U.S. Small Molecule CDMO Market Size, Share, and COVID-19 Impact Analysis, By Product (Active Pharmaceutical Ingredients (API) and Finished Drug Products), By Drug Type (Innovators and Generics), and U.S. Small Molecule CDMO Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareU.S. Small Molecule CDMO Market Insights Forecasts to 2035

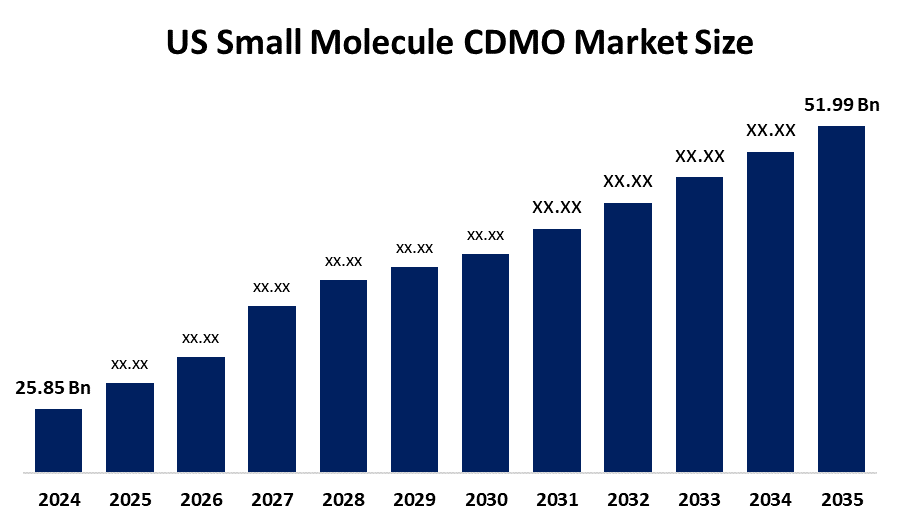

- The US Small Molecule CDMO Market Size Was Estimated at USD 25.85 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.56% from 2025 to 2035

- The USA Small Molecule CDMO Market Size is Expected to Reach USD 51.99 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the U.S. Small Molecule CDMO market is anticipated to reach USD 51.99 billion by 2035, growing at a CAGR of 6.56% from 2025 to 2035. The US small molecule CDMO market is driven by rising demand for novel drugs, outsourcing of API and drug manufacturing, advanced synthetic capabilities, regulatory compliance, and focus on high-value therapeutic areas.

Market Overview

The U.S. Small Molecule Contract Development and Manufacturing Organization (CDMO) market consists of up of service providers who assist pharmaceutical firms with the development, production, and commercialization of small-molecule pharmaceuticals. CDMOs provide end-to-end solutions that include process development, active pharmaceutical ingredient (API) manufacture, formulation, and packaging, allowing businesses to reduce costs, expand production, assure regulatory compliance, and shorten time-to-market. Market growth is being driven by increased outsourcing from pharmaceutical corporations seeking efficiency, cost reduction, and a focus on core R&D, as well as branded medicine patent expirations raising demand for cost-effective generics. Key trends include expanding CDMO offerings from early-stage API synthesis to clinical and commercial manufacturing, focusing on high-value therapeutic areas, and incorporating advanced synthetic chemistry and regulatory capabilities, all of which increase CDMOs' importance in US small-molecule drug development. The rising focus on biologics and biosimilars provides CDMOs opportunities to broaden and diversify their service offerings.

Report Coverage

This research report categorizes the market for the U.S. small molecule CDMO market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US small molecule CDMO market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA small molecule CDMO market.

U.S. Small Molecule CDMO Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 25.85 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.56% |

| 2035 Value Projection: | USD 51.99 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Drug Type |

| Companies covered:: | Cambrex Corporation, Catalent, Inc., CordenPharma International, Eurofins Scientific, Lonza, Recipharm AB, Thermo Fisher Scientific Inc., WuXi AppTec, AMRI, Fujifilm Diosynth Biotechnologies, Siegfried Holding AG And Other Player |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising demand incidence of chronic disease such as cancer, diabetes and cardiovascular disorders is driving demand for new therapeutics is one of the key drivers for this market. WHO reports chronic diseases cause 71% of global deaths, prompting faster drug development and increased reliance on CDMOs for manufacturing. The expanding pharmaceutical outsourcing trend is driving CDMO demand, as businesses benefit from cost savings, operational flexibility, and specialized knowledge, allowing them to focus on key operations such as drug research and commercialization. Additionally, innovations in drug development, including high throughput screening and advancement synthesis methods enable CDMOs to expand their services and attract larger client base.

Restraining Factors

The advanced manufacturing facilities can be expensive is one of the notable restraints for this market. Additionally, shortages of raw materials or APIs can affect production process.

Market Segmentation

The U.S. small molecule CDMO market share is classified into product and drug type.

- The active pharmaceutical ingredients segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The U.S. small molecule CDMO market is segmented by product into active pharmaceutical ingredients (API) and finished drug products. Among these, the active pharmaceutical ingredients segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is attributed to rising demand for complex and high potency small molecule therapies across various therapies areas. Additionally, firms outsource API production to CDMOs with advanced capabilities.

- The innovators segment held a highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The U.S. small molecule CDMO market is segmented by drug type into innovators and generics. Among these, the innovators segment held a highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to pharmaceutical companies increasingly focus on novel small molecule drugs with unique mechanism, targeting high values areas like oncology, immunology, and rare diseases.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. small molecule CDMO market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cambrex Corporation

- Catalent, Inc.

- CordenPharma International

- Eurofins Scientific

- Lonza

- Recipharm AB

- Thermo Fisher Scientific Inc.

- WuXi AppTec

- AMRI

- Fujifilm Diosynth Biotechnologies

- Siegfried Holding AG

Recent Developments

- In May 2025, Lonza introduced the Design2Optimize platform to enhance small-molecule API development and production using optimized design of experiments for process efficiency

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US small molecule CDMO market based on the below-mentioned segments:

U.S. Small Molecule CDMO Market, By Product

- Active Pharmaceutical Ingredients (API)

- Finished Drug Products

U.S. Small Molecule CDMO Market, By Drug Type

- Innovators

- Generics

Need help to buy this report?