product development, the market is experiencing rapid product expansion.

Restraining Factors

Dental implant procedures are costly and are governed by several variables, such as the form of implant, implant material, implant structure, and the number of teeth to be restored by the implant. Access to adequate dental facilities and dentists is another restraining factor to the growth of the UK dental implant market. Strict regulations and compliance requirements in the UK dental industry can pose barriers to entry for new manufacturers or providers. Compliance with standards such as the Medical Devices Regulation (MDR) may increase costs and hinder innovation.

Market Segmentation

The UK dental implants market share is classified into material and end-use.

- The titanium segment is expected to grow at the fastest CAGR during the forecast period.

The UK dental implants market is segmented by material into zirconium and titanium. Among these, the titanium segment is expected to grow at the fastest CAGR during the forecast period. Titanium implants have been widely adopted due to their excellent biocompatibility, which means they are well tolerated by the human body. This reduces the risk of rejection or adverse reactions, making them a preferred choice for dental implant procedures. Titanium implants offer high durability and strength, which ensures long-term stability and performance. This durability is essential for dental implants, as they need to withstand the constant pressures and forces exerted during chewing and speaking.

- The hospital segment is expected to hold the largest share of the UK dental implants market during the forecast period.

Based on the end-use, the UK dental implants market is divided into dental clinics, hospitals, and academic & research institutes. Among these, the hospitals segment is expected to hold the largest share of the UK dental implants market during the forecast period. Geriatric patients demand greater attention throughout surgeries and have a weakened immune system. Furthermore, prolonged exposure to infectious microorganisms and poor oral hygiene have increased demand for dental implants among the elderly, facilitating the expansion of the United Kingdom dental implants market during the next five years.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK dental implants market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Osstem Implant Co Ltd

- Kyocera Corporation

- BioHorizons IPH, Inc.

- Bicon, LLC

- Dentium Co., Ltd.

- ARCH Medical Solutions Corp

- Straumann Holding AG

- Nobel Biocare Services AG

- Dentsply Sirona Inc

- Zimmer Biomet Holdings, Inc.

- Henry Schein UK Holdings Limited

- Thommen Medical AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2024, DENTSPLY Sirona introduced a new digital denture manufacturing product, the Primeprint Solution, which is anticipated to help practices and labs progress in digital denture manufacturing. This system enables the creation of impactful, printable denture bases, thereby aiding in the development and progress of dental practices and laboratories.

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the UK dental implants market based on the below-mentioned segments:

UK Dental Implants Market, By Material

- Zirconium

- Titanium

UK Dental Implants Market, By End-Use

- Dental Clinics

- Hospitals

- Academic & Research Institutes

Need help to buy this report?