U.S. Grid Analytics Market Size, Share, By Component Type (Software, Services, and Hardware), By Application (Asset Management, Grid Operations & Reliability, Load & Demand Forecasting), U.S. Grid Analytics Market Insights, Industry Trend, Forecasts to 2035.

Industry: Energy & PowerU.S. Grid Analytics Market Insights Forecasts to 2035

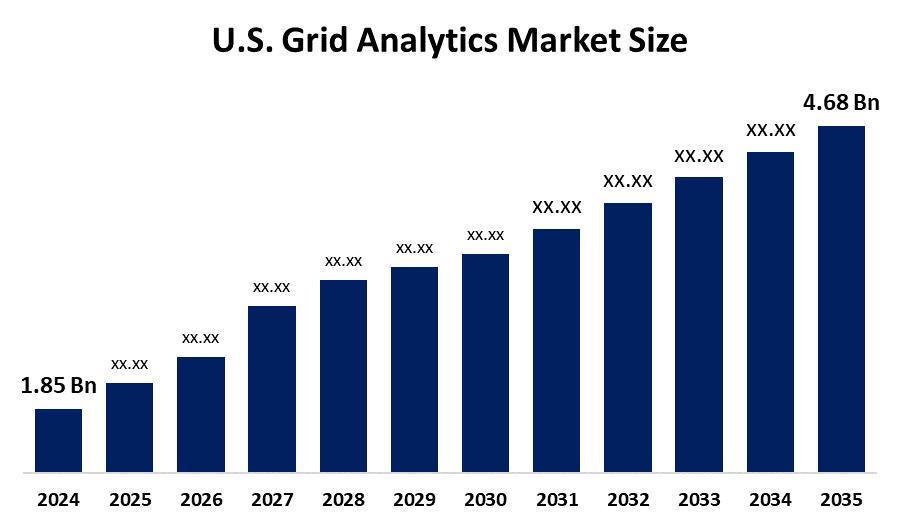

- U.S. Grid Analytics Market Size 2024: USD 1.85Bn

- U.S. Grid Analytics Market Size 2035: USD 4.68Bn

- U.S. Grid Analytics Market CAGR 2024: 8.8%

- U.S. Grid Analytics Market Segments: Component Type and Application

Get more details on this report -

The term U.S. grid analytics market denotes software and data-driven tools that scrutinise power grid details with the objective of upgrading the whole cycle of monitoring, forecasting, reliability, and operational efficiency across the networks of transmission and distribution. Outage management, load forecasting, asset performance monitoring, predictive maintenance, renewable integration, and enhancing grid reliability and resilience are some of the uses.

In the United States, Oracle Utilities in February 2025 rolled out its new, cloud-based grid analytics that was powered by artificial intelligence, taking the capability of predicting, anomaly detection, and grid state visualisation to the real time. The new system is formed by AMI data from different sources, ranging from households, weather and substation sensors that supply the same orifice of analytics to assist utilities in better predicting outages and managing loads during extreme weather conditions. The availability of an automated data governance module alongside the platform facilitates the adherence of the companies to U.S. state regulatory reporting requirements, thus making it quicker than before.

The U.S. Department of Energy (DOE) has launched the Grid Resilience and Innovation Partnerships (GRIP) Program, which is a comprehensive program to upgrade the electric grid of the entire country. The plan assigns $10.5 billion to the BIL for improving the grid's functionalities by making it more flexible, resilient to severe weather, and integrating the latest technology, such as artificial intelligence and smart grid solutions.

Future opportunity is expected to be in the areas of AI-driven predictive analytics, real-time grid optimization, large-scale renewable integration, EV infrastructure management, and improved grid resilience against cyber threats, as well as extreme weather events.

U.S. Grid Analytics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.85 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 8.8% |

| 2035 Value Projection: | USD 4.68 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Application, By Component Type |

| Companies covered:: | AutoGrid Systems Inc. General Electric (GE) Grid4C IBM Corporation Innowatts Itron, Inc. Oracle Corporation Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the U.S. Grid Analytics Market:

The U.S. grid analytics market is driven by the increase in electrical energy consumption, the fast-paced incorporation of green energy, and the necessity for power grid upgrades. Resurgent demand for analytics is the result of widespread installation of intelligent meters, IoT sensors, and high-tech communication networks, which, in turn, create a lot of grid data. Besides, continuous pressure from the regulators to increase the reliability of grids, lower outages, improve security for the systems and everything else that runs counter to operational efficiency has been a contributing factor to the fast growth of the market.

The U.S. grid analytics market is restrained by the high cost of installation and integration, the ageing grid infrastructure, and the lack of data interoperability. Over these concerns, strict data privacy, vulnerability to cyberattacks, not having enough skilled personnel to handle the analytics, and the delicate nature of controlling large-scale real-time grid data are other factors that slow down the pace of adoption.

The future of the U.S. grid analytics market is bright and promising, with It is an ongoing trend that a lot of attention and support from all sides, as well as investors who want to put their money in the smart grids, AI-driven analytics, renewable energy integration, grid resilience initiatives, and government policies that favor the use of modern, data-oriented power network management practices.

Market Segmentation

The U.S. grid analytics market share is classified into component type and application.

By Component Type:

The U.S. grid analytics market is divided by component type into software, services, and hardware. Among these, the software segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The function of software has a great impact on the data analysis, grid monitoring, forecasting, and optimisation, which led to the utilities improving their performance in terms of efficiency, reliability, and decision-making through the entire energy management systems.

By Application:

The U.S. grid analytics market is divided by application into asset management, grid operations & reliability, and load & demand forecasting. Among these, the grid operations & reliability segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Utilities emphasised Grid Operations & Reliability by firstly focusing on the prevention of outages through monitoring, maintaining, and optimising the grid. This way, they not only ensure but also deliver a stable and reliable electricity supply across all regions.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the U.S. grid analytics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in U.S. Grid Analytics Market:

- AutoGrid Systems Inc.

- General Electric (GE)

- Grid4C

- IBM Corporation

- Innowatts

- Itron, Inc.

- Oracle Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the U.S. regional and country levels from 2020 to 2035. Spherical Insights has segmented the U.S. grid analytics market based on the below-mentioned segments:

U.S. Grid Analytics Market, By Component Type

- Software

- Services

- Hardware

U.S. Grid Analytics Market, By Application

- Asset Management

- Grid Operations & Reliability

- Load & Demand Forecasting

Need help to buy this report?