U.S. Retail Clinics Market Size, Share, and COVID-19 Impact Analysis, By Ownership (Retail Owned and Hospital Owned), By Diagnosis (Immunization, General Symptoms, Injuries, General Screening & Examination, Acute Respiratory Disease & Infection, Urinary Tract Infections, Ear Infections, Sprains, Strains, and Fractures, and Others), and U.S. Retail Clinics Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareU.S. Retail Clinics Market Insights Forecasts to 2035

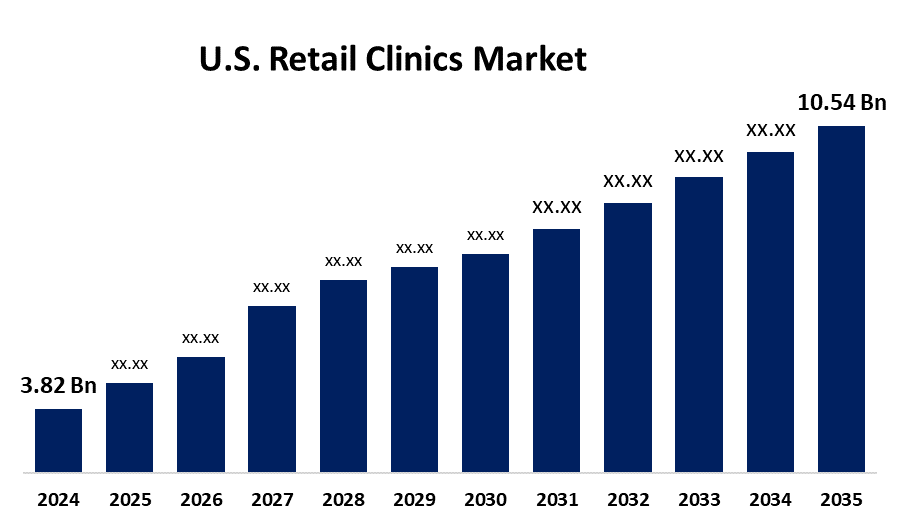

- The U.S. Retail Clinics Market Size was estimated at USD 3.82 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.67% from 2025 to 2035

- The U.S. Retail Clinics Market Size is Expected to Reach USD 10.54 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the U.S. retail clinics market is anticipated to reach USD 10.54 Billion by 2035. The U.S. retail clinics market is fueled by the it offers a scalable, affordable alternative to traditional primary care, enhancing access for underserved populations. Backed by medical professionals and digital records, they are reshaping the future of primary healthcare delivery.

Market Overview

The retail clinics market is the industry ecosystem that includes the creation, management, and use of easily accessible walk-in medical clinics, usually located inside retail establishments like pharmacies, supermarkets, and retail chains.

The retail clinic provides prompt care for both acute illnesses and preventive health services. Retail clinics are becoming more and more popular due to their accessibility, cost, and ease of use. They accommodate busy lifestyles by strategically placing themselves in common shopping areas and extending their business hours, which eliminates the need for appointments. Their allure has been increased by the combination of telehealth, immunizations, and diagnostics. Customers looking for affordable walk-in care alternatives are the main source of strong demand.

Report Coverage

This research report categorizes the market for U.S. retail clinics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. retail clinics market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. retail clinics market.

U.S. Retail Clinics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.82 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.67% |

| 2035 Value Projection: | USD 10.54 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Ownership, By Diagnosis and COVID-19 Impact Analysis |

| Companies covered:: | Target, CVS Health, Geisinger Health, Kroger Health, Walgreens, Walmart, Advocate Health Care, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The retail clinics are becoming essential substitutes for conventional primary care facilities, providing underprivileged communities with easily accessible and reasonably priced healthcare. Convenience is guaranteed by their placement in retail settings, particularly for patients with limited funds and time. These clinics guarantee quality and continuity of care because they are supported by reputable medical professionals and have electronic health records. Retail clinics are a viable option for increasing access to healthcare because of their scalability and affordability. Retail clinics have the potential to significantly alter primary care delivery as the need for easily accessible healthcare grows.

Restraining Factors

The patients with significant or long-term medical needs might not receive the basic, episodic care that retail clinics provide. Long-term patient-provider interactions, which are crucial for managing chronic illnesses, are hampered by the lack of continuity in care. This limitation may impede wider market expansion and uptake.

Market Segmentation

The U.S. retail clinics market share is classified into ownership and diagnosis.

- The retail owned segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The U.S. retail clinics market is segmented by ownership into retail owned and hospital owned. Among these, the retail owned segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by the minuteclinic clinics that are owned, run, or managed by businesses like CVS Health. Baptist Health System in Alabama is one of the top health systems with which CVS maintains clinical relationships. These health systems provide CVS consumers with prescription counseling, wellness initiatives, chronic illness monitoring, and clinical support.

- The immunization segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The U.S. retail clinics market is segmented by diagnosis into immunization, general symptoms, injuries, general screening & examination, acute respiratory disease & infection, urinary tract infections, ear infections, sprains, strains, and fractures, and others. Among these, the immunization segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to a rise in demand for vaccinations during and after the COVID-19 epidemic, since these clinics also offered testing services. These facilities are being promoted by governments in order to meet the expanding demand for vaccinations. Additionally, as these clinics are primarily run by huge retail chains, patients are offered better administration, data keeping, and drugs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. retail clinics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Target

- CVS Health

- Geisinger Health

- Kroger Health

- Walgreens

- Walmart

- Advocate Health Care

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2024, CVS Health announced the launch of a Community Resource Center and two new Workforce Innovation Talent Centers in Oklahoma City. The goal is to increase access to training and community services.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2035. Spherical Insights has segmented the U.S. retail clinics market based on the below-mentioned segments:

U.S. Retail Clinics Market, By Ownership

- Retail Owned

- Hospital Owned

U.S. Retail Clinics Market, By Diagnosis

- Immunization

- General Symptoms

- Injuries

- General Screening & Examination

- Acute Respiratory Disease & Infection

- Urinary Tract Infections

- Ear Infections

- Sprains, Strains, and Fractures

- Others

Need help to buy this report?