UAE Flying Taxi Market Size, Share, and COVID-19 Impact Analysis, By Propulsion Type (Electric, Hybrid Electric, and Hydrogen Fuel Cell), By Aircraft Type (Vertical Takeoff and Landing (VTOL), Electric Vertical Takeoff and Landing (eVTOL), and Hybrid VTOL (HVTOL)), and UAE Flying Taxi Market Insights, Industry Trend, Forecasts to 2035.

Industry: Aerospace & DefenseUAE Flying Taxi Market Insights Forecasts To 2035

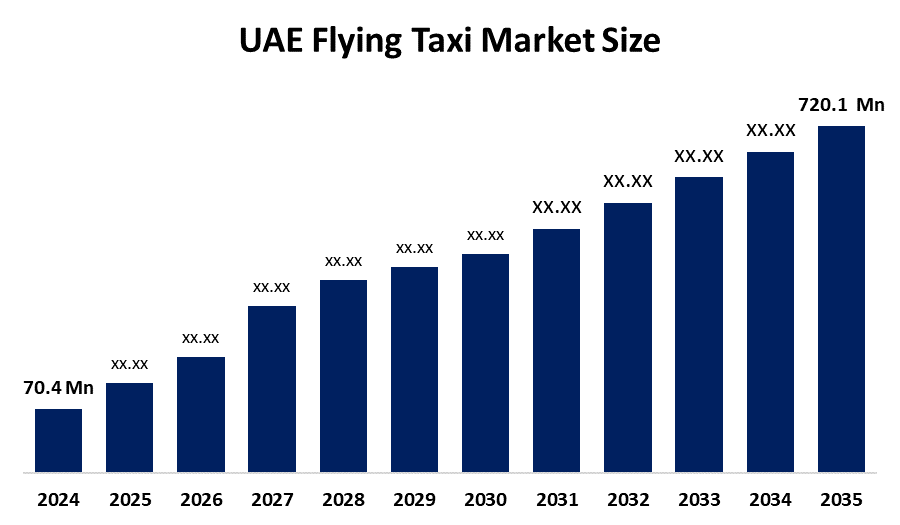

- The UAE Flying Taxi Market Size was Estimated at USD 70.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 26.25% from 2025 to 2035

- The UAE Flying Taxi Market Size is Expected to Reach USD 720.1 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The UAE Flying Taxi Market Size is anticipated to reach USD 720.1 Million by 2035, growing at a CAGR of 26.25% from 2025 to 2035. The UAE flying taxi market offers future opportunities in sustainable urban mobility, tourism enhancement, smart city integration, reduced congestion, zero-emission transport, and leadership in global eVTOL innovation through strategic investments and regulatory advancements.

Market Overview

The UAE flying taxi market refers to the emerging sector centered on electric vertical take-off and landing (eVTOL) aircraft designed for passenger transportation within urban and intercity routes. These services aim to deliver on-demand, sustainable, and congestion-free mobility, aligning with the UAE’s smart city vision and commitment to green transport. Market growth is driven by strong government initiatives such as Dubai’s 2030 Autonomous Transportation Strategy, the rising demand for zero-emission urban mobility, strategic collaborations with global eVTOL manufacturers like Joby Aviation and Volocopter, the country’s thriving tourism sector, and significant investments in infrastructure including vertiports and charging facilities. Recent developments include Dubai’s RTA announcing a partnership with Joby Aviation in February 2023 to launch commercial flying taxi operations by 2026, the planned construction of vertiports at strategic locations such as Downtown Dubai, Palm Jumeirah, and Dubai International Airport, and ongoing testing and demonstration flights involving Volocopter and Joby prototypes in UAE airspace.

Report Coverage

This research report categorizes the market for UAE flying taxi market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the UAE flying taxi market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UAE flying taxi market.

Driving Factors

The UAE flying taxi market is propelled by multiple driving factors, including strong government support through initiatives like Dubai’s 2030 Autonomous Transportation Strategy, which prioritizes advanced and sustainable mobility solutions. The growing demand for zero-emission, congestion-free urban transport is pushing the adoption of electric vertical take-off and landing (eVTOL) aircraft. Strategic partnerships with leading global players such as Joby Aviation and Volocopter are accelerating technology integration and operational readiness. Additionally, the UAE’s robust tourism sector is creating demand for premium, time-efficient travel experiences. Significant investments in dedicated infrastructure, including vertiports and charging stations, further strengthen the country’s position as a leader in urban air mobility.

Restraining Factors

The UAE flying taxi market faces restraints such as high infrastructure costs, evolving regulatory frameworks, airspace integration challenges, public acceptance concerns, and technological limitations affecting battery capacity, flight range, and operational safety.

Market Segmentation

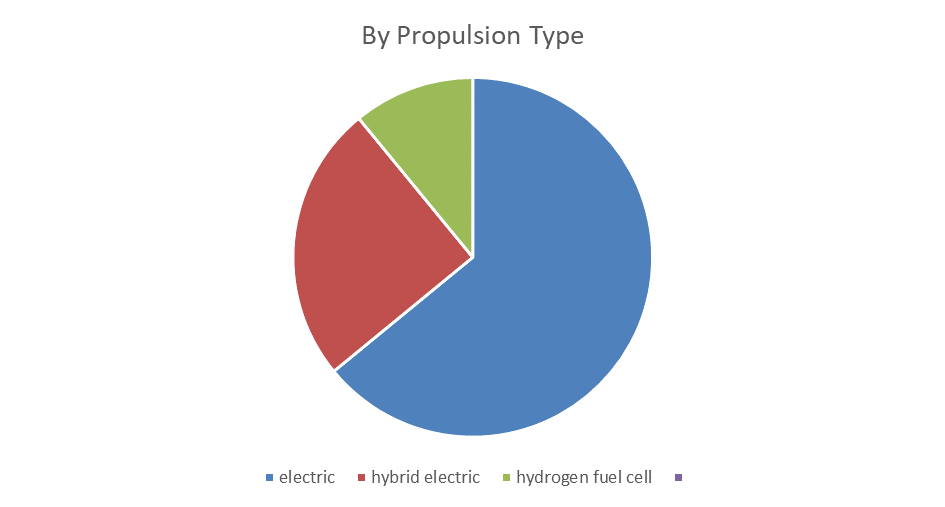

The UAE flying taxi market share is classified into propulsion type and aircraft type.

- The electric segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Get more details on this report -

The UAE flying taxi market is segmented by propulsion type into electric, hybrid electric, and hydrogen fuel cell. Among these, the electric segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by its zero-emission capability, lower operating costs, and strong alignment with the country’s sustainability goals. This segment is projected to grow at a substantial CAGR during the forecast period, supported by rapid advancements in battery technology, government incentives for green mobility, and ongoing partnerships with leading eVTOL manufacturers focusing primarily on fully electric models.

- The electric vertical takeoff and landing (eVTOL) segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UAE flying taxi market is segmented by aircraft type into vertical takeoff and landing (VTOL), electric vertical takeoff and landing (eVTOL) and hybrid VTOL (HVTOL). Among these, the electric vertical takeoff and landing (eVTOL) segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Supported by its eco-friendly design, operational efficiency, and alignment with the nation’s net-zero objectives. This segment is expected to grow at a significant CAGR during the forecast period, driven by rapid technological advancements, increasing investment in electric aviation infrastructure, and strong government backing for sustainable urban air mobility solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UAE flying taxi market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Workhorse Group Inc

- Vertical Aerospace Ltd

- Geely Automobile Holdings Ltd

- Lilium NV Ordinary Shares

- Joby Aviation Inc

- Guangzhou Automobile Group Co Ltd

- Embraer SA ADR

- Boeing Co

- Others

Recent Developments:

- June 2025, Joby Aviation delivered its first eVTOL aircraft to the UAE, marking progress toward a 2026 launch under a six-year exclusive Dubai deal. The company completed flight tests and is building vertiports, signaling rapid urban air mobility growth.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2020 to 2035. Spherical Insights has segmented the UAE flying taxi market based on the below-mentioned segments:

UAE Flying Taxi Market, By Propulsion Type

- Electric

- Hybrid Electric

- Hydrogen Fuel Cell

UAE Flying Taxi Market, By Aircraft Type

- Vertical Takeoff and Landing (VTOL)

- Electric Vertical Takeoff and Landing (eVTOL)

- Hybrid VTOL (HVTOL)

Need help to buy this report?