Turkey Defense Market Size, Share, and COVID-19 Impact Analysis, By Type (Military Land Vehicles, Missiles & Missile Defense Systems, Ammunition, Military Fixed Wing Aircraft, Naval Vessels & Surface Combatants, and Others) and Turkey Defense Market Insights, Industry Trend, Forecasts to 2035

Industry: Aerospace & DefenseTurkey Defense Market Insights Forecasts to 2035

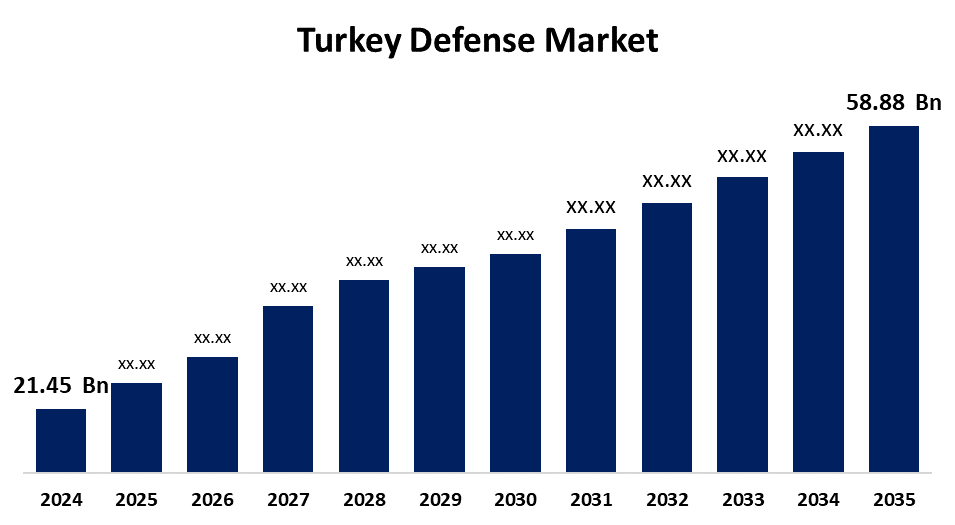

- The Turkey Defense Market Size was estimated at USD 21.45 Billion in 2024

- The Market Size is expected to grow at a CAGR of around 9.61% from 2025 to 2035

- The Turkey Defense Market Size is expected to reach USD 58.88 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Turkey Defense Market Size is anticipated to reach USD 58.88 Billion by 2035, Growing at a CAGR of 9.61% from 2025 to 2035.

Market Overview

Military spending, defense manufacturing, purchasing tactics, and technological developments in defense systems are all featured in the Turkey Defense Market. Turkey's defense industry has grown to improve domestic production and lessen dependency on foreign suppliers. Turkey is positioned as a major exporter with the development of advanced drones, armored vehicles, and naval platforms. The demand for helicopters, military drones, low interest rates, and military equipment spending all increased during this historic time. Future market growth is anticipated to be driven by defense spending since it supports the defense sector, which includes the development, production, and upkeep of military hardware. Since autonomous fighter jets can fly for longer periods without human pilots, companies in the market for manufacturing air-based defense equipment are investing in them. These aircraft are fitted with sensors to detect threats, process data, gather intelligence, disable the electronic systems of adversary aircraft, and eliminate other threats.

The upsurge in funding for the defense sector by the government of Turkey drives the market growth. For instance, through a new funding mechanism, Turkey intends to raise $2 billion a year for its Defense Industry Support Fund, which is obtained by private and corporate contributions. The initiative aims to accelerate ambitious projects in fields like artificial intelligence, unmanned systems, and next-generation fighter jets, as well as reduce dependency on foreign military technologies. The additional contributions, implemented in 2024, add up to a substantial amount.

The rising collaboration between Turkey and other robust defense sectors of other countries accelerates the market growth. For example, Turkey and the UK have signed the Turkey-UK Defense Industry Council (TUDIC) Specification, aiming to strengthen their relationship in the defence sector. The agreement focuses on industry collaborations, knowledge transfer, and co-development projects, aiming to foster cooperation in response to a changing global security situation and shared threats.

Report Coverage

This research report categorizes the market for the Turkey defense market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Turkey defense market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Turkey defense market.

Turkey Defense Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 21.45 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.61% |

| 2035 Value Projection: | USD 58.88 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 113 |

| Segments covered: | By Type and COVID-19 Impact Analysis |

| Companies covered:: | Otokar Otomotiv ve Savunma Sanayi AS, Turk Telekomunikasyon AS, Aselsan Eletronik Sanayi Ve Ticaret AS, Turkish Aerospace Industries, KOC Holding AS, and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

Government spending on modernizing military forces drives technological advancements, which in turn shape the Turkish defense market. This involves integrating cutting-edge technologies such as cyberwarfare tools, unmanned systems, artificial intelligence, and missile defense. These developments improve operational efficiency and give soldiers advanced equipment to tackle contemporary issues. New products that satisfy changing operational requirements have been developed as a result of the increased reliance on technology, which has also encouraged research and development investments across defense sectors. The need for modernized military capabilities and perceived threats are driving up defense budgets in Turkey. Developed as well as developing nations are being impacted by this trend, which supports the general upward trajectory of the Turkish defense market.

Restraining Factors

The lack of expenditure and R&D in manufacturing sectors, financial crisis, poor domestic institutions, limited development of advanced military technology, and political problems may limit the growth of the market.

Market Segmentation

The Turkey defense market share is classified by type.

- The military fixed-wing aircraft segment dominated the Turkey defense market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Turkey defense market is segmented by type into military land vehicles, missiles & missile defense systems, ammunition, military fixed wing aircraft, naval vessels & surface combatants, and others. Among these, the military fixed-wing aircraft segment dominated the Turkey defense market in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment dominance is attributed to factors such as improved operational efficiency,

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Turkey defense market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Otokar Otomotiv ve Savunma Sanayi AS

- Turk Telekomunikasyon AS

- Aselsan Eletronik Sanayi Ve Ticaret AS

- Turkish Aerospace Industries

- KOC Holding AS

- Others

Recent Developments:

- In April 2025, Turkish missile maker Roketsan signed a strategic agreement with Indonesia to establish a joint defense production facility, marking a strategic move in Turkey's growing defense industry partnerships to boost export capacity.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Turkey, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Turkey defense market based on the below-mentioned segments:

Turkey Defense Market, By Type

- Military Land Vehicles

- Missiles & Missile Defense Systems

- Ammunition

- Military Fixed Wing Aircraft

- Naval Vessels & Surface Combatants

- Others

Need help to buy this report?