U.S. Emergency Medical Services Billing Software Market Size, Share, and COVID-19 Impact Analysis, By Component (In-house and Outsourced), By Type (Land Ambulance Services, Air Ambulance Services, and Water Ambulance Services), and U.S. Emergency Medical Services Billing Software Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareU.S. Emergency Medical Services Billing Software Market Insights Forecasts to 2035

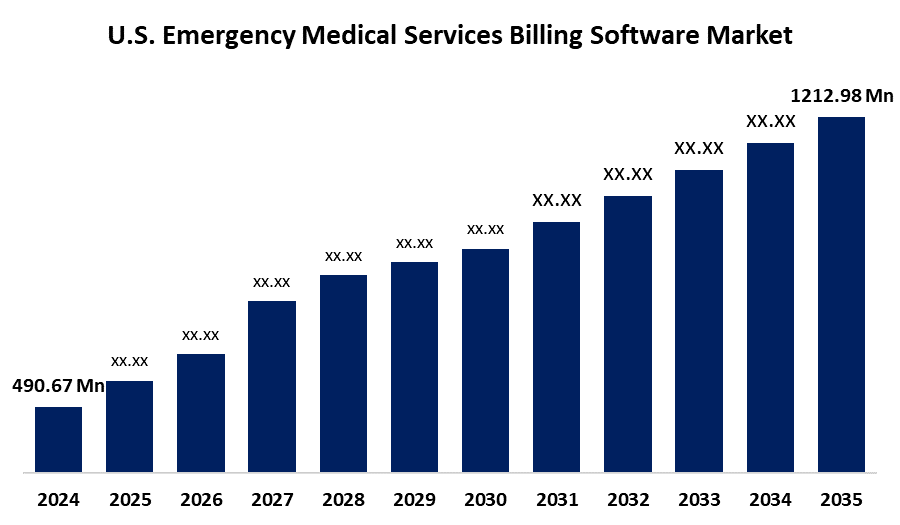

- The U.S. Emergency Medical Services Billing Software Market Size was Estimated at USD 490.67 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.58% from 2025 to 2035

- The U.S. Emergency Medical Services Billing Software Market Size is Expected to Reach USD 1212.98 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The U.S. Emergency Medical Services Billing Software Market Size is anticipated to reach USD 1212.98 Million by 2035. The U.S. emergency medical services billing software market is fueled as it offers a scalable, affordable alternative to traditional primary care, enhancing access for underserved populations. Backed by medical professionals and digital records, they are reshaping the future of primary healthcare delivery.

Market Overview

The emergency medical services billing software market is a specific procedure for filing and monitoring claims for payment of services rendered by emergency medical services. These services include ambulance transportation in both emergency and non-emergency scenarios, patient assessment, treatment, and emergency response. To guarantee correct coding, prompt claim submission, and fair compensation for services rendered by EMS personnel, such as EMTs, paramedics, and other emergency responders, EMS billing entails navigating complicated regulations and payer requirements, including Medicare, Medicaid, and private insurers.

The EMS billing industry is changing quickly due to a move toward value-based treatment, regulatory challenges, and technology improvements. To increase accuracy and decrease denials, automation and interoperability are becoming crucial. To satisfy changing payer criteria and produce patient-centered outcomes, providers must use data-driven techniques. Modernizing infrastructure and forming strategic alliances would be essential for negotiating this challenging environment. Long-term success in EMS billing ultimately depends on flexibility and creativity.

Report Coverage

This research report categorizes the market for U.S. emergency medical services billing software market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. emergency medical services billing software market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. emergency medical services billing software market.

U.S. Emergency Medical Services Billing Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 490.67 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 8.58% |

| 2035 Value Projection: | USD 1212.98 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 266 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Component and By Type |

| Companies covered:: | ZOLL Medical Corporation, Traumasoft, eso, Digitech Computer LLC, AdvancedMD, Inc., AIM EMS SOFTWARE & SERVICES, Kareo, Inc., ImagineSoftware, Technology Partners, LLC, iTech Workshop Pvt Ltd, Change Healthcare, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The market for EMS billing software in the United States is expected to grow rapidly due to government-led healthcare digitalization initiatives and the growing demand for accurate, efficient billing procedures. Because of their affordability, scalability, and flexibility, cloud-based solutions are becoming more and more popular, especially among smaller providers. EMS billing software would be essential to enhancing service delivery and revenue cycles as healthcare becomes more data-driven. Leading providers are adapting to changing market demands with creative, approachable cloud solutions. Through 2035, it is anticipated that this digital transformation would maintain market momentum.

Restraining Factors

The high implementation and maintenance costs, which small and rural EMS providers may find unaffordable. Significant technological obstacles are also presented by the intricate integration needs with current systems, such as dispatch software and electronic health records (EHRs).

Market Segmentation

The U.S. Emergency Medical Services Billing Software Market Share is classified into component and type.

- The outsourced segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The U.S. emergency medical services billing software market is segmented by component into in-house and outsourced. Among these, the outsourced segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by the agencies can concentrate on providing essential medical services by outsourcing EMS billing, which is a more affordable option than developing it internally. Accuracy and efficiency are increased by the use of sophisticated, integrated billing software. The number of software providers is increasing, giving EMS organizations more options when it comes to choosing customized solutions. Consequently, it is anticipated that the outsourced industry would experience significant expansion in the upcoming years.

- The land ambulance services segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The U.S. emergency medical services billing software market is segmented by type into land ambulance services, air ambulance services, and water ambulance services. Among these, the land ambulance services segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to its location throughout the prediction. Cloud-based EMS billing software, which provides real-time data access, automated workflows, and smooth connection with electronic patient care reporting (ePCR) systems, is being used by many ambulance providers. This makes it possible to submit claims more quickly, enhance cash flow, and cut down on administrative costs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. emergency medical services billing software market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ZOLL Medical Corporation

- Traumasoft

- eso

- Digitech Computer LLC

- AdvancedMD, Inc.

- AIM EMS SOFTWARE & SERVICES

- Kareo, Inc.

- ImagineSoftware, Technology Partners, LLC

- iTech Workshop Pvt Ltd

- Change Healthcare

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2022, Optum merged with Change Healthcare with the goal of improving clinical, administrative, and financial processes across all healthcare systems. This merger is expected to improve the delivery of EMS billing and other healthcare services.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2035. Spherical Insights has segmented the U.S. emergency medical services billing software market based on the below-mentioned segments:

U.S. Emergency Medical Services Billing Software Market, By Component

- In-house

- Outsourced

U.S. Emergency Medical Services Billing Software Market, By Type

- Land Ambulance Services

- Air Ambulance Services

- Water Ambulance Services

Need help to buy this report?