U.S. Emergency Medical Services Products Market Size, Share, and COVID-19 Impact Analysis, By Product (Life Support & Emergency Resuscitation, Patient Monitoring Systems, Wound Care Consumables, Patient Handling Equipment, Infection Control Supplies, Others), By End-Users (Hospitals & Trauma Centers, Ambulatory Surgical Centers, Others), and U.S. Emergency Medical Services Products Market Insights Forecasts to 2032.

Industry: HealthcareU.S. Emergency Medical Services Products Market Insights Forecasts to 2032

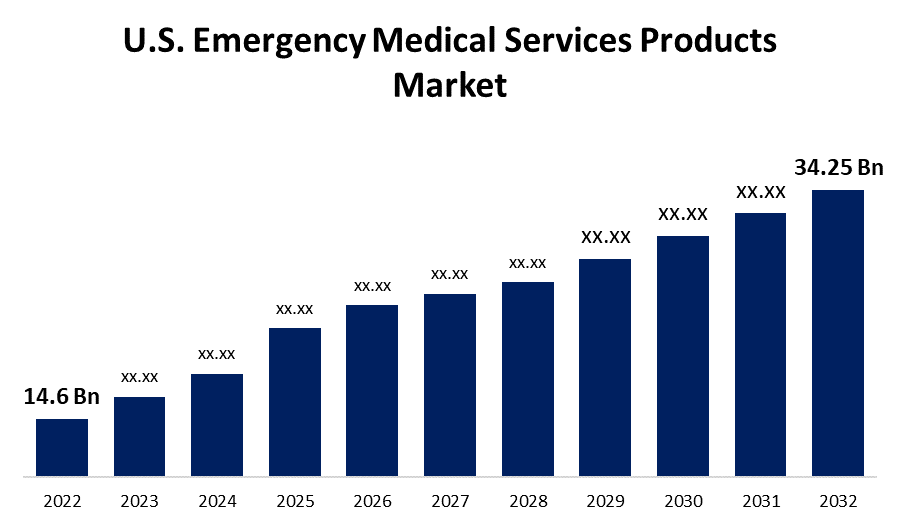

- The U.S. Emergency Medical Services Products Market Size was valued at USD 14.6 Billion in 2022.

- The Market is growing at a CAGR of 8.9% from 2022 to 2032.

- The U.S. Emergency Medical Services Products Market Size is expected to reach USD 34.25 Billion by 2032.

Get more details on this report -

The U.S. Emergency Medical Services Products Market Size is expected to reach USD 34.25 Billion by 2032, at a CAGR of 8.9% during the forecast period 2022 to 2032.

Market Overview

An emergency medical service is a specific kind of system that delivers healthcare services in an emergency situation. When there is illness among the patients, the service is activated. The goal of this service is to offer patients with emergency medical care. Emergency medical services are complex, and each component of the system plays a significant part in treatment. The emergency medical service provides acute care to patients and treats medical, obstetric, and surgical crises. Factors such as a well-established healthcare infrastructure, high healthcare expenditure, and attractive compensation guidelines improve the need to provide emergency medical services in the United States. In addition, the United States has a well-established system for emergency ambulance or paramedic services. The United States will emerge as an appealing enclave with greater accessibility through a centralized point of contact for all-case emergencies within the country. Furthermore, a large number of qualified individuals and strong insurance coverage are anticipated to drive product demand during the projected time frame.

Report Coverage

This research report categorizes the market for U.S. Emergency Medical Services Products Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. Emergency Medical Services Products Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the U.S. Emergency Medical Services Products Market.

U.S. Emergency Medical Services Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 14.6 Bn |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 8.9% |

| 022 – 2032 Value Projection: | USD 34.25 Bn |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Product, By End-Users. |

| Companies covered:: | 3M, Stryker, Cardinal Health, GE Healthcare, Becton, Dickinson, Johnson & Johnson, B. Braun, C. R. Bard, Life-Assist, McKesson Medical-Surgical Inc., Smiths Group plc, Penn Care Inc., Henry Schein, Inc., Medline Industries, Inc., and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising incidence of hospital emergency department (ED) visits, high healthcare expenditure, exceptionally qualified professionals, and the existence of several significant companies in the country are driving the emergency medical services goods market in the United States. In addition, an upsurge in the frequency of fatal injuries in the region resulted in an increase in ED visits, propelling market expansion. Added to that, according to the CDC, traumatic brain injury is the leading cause of disability and death in the United States, accounting for 30.0% of all injury deaths. The large number of disability cases and deaths as a result of trauma is projected to drive product demand. Further, advances in medical technology, which will lead to the creation of more sophisticated and efficient EMS devices, are likely to drive market expansion in the United States. In addition, there is a growing emphasis on developing EMS solutions with artificial intelligence (AI) capabilities to help healthcare workers make quick and correct judgments. Additionally, collaboration with government departments and healthcare organizations in order to standardize EMS standards and improve the general efficacy of emergency medical care is likely to increase market demand.

Market Segment

- In 2022, the life support & emergency resuscitation segment accounted for the largest revenue share of more than 37.5% over the forecast period.

On the basis of product, the U.S. Emergency Medical Services Products Market is segmented into life support & emergency resuscitation, patient monitoring systems, wound care consumables, patient handling equipment, infection control supplies, and others. Among these, the life support & emergency resuscitation segment is dominating the market with the largest revenue share of 37.5% over the forecast period. This is driven by a high need for emergency care as the number of vehicle accidents increases. Defibrillators, resuscitators, and ventilators tend to be utilized during incidents involving cars. Cardiopulmonary Resuscitation (CPR) is provided by the resuscitation system and is utilized in cases of cardiac arrest. Diagnostic and surgical items, a small oxygen cylinder, a manual suction device, a manual resuscitator, and an automatic ventilator are also part of the emergency resuscitation system.

- In 2022, the hospitals & trauma centers segment accounted for the largest revenue share of more than 74.2% over the forecast period.

On the basis of end-users, the U.S. Emergency Medical Services Products Market is segmented into hospitals & trauma centers, ambulatory surgical centers, and others. Among these, the hospitals & trauma centers segment is dominating the market with the largest revenue share of 74.2% over the forecast period. This is due to the increased prevalence of chronic diseases such as dementia, diabetes, arthritis, cancer, and heart disease as people age. Trauma centers provide fast treatment for chronic illnesses by detecting them early using medical tools. According to the Centers for Disease Control and Prevention, the overall number of emergency department visits in the United States is 130 million each year, with 35 million of those being injury-related. Emergency medical equipment assists in the rapid diagnosis and monitoring of vital signs in patients.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. Emergency Medical Services Products Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M

- Stryker

- Cardinal Health

- GE Healthcare

- Becton, Dickinson

- Johnson & Johnson

- B. Braun

- C. R. Bard

- Life-Assist

- McKesson Medical-Surgical Inc.

- Smiths Group plc

- Penn Care Inc.

- Henry Schein, Inc.

- Medline Industries, Inc.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- On June 2023, Laerdal Medical, a pioneer in patient simulation, and SimX, a pioneer in virtual reality medical simulation, have announced a collaboration to improve patient safety with a VR simulation training system that prepares physicians to provide optimal care. Under the terms of the agreement, Laerdal will become the primary distributor of the SimX virtual reality simulation platform in the United States for hospitals, EMS, and government customers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the U.S. Emergency Medical Services Products Market based on the below-mentioned segments:

U.S. Emergency Medical Services Products Market, By Product

- Life Support & Emergency Resuscitation

- Patient Monitoring Systems

- Wound Care Consumables

- Patient Handling Equipment

- Infection Control Supplies

- Others

U.S. Emergency Medical Services Products Market, By End-Users

- Hospitals & Trauma Centers

- Ambulatory Surgical Centers

- Others

Need help to buy this report?