United States Commercial Water Treatment System Market Size, By Type (Filtration Systems, Membrane Systems (RO/NF/UF), Disinfection Systems (UV/Ozone/Chlorination), Adsorption, Distillation Systems, and Water Softening Systems); By Capacity (Small Scale (<1,000 GPD), Medium Scale (1,000-50,000 GPD), and Large Scale (>50,000 GPD)); By End-Use Industry (Food and Beverages, Manufacturing, Healthcare, Commercial Offices, Educational Institutions, Hospitality, Retail and Others); Analysis and Forecast 2023 - 2032

Industry: Machinery & EquipmentUnited States Commercial Water Treatment System Market Insights Forecasts to 2033

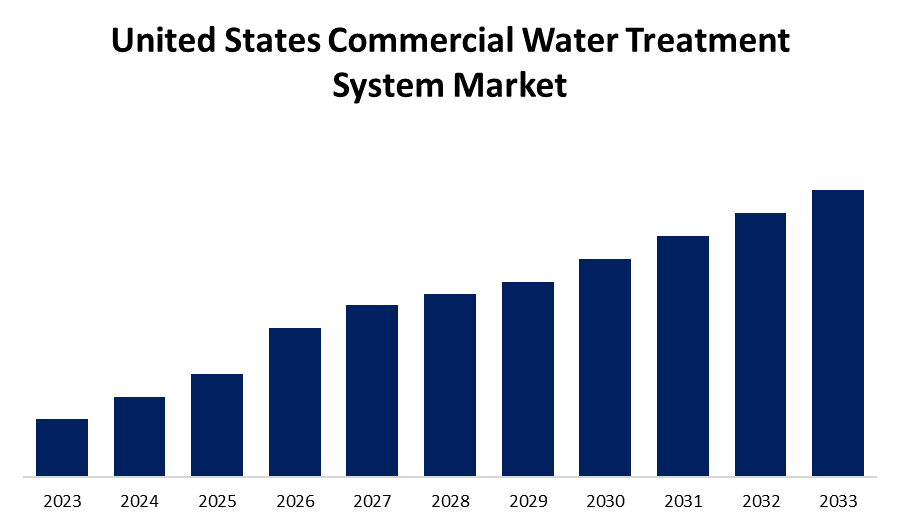

- The Market Size is Growing at a CAGR of 4.9% from 2023 to 2033.

- The United States Commercial Water Treatment System Market Size is Expected to Hold a Significant Share by 2033.

Get more details on this report -

The United States Commercial Water Treatment System Market Size is Expected to Hold a Significant Share by 2033, at a CAGR of 4.9% during the forecast period 2023 to 2033.

Market Overview

Water treatment technology is an important line of defense in eliminating bacteria and contaminants before providing potable and clean water for consumption. It is divided into several stages: collection, screening and straining, chemical addition, coagulation and flocculation, sedimentation and clarification, filtration, disinfection, storage, and distribution. The demand for chemically treated water has increased due to population growth and industrialization in many end-use segments that use water treatment technology to provide clean and drinkable water. This could be one of the key factors driving the growth of the water treatment technology market. Furthermore, both developed and developing countries face water scarcity issues due to a lack of freshwater resources, prompting governments to place a greater emphasis on water treatment technologies for producing clean and potable water. This will drive the growth of the water treatment technology market over the forecast period.

Report Coverage

This research report categorizes the market for United States commercial water treatment system market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States commercial water treatment system market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States commercial water treatment system market.

United States Commercial Water Treatment System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Forecast Period: | 2022 - 2032 |

| Forecast Period CAGR 2022 - 2032 : | 4.9% |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 171 |

| Tables, Charts & Figures: | 96 |

| Segments covered: | By Type, By Capacity, By End-Use Industry and COVID-19 Impact Analysis. |

| Companies covered:: | Ecolab Inc., Pentair Plc, Xylem Inc., 3M Company, Pall Corporation (Danaher Corporation), Calgon Carbon Corporation (Kuraray Co., A. O. Smith Corporation, Honeywell Internaltional, Dow Chemical Company, and Siemens Water Technologies LLC and other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The United States commercial water treatment system market growth is being driven by the demand for clean water. As industrialization increases, more wastewater is discharged into the environment, necessitating treatment prior to release. To comply with environmental laws and protect the environment, companies are investing in wastewater treatment technology. Water scarcity and wastewater costs are rising, emphasizing the importance of smart water technologies. Also, poor management has led to impending water shortages in United States. In this context, replacing outdated technology with new sensors and devices enables real-time monitoring and proactive contamination detection. IoT-powered smart water systems are also gaining popularity, tracking quality and treatment processes efficiently. These advancements are expected to drive the U.S commercial water treatment equipment market growth over the forecast period.

Restraining Factors

Water treatment technology has become more expensive in recent years as a result of the high cost of water and wastewater treatment equipment. Furthermore, water treatment technology entails several stages that necessitate the use of highly efficient machines that can only be operated by trained professionals. Thus, high equipment costs and a scarcity of trained professionals hamper the growth of the water treatment technology market over the forecast period.

Market Segment

In 2023, the filtration systems segment accounted for the largest revenue share over the forecast period.

Based on the type, the United States commercial water treatment system market is segmented into filtration systems, membrane systems (RO/NF/UF), disinfection systems (UV/Ozone/Chlorination), adsorption, distillation systems, and water softening systems. Among these, the filtration systems segment has the largest revenue share over the forecast period. this dominance is expected to continue during the forecast period because filtration is widely used across commercial, industrial, and municipal applications for removing contaminants from water. Filtration systems are the backbone of many treatment setups due to their versatility and cost-effectiveness.

In 2023, the large scale (>50,000 GPD) segment accounted for the largest revenue share over the forecast period.

Based on the capacity, the United States commercial water treatment system market is segmented into small scale (<1,000 GPD), medium scale (1,000–50,000 GPD), and large scale (>50,000 GPD). Among these, the large scale (>50,000 GPD) segment has the largest revenue share over the forecast period. Commercial water purification processes large volumes of water at high flow rates. The type of water treatment used in a system is largely determined by the desired level of purity in the final water makeup.

In 2023, the food & beverages segment accounted for the largest revenue share over the forecast period.

Based on the end-use industry, the United States commercial water treatment system market is segmented into food & beverages, manufacturing, healthcare, commercial offices, educational institutions, hospitality, retail, and others. Among these, the food & beverages segment has the largest revenue share over the forecast period. The food service industry relies on water treatment systems to provide high-quality drinking water to its customers, extend the life of appliances that come into contact with water, and reduce the use of chemicals and detergents.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States commercial water treatment system market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Key Players

- Xylem Inc.

- Veolia North America

- Ecolab Inc.

- Culligan International Company

- Pentair plc

- DuPont de Nemours, Inc.

- Pall Corporation (Danaher Corporation)

- 3M Company

- Calgon Carbon Corporation (Kuraray Co., Ltd.)

- A. O. Smith Corporation

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States Commercial Water Treatment System Market based on the below-mentioned segments:

United States Commercial Water Treatment System Market, By Type

- Filtration Systems

- Membrane Systems (RO/NF/UF)

- Disinfection Systems (UV/Ozone/Chlorination)

- Adsorption/Activated Carbon Systems

- Distillation Systems

- Water Softening Systems

United States Commercial Water Treatment System Market, By Capacity

- Small Scale (<1,000 GPD)

- Medium Scale (1,000–50,000 GPD)

- Large Scale (>50,000 GPD)

United States Commercial Water Treatment System Market, By End-Use Industry

- Food & Beverages

- Manufacturing

- Healthcare

- Commercial Offices

- Educational Institutions

- Hospitality

- Retail

- Others

Need help to buy this report?