U.S. Standby Generator Sets Market Size, Share, and COVID-19 Impact Analysis, By Power Rating (75 kVA, 75-375 kVA, 375-750 kVA, Above 750 kVA), By Fuel (Diesel, Gas), By Application (Residential, Commercial, Industrial), and U.S. Standby Generator Sets Market Insights, Industry Trend, Forecasts to 2022 - 2032.

Industry: Energy & PowerU.S. Standby Generator Sets Market Insights Forecasts to 2032

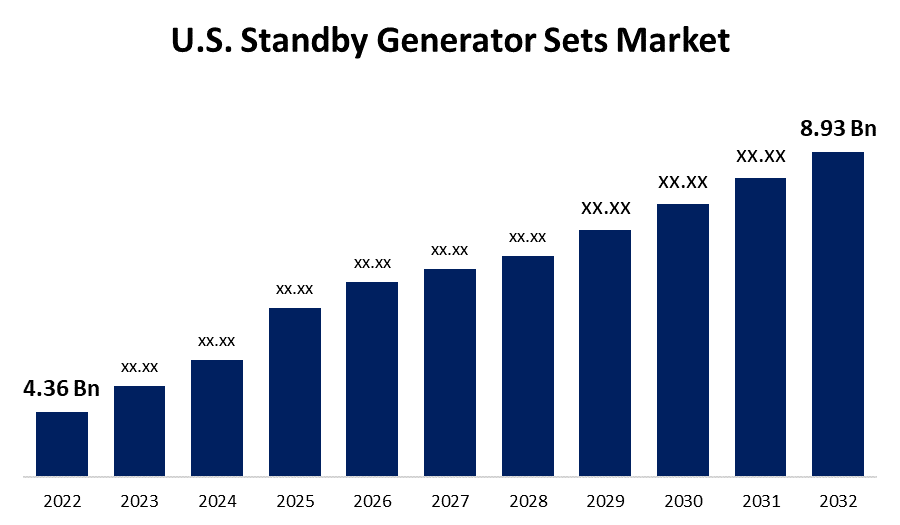

- The U.S. Standby Generator Sets Market Size was valued at USD 4.36 Billion in 2022.

- The Market is growing at a CAGR of 7.43% from 2022 to 2032.

- The U.S. Standby Generator Sets Market Size is expected to reach 8.93 Billion by 2032.

Get more details on this report -

The U.S. Standby Generator Sets Market Size is expected to reach USD 8.93 Billion by 2032, at a CAGR of 7.43% during the forecast period 2022 to 2032.

Market Overview

Standby generators are alternate electrical power sources that begin operating within seconds of a power outage and are ideal for backup power in homes and commercial buildings such as hospitals and data centers. Standby power rated generators are the most commonly rated generator sets. Their primary use is to provide emergency power for a limited time during a power outage. The deterioration of power infrastructure in various regions of the United States has prompted businesses and homeowners to purchase standby generator sets to protect against power outages. Weather-related incidents, such as storms and wildfires, are becoming more frequent and severe, emphasizing the critical need for stable backup power sources. Furthermore, the increasing reliance on digital technologies in various industries, such as healthcare and data centers, necessitates continuous power supply, fueling market growth. Furthermore, the growing development of new public safety structures is also expected to increase energy requirements across multiple verticals, driving the demand for continuous and backup power products. For instance, the US Energy Information Administration (EIA) predicted in September 2021 that the industrial sector, which includes construction, agriculture, mining, manufacturing, and refining, would likely account for the highest share of US energy consumption.

Report Coverage

This research report categorizes the market for U.S. standby generator sets market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. standby generator sets market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the U.S. standby generator sets market.

us-standby-generator-sets-market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 4.36 Bn |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 7.43% |

| 022 – 2032 Value Projection: | USD 8.93 Bn |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Power Rating, By Fuel, By Application. |

| Companies covered:: | Cummins, Briggs & Stratton, Kohler, Generac Power Systems, HiPower System, Briggs and Stratton, John Deere, Ingersoll Rand, Caterpillar In, American Honda Motor Corp., and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Power supply in the United States is impacted by unexpected grid problems, transmission and distribution line faults, weather issues, and other factors. Regulatory organizations are taking steps to reduce power outages and enable continuous operations. Unexpected power outages have increased consumer demand for reliable backup power sources in the residential and commercial sectors, accelerating the generator sales market in the United States. Furthermore, the ability to remain operational across industrial infrastructures in the absence of grid power sources has prompted users to take a variety of measures to avoid blackout conditions. The industry's pace is expected to be increased by the exponential increase in power demand and the development of new power generation, transmission, and distribution stations to meet the growing demand. Furthermore, rising spending in the construction, manufacturing, mining, commercial, and many other end-user industries has prompted various public and private authorities to step up efforts to meet peak consumer demand. For instance, the United States Census Bureau announced in 2021 that total spending on public building projects increased by around USD 76 billion in March 2021 in comparison to the previous year. According to the same report, residential construction accounted for the significant additions of around USD 138 billion, while other constructions decreased significantly.

Restraining Factors

Standby generator installation costs are frequently very high. Furthermore, these generators demand continuous and timely maintenance. As a result, the overall cost of generators rises dramatically, which has an impact on market growth. Furthermore, rising government regulations aimed at reducing carbon emissions are expected to restrict the growth of the standby generator market.

Market Segment

- In 2022, the Above 750 kVA segment accounted for the largest revenue share over the forecast period.

Based on the power rating, the U.S. standby generator sets market is segmented into 75 kVA, 75-375 kVA, 375-750 kVA, and Above 750 kVA. Among these, the Above 750 kVA segment has the largest revenue share over the forecast period. The expected demand for emergency and continuous power situations in heavy-duty applications. These units are commonly used to provide power in operations that require continuous standby or emergency loads. The generator units are primarily intended for use in heavy-duty industries that use them such as the oil and gas industry, mining, power plants, construction, and manufacturing facilities, among others.

- In 2022, the commercial segment is expected to hold the largest share of the U.S. standby generator sets market during the forecast period.

Based on the application, the U.S. standby generator sets market is classified into residential, commercial, and industrial. Among these, the commercial segment is expected to hold the largest share of the U.S. Standby Generator market during the forecast period. Businesses of all sizes are recognizing the critical need for a dependable power supply in order to maintain continuous operations. Standby generator sets have become indispensable assets for ensuring continuous manufacturing processes, supporting healthcare facilities, and safeguarding data centers. In response to rising power demands and the need for business continuity, the commercial sector continues to invest heavily in standby generator sets, contributing to market growth.

- In 2022, the diesel segment accounted for the largest revenue share over the forecast period.

On the basis of fuel, the U.S. standby generator sets market is segmented into diesel and gas. Among these, the diesel segment has the largest revenue share over the forecast period. To avoid power outages caused by ageing electricity grid infrastructure and natural disasters, as well as adverse weather conditions, people in the country began installing generators powered by various fuels, such as diesel. Diesel generators are popular in the country due to their low cost and ease of availability. As a result, the country's high installation rate of diesel gensets is expected to rise further during the forecast period. People in the country began installing generators powered by various fuels, such as diesel, to avoid power outages caused by ageing electricity grid infrastructure and natural calamities, as well as adverse weather conditions. Diesel generators are popular in the country due to their low cost and ease of availability.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. standby generator sets market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cummins

- Briggs & Stratton

- Kohler

- Generac Power Systems

- HiPower System

- John Deere

- Ingersoll Rand

- Caterpillar In

- American Honda Motor Corp.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- On February 2023, Caterpillar recently launched the Cat XQ330 mobile diesel-powered generator set, a new power solution for standby and prime power applications that complies with US EPA Tier 4 Final emission standards.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the U.S. standby generator market based on the below-mentioned segments:

U.S. Standby Generator Sets Market, By Power Rating

- 75 kVA

- 75-375 kVA

- 375-750 kVA

- Above 750 kVA

U.S. Standby Generator Sets Market, By Fuel

- Diesel

- Gas

U.S. Standby Generator Sets Market, By Application

- Residential

- Commercial

- Industrial

Need help to buy this report?